A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

ABOUT THE NAIC

The National Association of Insurance Commissioners (NAIC) is the oldest association of state government officials.

Its members are the chief insurance regulators in all 50 states, the District of Columbia, and five U.S. territories. State

regulators’ primary responsibility is to protect insurance consumers’ interests, and the NAIC helps regulators do this in

several different ways. This Shopper’s Guide is one example of the NAIC’s work to help the states educate and protect

consumers.

Another way the NAIC helps state insurance regulators is by giving them a forum to develop uniform public policy

when appropriate. It does this through a series of model laws, regulations, and guidelines developed for the states’

use. The states may choose to adopt the models intact or change them to meet the needs of their marketplace and

consumers. As you read through this Shopper’s Guide, you’ll find several references to NAIC model laws or regulations

related to long-term care insurance. Check with your state insurance department to find out if your state has enacted

these NAIC models.

National Association of Insurance Commissioners

1100 Walnut Street, Suite 1500

Kansas City, MO 64106-2197

816.842.3600

www.naic.org

Revised 2019

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

ABOUT THIS SHOPPER’S GUIDE

The decision to buy long-term care insurance is an important financial decision that shouldn’t be rushed. The

National Association of Insurance Commissioners (NAIC) wrote this Shopper’s Guide to help you understand long-

term care and the insurance options that can help you pay for long-term care services. The decision to buy long-

term care insurance is very important. You should not make it in a hurry. Most states’ laws require insurance

companies or agents to give you this Shopper’s Guide to help you better understand long-term care insurance and

decide which, if any, policy to buy. Some states produce their own shopper’s guide.

Take a moment to look at the table of contents and you will see the questions this Shopper’s Guide answers. Then read

the Shopper’s Guide carefully. If you see a term you don’t understand, look in the glossary starting on page 31. (Terms

in bold in the text are in the glossary.) Take your time. Decide if buying a policy might be right for you.

If you decide to shop for a long-term care insurance policy, start by getting information about the long-term care

services and facilities you might use and how much they charge. Use the worksheets at the back of this Shopper’s

Guide to write down information. Use Worksheet 1—Availability and Cost of Long-Term Care in My Area on page

47 to collect information about the facilities and services in your area. Then, as you shop for a policy, use

Worksheet 2—Compare Long-Term Care Insurance Policies on page 47 to compare long-term care insurance

policies.

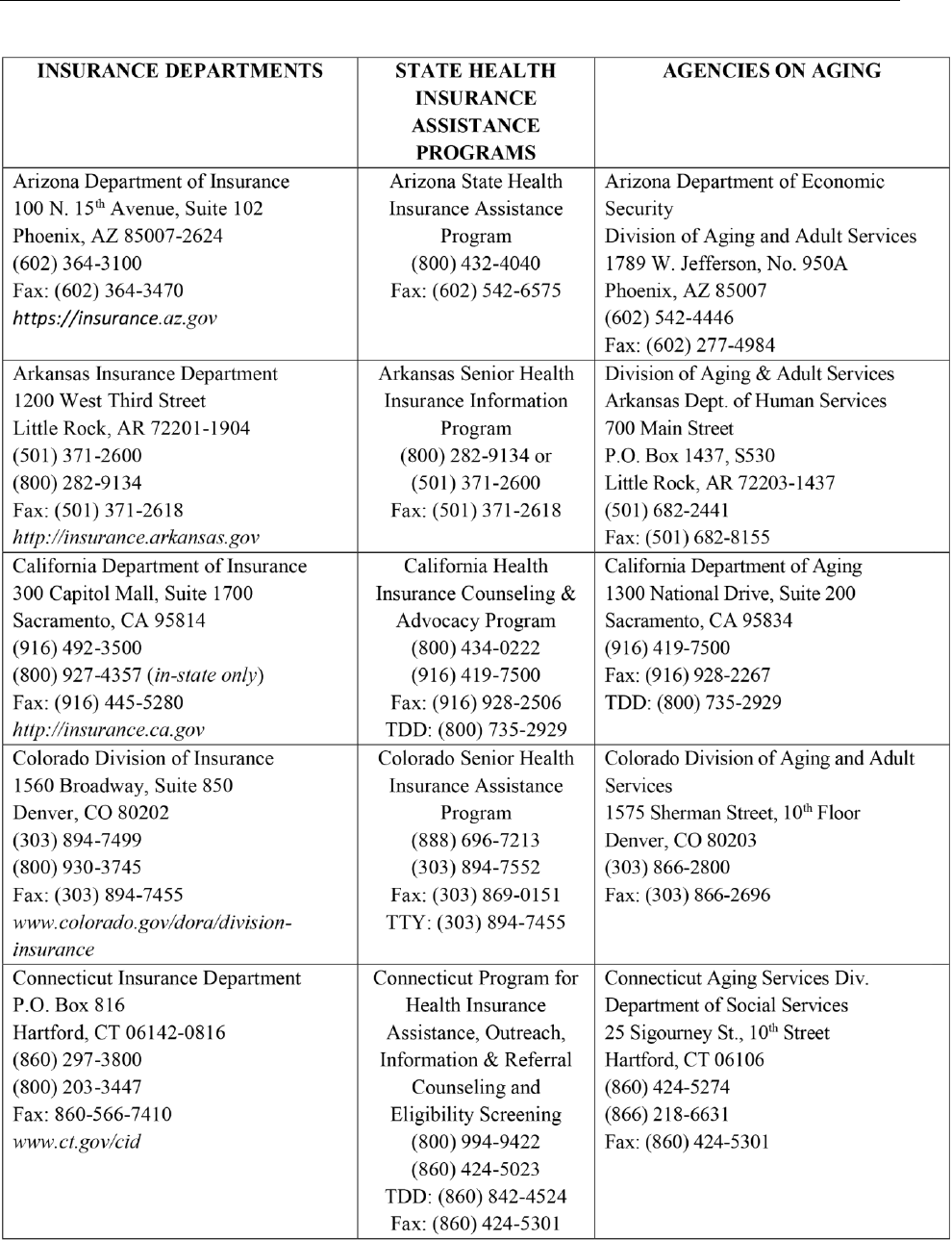

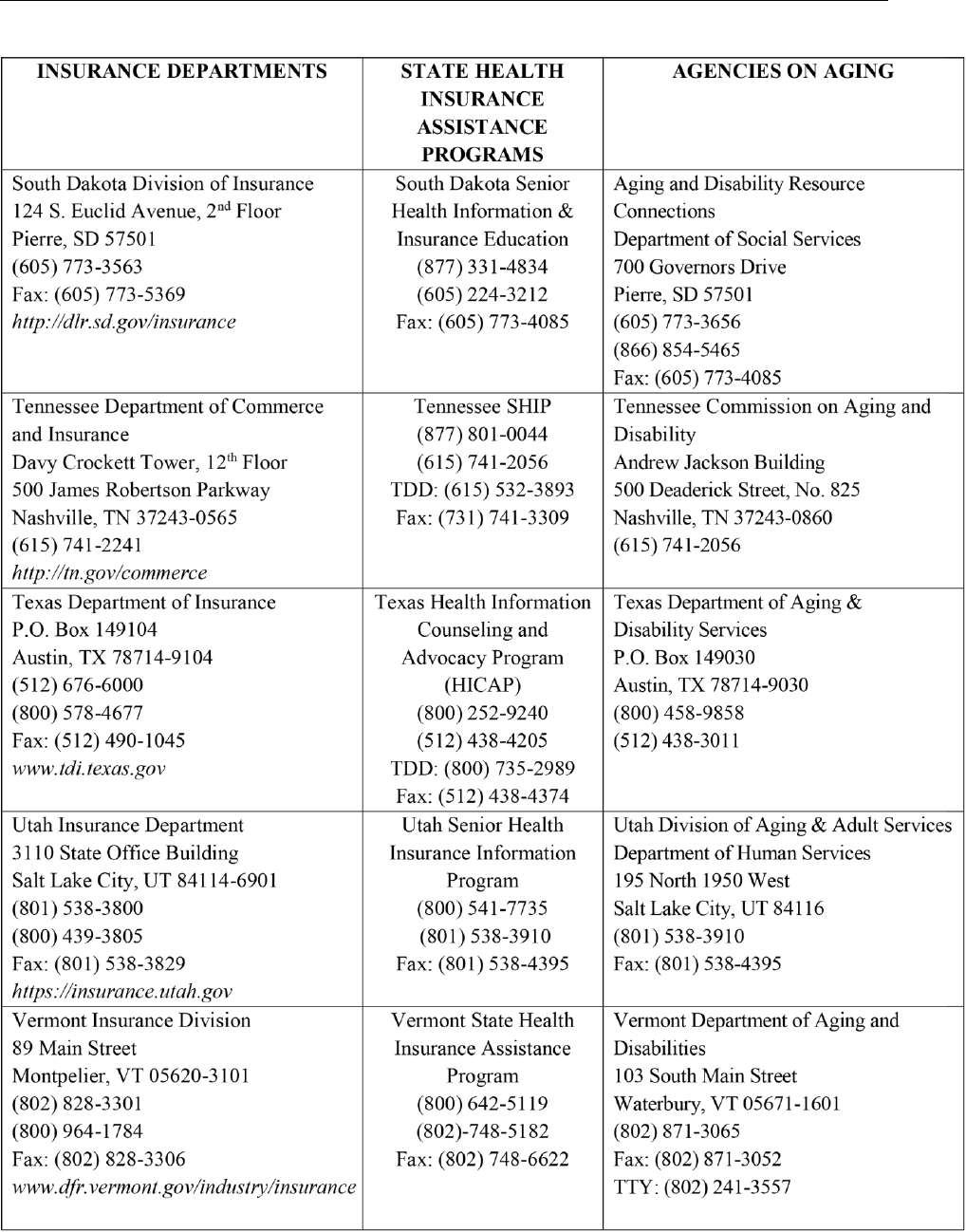

If you have questions, call your state insurance department or another consumer assistance agency in your state. See

the list of state insurance departments, agencies on aging, and state health insurance assistance programs starting

on page 51.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

TABLE OF CONTENTS

WHAT IS LONG-TERM CARE? ................................................................................................................................... 1

How Much Does Long-Term Care Cost? ............................................................................................................ 1

Nursing Home Costs ........................................................................................................................... 1

Assisted Living Facility Costs .............................................................................................................. 1

Home Care Costs................................................................................................................................ 1

How Might I Pay for Long-Term Care? ............................................................................................................... 2

Personal Resources ............................................................................................................................ 2

Medicare ........................................................................................................................................... 2

Medicare Supplement Insurance (Medigap) ...................................................................................... 2

Medicaid ............................................................................................................................................ 2

WILL I NEED OR USE LONG-TERM CARE? ................................................................................................................. 4

WHAT IS LONG-TERM CARE INSURANCE? ............................................................................................................... 5

Do I Need to Buy Long-Term Care Insurance? .................................................................................................. 5

What Types of Policies or Contracts Can I Buy that Provide Long-Term Care

Benefits or Coverage? ...................................................................................................................................... 6

Individual Policies ............................................................................................................................... 7

A Life Insurance Policy or Annuity Contract ....................................................................................... 7

A Hybrid/Combination Life Insurance Policy ...................................................................................... 7

Policies from Your Employer .............................................................................................................. 8

Policies from Federal or State Government ....................................................................................... 8

Association Policies ........................................................................................................................... 9

Policies Sponsored by Continuing Care Retirement Communities ..................................................... 9

Long-Term Care Insurance Partnership Policies .................................................................................. 9

Tax-Qualified Policies ....................................................................................................................... 10

HOW LONG-TERM CARE BENEFITS ARE PAID ......................................................................................................... 13

Shared Care .................................................................................................................................................... 13

What Services Are Covered? ......................................................................................................................... 13

Where Services Are Covered? ....................................................................................................................... 14

What Services Aren’t Covered? ..................................................................................................................... 14

How Much Coverage Will I Have? .................................................................................................................. 15

When Will I Be Eligible for Benefits? .............................................................................................................. 16

Types of Benefit Triggers ................................................................................................................................ 16

When Benefits Start (Elimination Period) ...................................................................................................... 17

Inflation Protection ........................................................................................................................................ 18

Third-Party Notice ......................................................................................................................................... 19

Other Long-Term Care Insurance Policy Options I Might Choose ................................................................... 19

What If I Can’t Afford the Premiums After I Buy the Policy? .......................................................................... 20

Will My Health Affect My Ability to Buy a Policy? .......................................................................................... 21

What Happens If I Have Preexisting Conditions? ........................................................................................... 22

Can I Renew My Long-Term Care Insurance Policy? ....................................................................................... 22

HOW MUCH DO LONG-TERM CARE INSURANCE POLICIES COST? ........................................................................... 23

What Options Do I Have to Pay the Premiums on the Policy? ........................................................................ 25

If I Already Own a Policy, Should I Switch or Upgrade? .................................................................................. 26

WHAT SHOPPING TIPS SHOULD I KEEP IN MIND? ................................................................................................. 27

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE: WHAT IS LONG-TERM CARE?

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

GLOSSARY ............................................................................................................................................................ 31

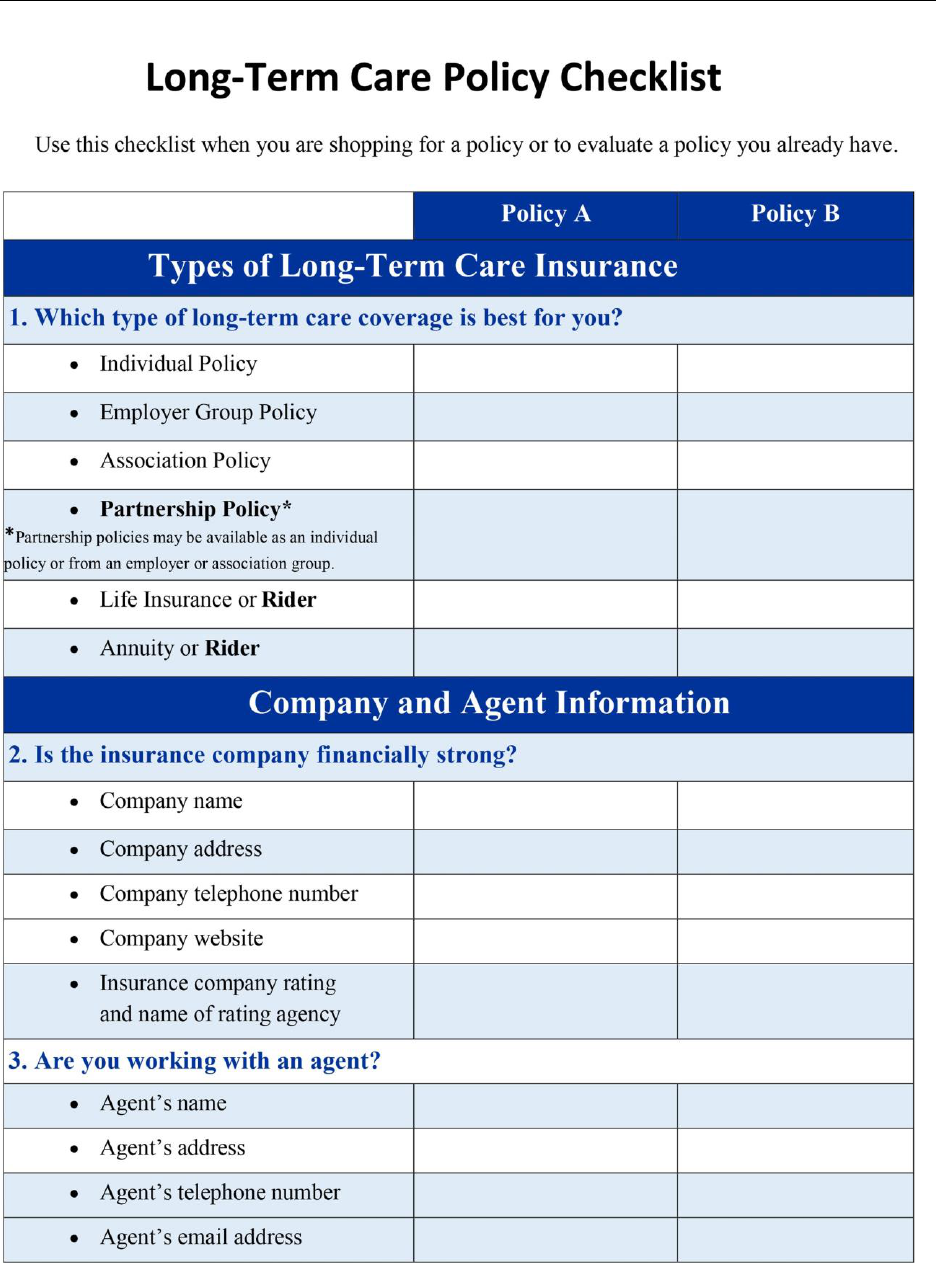

Personal Assessment and Long-Term Care Policy Checklist ............................................................................ 40

Long-Term Care Insurance Personal Worksheet ............................................................................................. 47

List of State Insurance Departments, Agencies on Aging and State

Health Insurance Assistance Programs .......................................................................................................... 51

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE: WHAT IS LONG-TERM CARE?

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

1

WHAT IS LONG-TERM CARE?

This kind of care is different from medical care, because it generally helps you to live as you live now instead of

improving or correcting medical problems. People often think of long-term care as strictly nursing home care. Long-

term care services actually may include help with activities of daily living, home care, respite care, hospice

care or adult day care. This care maybe given in your own home, an adult day care facility, assisted living facility,

nursing home or hospice facility.

NOTE: Medicare generally doesn’t pay for personal care services when you aren’t also receiving Medicare-covered

skilled care services. Medicare has its own definition of skilled care. Refer to the booklet, Medicare & You, to learn

more about how Medicare defines skilled care.

Personal Assessment

It’s important to identify your reason(s) for buying a policy. This influences many of the choices you’ll make in

selecting coverage. A person with few resources, a modest income and a goal of staying off Medicaid will approach

the purchase one way. A person with a larger amount of assets and income may approach it differently. Please

review the Personal Assessment and Long-Term Care Policy Checklist starting on Page 40 to help you determine

whether a long-term care insurance policy right for you and your family.

A. How Much Does Long-Term Care Cost?

Long-term care can be expensive. The cost depends on the amount and type of care you need and where you

get it. Below are some average annual costs for care in a nursing home, an assisted living facility and your own

home. Long-term care may cost more or less where you live.

Nursing Home Costs

In 2018, the national average cost of nursing home care was about $89,297 per year (for a semi-private room). This

cost doesn’t include items such as therapies and medications, which could greatly increase the cost.

Assisted Living Facility Costs

In 2018, assisted living facilities reported charging $4,000 a month (for a one- bedroom unit) on average, or $48,000

per year, including rent and most other fees. Residents may pay more for additional care.

Home Care Costs

In 2018, the cost of basic home care averaged $22 per hour for a home health aide in the U.S. That’s $34,320

per year for a home health aide who visits six hours a day, five days a week. Skilled care from a nurse in your home

is typically more expensive. Annual costs for home care depend on the number of days a week the caregiver visits,

the type of care required and the length of each visit. Home care can be unaffordable for many if round-the-clock

care is required. These costs are different across the country. Your state insurance department or the insurance

counseling program in your state may know the costs for your area. (See the list of state insurance departments,

agencies on aging and state health insurance assistance programs starting on Page 51.)

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE: WHAT IS LONG-TERM CARE?

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

2

B. How Might I Pay for Long-Term Care?

People pay for long-term care in different ways. These include individuals’ or their families’ personal resources, including

savings, investments or other assets such as a home, long- term care insurance and some help from Medicaid for

those who qualify. Medicare, Medicare supplement insurance, or your employee or retiree health insurance usually

will not pay for long-term care.

Personal Resources

Individuals and their families usually use some of their own money to pay for part or all of their long-term care costs.

Many use savings and investments. Some sell assets, such as their homes, to pay for their long-term care needs.

Medicare

Medicare does NOT cover long-term care. However, Medicare Part A does cover skilled nursing facility care, nursing

home care (as long as custodial care isn’t the only care you need), hospice care and limited home care. You should

NOT count on Medicare to pay your long-term care costs. Please see www.medicare.gov/ coverage/long-term-

care.html for more information about Medicare.

Medicare Supplement Insurance

Medicare supplement insurance (Medigap) is private insurance that helps pay for some of the gaps in Medicare

coverage, such as hospital deductibles and physician charges greater than Medicare approves. Medigap usually

doesn’t pay for long-term care. Please see www.medicare.gov/supplement-other- insurance/medigap/whats-

medigap.html for more information about Medigap.

Medicaid

Medicaid is the government-funded program that pays for nursing home care only for individuals who are low

income and have spent most of their assets. Medicaid pays for nearly one-third of all nursing home care in the

U.S., but many people who need long-term care never qualify for Medicaid assistance. Medicaid also pays for some

home- and community-based services. To get Medicaid help, you must meet federal and state guidelines for income

and assets. Many people start paying for nursing home care out of their own money and “spend down” their income

and assets until they’re eligible for Medicaid. Medicaid then may pay part or all of their nursing home costs. You may

have to use up most of your assets paying for your long-term care before Medicaid is able to help. You may be able to

keep some assets and income for a spouse who stays at home. Also, you may be able to keep some of your assets if

your long-term care insurance is approved by a state as a long-term care insurance partnership policy. (See section on

“Long Term Care Insurance Partnership Policies” on Page 9.)

State laws differ about how much income and assets you can keep and still be eligible for Medicaid. (Some assets,

such as your home, may not keep you from being eligible for Medicaid.) However, federal law requires your state to

recover from your estate the costs of the Medicaid benefits you receive, subject to certain rules. Contact your state

Medicaid office, state office on aging, or department of social services to learn about the rules in your state. The

health insurance assistance program in your state also may have some Medicaid information. (See the list of state

insurance departments, agencies on aging and state health insurance assistance programs starting on Page 51.)

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

3

WILL I NEED OR USE LONG-TERM CARE?

If you have a major illness or injury—such as a stroke, heart attack or broken hip—and need assistance with activities

of daily living, such as bathing or dressing, you may need long-term care. If you do need care, you may need nursing

home or home care for only a short time. Or, you may need these services for many months, years or the rest of

your life.

It’s hard to know if and when you’ll need long-term care, but the statistics that follow may help:

• Life expectancy after age 65 is about 19.4 years (20.6 years for females and 18 years for males). The longer

people live, the greater the chance they’ll need help due to chronic conditions.

• About 11 million Americans of all ages require long-term care, but only 1.4 million live in nursing homes.

• About 70% of people who reach age 65 are expected to need some form of long- term care at least once in their

lifetime.

• About 35% of people who reach age 65 are expected to enter a nursing home at least once in their lifetime. Of

those who are in a nursing home, the average stay is a year.

• From 2015 to 2055, the number of people age 85 and older will almost triple, from more than 6 million to more

than 18 million. This growth is certain to lead to an increase in the number of people who need long-term care.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

4

WHAT IS LONG-TERM CARE INSURANCE?

Long-term care insurance is one way you may pay for long-term care. This type of insurance will pay or reimburse

you for some or all of your long-term care costs. It was introduced in the 1980s as nursing home insurance but now

often covers services in other facilities. The rest of this Shopper’s Guide gives you information about long-term care

insurance.

A federal law, the Health Insurance Portability and Accountability Act of 1996 (HIPAA) gives some federal income

tax advantages to people who buy certain long- term care insurance policies. These policies are called tax-qualified

long-term care insurance policies or, simply, qualified policies. The tax advantages of these policies are outlined on

Page 10. There may be other tax advantages in your state. You should check with your state insurance department

or insurance counseling program for information about tax-qualified policies. (See the list of state insurance

departments, agencies on aging and state health insurance assistance programs starting on Page 51.) Check with

your tax advisor to learn if the tax advantages make sense for you.

A. Do I Need To Buy Long-Term Care Insurance?

Whether you should buy a long-term care insurance policy depends on your age, health, overall retirement goals,

income and assets. Please review the Personal Assessment and Long-Term Care Policy Checklist starting on Page 46

to help you determine whether buying long-term care insurance is right for your situation.

However, carefully consider whether buying a policy makes financial sense if you can’t afford the premium or aren’t

sure you can pay the premium, including any increases, for the rest of your life.

If you already have health problems that could lead to long-term care (for example, Alzheimer’s disease or

Parkinson’s disease), you probably won’t be able to buy a policy. Insurance companies have medical underwriting

standards to keep the cost of long- term care insurance affordable. If companies didn’t have these standards, most

people wouldn’t buy long-term care insurance until they needed long-term care.

In some states, a regulation requires the insurance company and agent to go through a personal worksheet with you

(see the Long-Term Care Insurance Personal Worksheet on Page 47) to help decide if long-term care insurance is

right for you. It also asks you questions about your income and your savings and investments to help with your decision.

Some states require you to fill out the worksheet and send it to the insurance company. Even if you aren’t required

to fill out the worksheet, it might help you decide if long-term care insurance is right for you.

REMEMBER: Not everyone should buy a long-term care insurance policy nor rely solely on long-term care insurance.

Paying for long-term care can be done by combining different sources, such as assets, income and long-term care

insurance. For some, a policy is affordable and worth the cost. For others, it may be unaffordable. You should not

buy long-term care insurance if the only way you can afford to pay for it is to not pay other important bills. Look

closely at your needs and resources. Talk with family members, a friend or a trusted and knowledgeable financial

professional to decide if long-term care insurance is right for you.

Is Long-Term Care Insurance Right For You?

You should NOT buy long-term care insurance if:

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

5

• You can’t afford the premiums.

• You don’t have many assets.

• Your only source of income is a Social Security benefit or Supplemental Security Income (SSI).

• You often have trouble paying for utilities, food, medicine or other important needs.

• You are on Medicaid.

You may want to consider buying long-term care insurance if:

• You have many assets and/or a good income.

• You don’t want to use most or all of your assets and income to pay for long-term care.

• You can afford to pay the insurance premiums, including possible premium increases.

• You don’t want to burden family or friends.

• You want to be able to choose where you receive care.

If, after careful thought, you decide that long-term care insurance is right for you, check out the company and the agent,

if one is involved, before you buy a policy. If you have questions about licensing, contact your state insurance

department. (See the list of state insurance departments, agencies on aging and state health insurance assistance

programs starting on Page 51.)

B. What Types of Policies or Contracts Can I Buy That Provide Long-Term Care Benefits or Coverage?

Private insurance companies sell long-term care insurance policies. You can buy an individual policy from an agent,

through the mail or by telephone. Or, you can buy coverage under a group plan through an employer or through

membership in an association. The federal government and several state governments offer long-term care insurance

coverage to their employees, retirees and their families. These programs are voluntary, and participants pay the

premiums. You also can get long-term care benefits through some life insurance policies.

Individual Policies

One of your options is a long-term care insurance policy. Insurance agents sell many of these policies, but companies

also sell policies through the mail or by telephone. Individual policies can be very different from one company to the

next. Also, policies from the same company may be different from each other. Shop among policies, companies and

agents to get the coverage that best fits your needs.

Life Insurance Policies and Annuity Contracts

A Life Insurance Policy or Annuity Contract You Already Have

If you have a cash value life insurance policy, you can take some of the cash value to pay for long-term care expenses.

But first, ask how a withdrawal might affect your death benefits and talk with your tax advisor or consultant. Or, if

you no longer need the policy, you could cancel (or surrender) it and take all the cash value. But think about how that

would affect your beneficiaries.

If you have an annuity, you may be able to take some of the annuity’s value to pay for long- term care expenses. Most

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

6

annuities require you to pay a surrender charge to withdraw some of the value. Some companies will waive that

charge if the withdrawal is to pay for long-term care.

A Hybrid/Combination Life Insurance Policy or Annuity Contract That Has Provisions That Could Be Used for Long-

Term Care

An increasing number of life insurance policies and some annuity contracts now offer an add-on rider that you could

use to pay long-term care expenses. This type of rider gives you more coverage if you need long-term care. You usually

pay an extra premium for a rider.

A life insurance policy that uses an accelerated death benefit (sometimes called a living benefit) could be used to pay

for long-term care expenses also may be called a “life/long- term care,” “hybrid,” “linked benefits” or “combo” policy.

It may be an individual or a group life insurance policy. This benefit lets you access some or all of the policy’s death benefit

while you’re alive. You must meet certain conditions to use the rider to pay for long-term care expenses. Usually, the

benefit triggers are being unable to perform a certain number of activities of daily living or being cognitively

impaired.

The company may pay benefits in one of two ways. One way is a reimbursement based on your long-term care

expenses. Or, the company may pay a set amount each month (an indemnity benefit). The amount is either set in

the rider or the owner chooses it. In either case, there may be minimum and maximum amounts paid each month

based on the policy benefit.

A life insurance policy with an accelerated benefit rider for long-term care must follow all the laws and regulations that

apply to long-term care policies. Many of these riders may be tax-qualified. Consult with your tax advisor or tax

consultant for more information.

Long-term care benefits paid as an accelerated death benefit likely will reduce the death benefit the policy will

pay after you die. For example, suppose your policy has a $100,000 death benefit and you use $60,000 for long-term

care. Then your beneficiary would get a $40,000 (not a $100,000) death benefit. Some policies may offer a small

death benefit even if all of the original death benefit amount is used for long-term care expenses.

Also, many life insurance policies and annuity contracts offer benefits beyond the acceleration of the death benefit.

These are often called extension of benefits riders. They provide more benefits for a set period of time after you’ve

used up a policy’s cash value and/or death benefit or your annuity’s value. These policies offer both accelerated

death benefits and an extension of benefits rider. The benefits may increase by a set inflation percentage.

As with all insurance products, premiums are higher for policies with more benefits. So, the premium for a traditional

stand-alone long-term care policy could be much less than the premium for a hybrid/combo policy, all else being

equal.

Policies from Your Employer

Your employer may offer a group long-term care insurance plan or individual policies at a group discount. The

employer group plan may be similar to an individual policy you could buy. One advantage of an employer group plan

for active employees is you may not have to meet as many medical requirements to get a policy, or the medical

screening process may be more relaxed. Many employers also let retirees, spouses, parents and parents-in-law apply

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

7

for this coverage. Relatives usually must pass the company’s medical screening to qualify for coverage and must pay

the premium.

If you leave your job or are fired, or your employer cancels the group plan, the insurance company must let you keep

your coverage. Your premiums and benefits may change, however.

If an employer offers long-term care insurance, think about it carefully. An employer group plan may give you options

you can’t find if you buy a policy on your own.

Policies from Federal or State Government

Federal and U.S. Postal Service employees and annuitants, members and retired members of the uniformed services

and qualified relatives of any of these are eligible to apply for long-term care insurance coverage under the Federal

Long-Term Care Insurance Program. A company completes underwriting and issues the policy, but the federal

government doesn’t pay any of the premiums. The group rates under this program may or may not be lower than

individual rates, and the benefits also may be different. If you (or a member of your family) are a state or public employee

or retiree, you may be able to buy long-term care insurance under a state government program.

Association Policies

Many associations let insurance companies and agents offer long-term care insurance to their members. These

policies are like other long-term care insurance policies and typically require medical underwriting. Like employer

group plans, association policies usually give their members a choice of benefits. If you are joining an association just to

buy insurance, consider the cost of membership in the total cost of coverage. In addition, understand your options

and rights if coverage should end.

Policies Sponsored by Continuing Care Retirement Communities

Continuing care retirement communities (CCRC) may offer or require you to buy long-term care insurance. A CCRC is

a retirement complex that offers a broad range of services and levels of care. You must be a resident or on the waiting

list of a CCRC to qualify. You also must meet the insurance company’s medical requirements to buy its long-term care

insurance policy. The coverage is similar to other group or individual policies.

Long-Term Care Insurance Partnership Policies

There are long-term care insurance partnership policies that help you manage the financial impact of spending down

your assets to meet Medicaid eligibility standards. When you buy a partnership policy, you’re protected from the

normal Medicaid requirement to spend down your income and assets to become eligible.

NOTE: These vary by state.

In most states, you don’t have to use up all of your partnership policy benefits to qualify for Medicaid. In most states,

you can qualify for Medicaid and keep income and assets equal to the amount of claims your partnership policy paid.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

8

Partnership policies must be federally tax-qualified plans. They also must include certain consumer protections. They

must include inflation protection benefits, so benefits keep up with increasing long-term care costs over time.

Partnership policies are required to include inflation protection only for those who are 75 or younger when they

buy the policy. The requirements are:

• Compound annual inflation protection for those younger than age 61.

• Some level of inflation protection for those ages 61 to 75.

NOTE: This inflation protection requirement varies in the following states: California; Connecticut; Indiana; and New

York

How will you know if you have a partnership policy? The insurance company will either give you that information in

writing with your policy or send you a letter. Either way, it’s very important to keep this notice.

Please keep in mind that partnership policies have specific requirements. They aren’t offered in every state. Check

with your state insurance department or insurance assistance program to learn if these policies are available in your

state. Many states with long-term care partnership policies have information about them on their websites. Use this

link to locate your state’s insurance department website: www.naic.org/state_web_map.htm. Also, the U.S.

Department of Health and Human Services maintains a website at https://longtermcare.acl.gov/costs-how-to-

pay/what-is-long-term-care-insurance/where-to-look-for-long-term-care-insurance.html with information about

long-term care insurance and partnership policies.

Tax-Qualified Policies

You may have a choice between a federally “tax-qualified” long-term care insurance policy and one that is

“non-tax-qualified.” The differences between the two types of policies are important. A tax-qualified policy, or

a qualified policy, offers certain federal income tax advantages. If you itemize your income tax deductions, you

may be able to deduct part or all of the premium you pay for a tax-qualified policy. Consult with your tax advisor

or tax consultant regarding how this may apply to you.

Federally Tax-Qualified Policies

• Can deduct annual premiums, subject to a cap

• Benefits received generally aren’t counted as income

Federally Non-Tax-Qualified Policies

• Annual premiums can’t be deducted

• Benefits received generally are counted as income

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

9

Long-term care insurance policies sold on or after January 1, 1997, as tax-qualified must meet certain federal

standards. To be qualified, policies must be labeled as tax-qualified, be guaranteed renewable (as defined under

the Internal Revenue Code), include a number of consumer protections, and cover only qualified long-term care

services. If you bought a long-term care insurance policy before January 1, 1997, that policy is probably qualified.

HIPAA allowed these policies to be “grandfathered,” or considered qualified, even though they may not meet all

the standards that new policies must meet to be qualified. The tax advantages are the same regardless of whether

the policy was sold before or after 1997. You should carefully consider the advantages and disadvantages of trading

a grandfathered policy for a new policy. In most cases, it’s to your advantage to keep your old policy.

Qualified long-term care services usually are those from long-term care providers. You must be chronically ill. Your

care must follow a plan that a licensed health care practitioner prescribes. You’re considered chronically ill if

it’s expected that you’ll be unable to do at least two activities of daily living without substantial assistance from

another person for at least 90 days. Another way you may be considered chronically ill is if you need substantial

supervision to protect your health and safety because you have a cognitive impairment. A policy issued to you

before January 1, 1997, doesn’t have to define chronically ill this way. (See information about benefit triggers

on Page 16.)

Some life insurance and annuity policies with long-term care benefits may be tax-qualified. However, be sure to

check with your personal tax advisor or tax consultant to learn how much of the premium can be deducted as a

medical expense. Tax-qualified life insurance and annuity policies with long-term care benefits must meet

the same federal standards as other tax-qualified policies, including the requirement that you must be

chronically ill to receive benefits.

Some deferred annuities provide long- term care benefits by providing an enhanced long-term care value greater

than the cash value when used for qualifying care. Some annuities are tax-qualified and have tax advantages that

are not provided to annuities, which simply allow you to withdraw some of the cash value without paying a

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

10

surrender penalty. You should consult with your tax advisor or tax consultant for more information.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

11

HOW LONG-TERM CARE BENEFITS ARE PAID

Long-term care insurance policies generally pay benefits by different methods of payment. Once your eligibility is

determined, long-term care insurance policies generally pay benefits using one of three different methods:

• The expense-incurred method pays you or your provider the lesser of either the expense or dollar limit of your

policy.

• The indemnity method pays benefits based on a set dollar amount that is paid directly to you regardless of

your cost.

• The disability method pays you the full daily benefit regardless of

whether you are receiving long-term care services.

Most policies purchased today pay benefits according to the expense-incurred method.

A. Shared Care

You may be able to buy long-term care insurance that covers more than just one person, often called shared care. The

maximum lifetime benefit usually applies to both individuals. If either covered individual collects benefits, that amount

is subtracted from the maximum lifetime benefit. For example, suppose two people have shared care that has a

$150,000 maximum lifetime benefit and one person uses $25,000 in benefits. Then $125,000 would be left to pay

benefits for either person or both. Some coverages have provisions to protect each individual from the other person

using up all the benefits. In one variation, neither individual can access the other person’s coverage. Instead, there is

a “third pool” which both individuals can share.

B. What Services Are Covered

It’s important that you understand what services your long-term care insurance policy covers and how it covers the

many types of services you might need to use. Policies may cover the following:

• Nursing home care

• Home care

• Respite care

• Hospice care

• Personal care in your home

• Services in assisted living facilities

• Services in adult day care centers

• Services in other community facilities

Policies may cover home care in several ways. Those who may provide care may be limited by your policy or state

requirements. For instance, services may need to be provided from a licensed provider or agency. Other policies may

pay for services from home care aides to help with personal care who may not be licensed or aren’t from licensed

agencies.

You may find a policy that pays for homemaker services or chore worker services. This type of benefit, though not

available in all policies, would pay for someone to come to your home to cook meals and run errands. Generally, adding

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

12

home care benefits to a policy increases the cost of the policy.

NOTE: Most policies do not pay benefits to family members who provide care and may not apply any care they provide to

your elimination or waiting period. Check the exclusions or definition section of your policy.

C. Where Services Are Covered

You should know what types of facilities your long-term care policy covers. If you’re not in the right type of facility

(described in your policy), the insurance company can refuse to pay for your care. There may be other options for

elder care in the future. Your policy might not cover those, but you always should check with your insurance company

before making plans for your care.

Some policies may pay for care in any state-licensed facility. Others only pay for care in some state-licensed facilities,

such as a licensed nursing facility. Still others list the types of facilities where services won’t be covered, which may

include state-licensed facilities. (For example, some places that care for elderly people are referred to as homes for the

aged, rest homes or personal care homes, and often aren’t covered by long-term care policies.) Some policies may

list specific points about the kinds of facilities they’ll cover. Some say the facilities must care for a certain number of

patients or give a certain kind of care.

NOTE: If you do NOT live in the kind of facility named in your policy, the insurance company may NOT pay for the

services you require.

When you shop for a long-term care policy, carefully compare the types of services and facilities the policy

covers. Also know that many states, companies and policies define assisted living facilities differently. Before you

move or retire to another state, ask if your policy covers the types of services and facilities available in your new

state. Also, if your policy lists kinds of facilities, check if your policy requires the facility to have a license or certification

from a government agency.

D. What Services Aren’t Covered (Exclusions and Limitations)

Most long-term care insurance policies usually don’t pay benefits for:

• A mental or nervous disorder or disease, other than Alzheimer’s disease or other dementia.

• Alcohol or drug addiction.

• Illness or injury caused by an act of war.

• Treatment in a government facility or treatment the government has already paid for.

• Attempted suicide or intentionally self-inflicted injuries.

NOTE: Many policies don’t cover or limit their coverage for care outside the United States.

E. How Much Coverage Will I Have?

The policy or certificate may state the amount of coverage in one of several ways. A policy may pay different amounts

for different types of long-term care services. Be sure you understand how much coverage you’ll have and how the

policy will cover any long-term care services you receive.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

13

Maximum Benefit Limit. Most policies limit the total benefit they’ll pay over the life of the policy, but a few don’t.

Some policies state the maximum benefit limit in years (one, two, three or more, or even lifetime). Others write the

policy maximum benefit limit as a total dollar amount. Policies often use words like “total lifetime benefit,”

“maximum lifetime benefit” or “total plan benefit” to describe their maximum benefit limit. When you look at a

policy or certificate, be sure to check the total amount of coverage. In most states, the minimum benefit period is

one year. Most nursing home stays are short,

but illnesses that go on for several years could mean long nursing home stays. You’ll have to decide if you want

protection for very long stays. Policies with longer maximum benefit periods cost more. You usually can learn what

the benefit period is by looking through the first few pages of the policy for the schedule page.

Daily/Weekly/Monthly Benefit Limit. Policies normally pay benefits by the day, week or month. For example, in

an expense- incurred plan, a policy might pay a daily nursing home benefit of up to $200 per day and a weekly

home health care benefit of up to $1,400 per week. Some policies pay one time for single events, such as installing

a home medical alert system.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

14

When you buy a policy, insurance companies let you choose a benefit amount for care in a nursing home. If a policy

covers home care, the benefit is usually a percentage of the nursing home care benefit; for example, 50% or 75%.

But, more policies now pay the same benefit amounts for care at home as in a facility. Often, you can choose the home

care benefit amount you want.

It’s important to know how much skilled nursing homes, assisted living facilities and home health care agencies

charge for their services BEFORE you choose the benefit amounts in your long-term care insurance policy. Check the

facilities in the area where you think you may be receiving care, whether they’re local, near a grown child or in a

new place where you may retire.

F. When Will I Be Eligible for Benefits (Benefit Triggers)?

“Benefit triggers” is the term usually used to describe the way insurance companies decide when to pay benefits.

This term refers to how the insurance company decides if you’re eligible for benefits. Benefit triggers are an

important part of a long-term care insurance policy. Different policies may have different benefit triggers, so look at

this policy feature carefully as you shop. Look for a section called “Eligibility for the Payment of Benefits” or simply

“Eligibility for Benefits” in the policy and outline of coverage. Some states require certain benefit triggers.

NOTE: Companies may use different benefit triggers for home care coverage than for nursing home care, but most

don’t. If they do, the benefit trigger for nursing home care is usually harder to meet than the one for home care.

Also, the benefit triggers for tax-qualified contracts are mostly the same across insurance policies. Check with your

state insurance department to find out what your state requires. (See the list of state insurance departments, agencies

on aging and state health insurance assistance programs starting on Page 57.)

G. Types of Benefit Triggers

Activities of Daily Living (ADLs)

The most common way insurance companies decide when you’re eligible for benefits is that you are expected to be

unable to do two ADLs without human assistance for 90 days. Most policies use six ADLs: bathing; continence;

dressing; eating; toileting; and transferring.

NOTE: Medicare still requires a three-day hospital stay to be eligible for Medicare payment of skilled nursing facility

benefits. Generally, today’s long-term care policies don’t require pre-hospitalization to be eligible for benefits.

If the policy you’re thinking of buying pays benefits when you can’t do certain ADLs, be sure you understand what

that means. Some policies say that someone must be actively engaged into helping you do the activities. That’s known

as hands-on assistance. Others say you qualify even if you only need someone nearby to help you if you need it

(stand-by assistance). The more clearly a policy describes its requirements, the clearer you and/or your family will be

when you need to file a claim.

Cognitive Impairment. Another benefit trigger is “cognitive impairment.” Coverage of cognitive impairment is

especially important if you develop Alzheimer’s disease or other dementia.

Doctor Certification of Medical Necessity. Another benefit trigger is “medical necessity.” Some long-term care

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

15

insurance policies require that your doctor order, or certify, that care is medically necessary. However, tax-qualified

policies can’t use this benefit trigger.

H. When Benefits Start (Elimination Period)

With many policies, your benefits won’t start the first day you go to a nursing home or start using home care. How

many days you have to wait for benefits to start will depend on the elimination period (sometimes called a

deductible or a waiting period) you pick when you buy your policy. Typically, a single elimination period applies to

any covered service, but the elimination period for home care may be shorter.

The elimination period can be 20, 30, 60, 90 or 100 days before benefits begin. It’s important to remember that you

must pay for your own care during the elimination period before benefits can begin. Companies don’t pay for care

provided by family members during or after the elimination period. It’s important that you understand how an

elimination period is defined and applied in any policy you buy.

There are two ways that companies count an elimination period.

Under a “calendar day” method, every day that you satisfy the benefit triggers count toward the elimination

period, regardless of whether you received any services on those days. However, many coverages will not start

counting those days until you incur costs. So, it can be important to get commercial services as soon as possible

when you need care.

Under the service days method, only the days that you pay for professional care services covered by the policy

count toward the elimination period. For example, if you only use paid care for three days a week, it will take longer

for your benefits to start than if you use paid care five days a week. So, you would have more out-of-pocket costs

before your benefits begin.

You may choose to pay a higher premium for a shorter elimination period. If you choose a longer elimination period,

you’ll pay a lower premium. For example:

• A 30-day waiting period means the insurer will not cover long-term care costs incurred during the first 30 days

you would otherwise be eligible.

• A 90-day waiting period means the insurer will not cover long-term care costs incurred during the first 90 days

you would otherwise be eligible.

When choosing a waiting period, keep in mind that, by the time you need care, long-term care may be much more

costly than today and your maximum daily benefit may have inflated. If you have a financial partner, consider

also that you and your partner might both go through waiting periods.

Be sure you know how the policy defines the elimination period. Find out if the insurance company requires

another elimination period for a second stay. Some policies only require you to meet the elimination period once

in your lifetime. Others require you to satisfy the elimination period with each “episode of care.”

I. Inflation Protection

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

16

Inflation protection can be one of the most important features you can add to a long-term care insurance policy.

Inflation protection increases the premium, because it increases the potential benefits. However, unless your

benefits increase over time, years from now you may find that they haven’t kept up with increasing long-term care

costs. For example, if inflation is 5% a year, a nursing home that costs $150 a day in 2018 will cost $398 a day in 20

years. Obviously, the younger you are when you buy a policy, the more important it is for you to think about adding

inflation protection. You usually can buy inflation protection in one of two ways: automatically or by special offer.

Automatic Inflation Protection. With automatic inflation protection, your benefit amounts go up each year, usually

with no change in your premium. The maximum daily benefit automatically increases each year by a fixed

percentage, usually 3%, for the life of the policy or for a certain period, usually 10 or 20 years.

Policies that increase benefits for inflation automatically “compound” rates. If the increase is compounded, the

annual increase will be a larger dollar amount each year and, at 3% a year, a $200 daily benefit will be a $531 daily

benefit by 2050.

The following table shows the effects of inflation on cost of care over a 30-year period, assuming a daily cost of $200

in 2020.

Compound Interest

Rate of Inflation

2020

2030

2040

2050

3%

$200

$269

$361

$485

5%

$200

$326

$531

$864

7%

$200

$393

$774

$1,522

Special Offer or Non-Automatic Inflation Protection. The second way to buy inflation protection lets you choose to

increase your benefits from time to time, such as every two or three years. If you regularly use the special offer

option, you usually don’t have to prove you’re in good health. Your premium increases if you increase your benefits.

How much it increases depends on your age at the time and how much you increase your benefit. Increasing your

benefits every few years may help you afford the cost of increasing your benefits later. If you turn down the option

to increase your benefit one year, you may not get the chance again. If you do, you may have to prove good health,

or it may cost you more money. If you don’t accept an offer, check your policy to see how that affects future offers.

Some policies continue the inflation offers while you receive benefits, but most don’t. Check your policy carefully.

NOTE: Most states’ regulations require companies to offer inflation protection. It’s up to you to decide whether to

buy it. If you don’t buy the protection, the company may ask you to sign a statement saying you didn’t want it. Be

sure you know what you’re signing.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

17

J. Third-Party Notice

You can name someone the insurance company would be required to contact if your coverage is about to end

because your premiums aren’t paid. Without this notice, people with cognitive impairments who forget to pay the

premium might lose their coverage when they need it the most.

You can choose a relative, friend or a professional (e.g., a lawyer or accountant) as your third party. After the

company contacts the person you choose, he or she would have some time to arrange to pay the overdue

premium. Some states require insurance companies to give you the chance to name a contact and to update your

list of contacts from time to time.

K. Other Long-Term Care Insurance Policy Options I Might Choose

You can probably choose other policy features, but some insurers don’t offer all of them. Each may increase your policy’s

cost.

Waiver of Premium. Premium waiver lets you stop paying the premium once you’re eligible and the insurance

company starts to pay benefits. Many long- term care insurance policies automatically include this feature, but some

may only offer it as an optional benefit. Some companies waive the premium as soon as they make the first benefit

payment. Others wait until you’ve received benefits for 60 to 90 days.

Premium Refund at Death. When you die, this benefit pays to your estate any premiums you paid, generally reduced

by any benefits the company paid. Some provisions refund premiums only if the policyholder dies before a certain

age, usually 65 or 75, and some refund only upon the second death of a couple.

Downgrades. While it may not always appear in the contract, most insurers let you reduce your coverage if you have

trouble paying the premium. When you downgrade your policy, it covers less and/or has lower benefits and you’ll pay

a lower premium. Downgrading may let you keep your policy instead of dropping it.

L. What If I Can’t Afford the Premiums After I Buy the Policy?

Nonforfeiture Benefit. If, for whatever reason, you drop your coverage and your policy has a nonforfeiture benefit,

you’ll get some value for the money you’ve paid into the policy. Without this type of benefit, you get nothing, even

if you paid premiums for 10 or 20 years before you dropped the policy. A nonforfeiture benefit can add roughly 10%

to 100% (and sometimes more) to a policy’s cost. How much it adds depends on such things as your age at the time

you bought the policy, the type of nonforfeiture benefit and whether the policy has inflation protection.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

18

Some states require insurance companies to offer long-term care insurance policies with a nonforfeiture benefit. If

so, you may be given benefit choices, including a reduced paid-up policy, shortened benefit period policy and an

extended term policy. With any of these, when you stop paying your premiums, the company gives you a paid-up

policy. Depending on the option you choose, your paid-up policy could either have the same benefit period but with

a lower daily benefit (reduced paid-up policy) or the same daily benefit but with a shorter benefit period (shortened

benefit period policy or extended term policy) than your original policy. Regardless, the level of benefits depends

on how long you paid premiums and how much you’ve paid in premiums. Because the policy is paid-up, you won’t owe

any more premiums. If the nonforfeiture benefit is extended term and you don’t use the benefits in a certain period

of time, your coverage ends. There’s no time limit to use the benefits if the nonforfeiture benefit is a reduced paid-

up policy.

Other insurers may offer a “return of premium” nonforfeiture benefit. They pay back all or part of the premiums that

you paid in if you drop your policy after a certain number of years. This type of nonforfeiture benefit usually costs

the most. You have the option to add a nonforfeiture benefit if you’re buying a tax-qualified policy. The return of

premium, the reduced paid-up policy and the shortened benefit period nonforfeiture benefits could be choices when

you buy a tax-qualified policy.

Contingent Nonforfeiture. In some states, if you don’t accept the offer of a nonforfeiture benefit, a company is

required to offer you a contingent benefit if the policy lapses. This means that when your premiums increase to a

certain amount (based on a table of increases), the company must give you a way to keep your policy without paying

the higher premium. For example, suppose you bought a policy at age 70 and didn’t accept the insurance company’s

offer of a nonforfeiture benefit. Also, suppose the policy is required to offer you a contingent benefit upon lapse if

the premium increases to 40% or more of the original premium. If you’re offered the contingent benefit upon lapse,

you could choose: 1) your current policy with reduced benefits so the premium stays the same; 2) a paid-up policy

with a shorter benefit period but no future premiums; or 3) your current policy with the higher premiums.

M. Will My Health Affect My Ability to Buy a Policy?

Companies that sell long-term care insurance medically “underwrite” their coverage. They look at your current and

past health before they decide to issue a policy. An employer or another type of group may not use medical

underwriting or may have more relaxed underwriting standards. Insurance companies’ underwriting practices

affect the premiums they charge you now and in the future. Some companies do what is known as “short-form”

underwriting. They only ask you to answer a few questions on the insurance application about your health. For

example, they may want to know if you’ve been in a nursing home or received care at home in the past 12 months.

Some companies do more underwriting. They may ask more questions, look at your current medical records and ask

your doctor for a statement about your health. These companies may insure fewer people with health problems. If

you have certain conditions that are likely to mean you’ll soon need long-term care (Parkinson’s disease, for

example), you probably can’t buy coverage from these companies.

Sometimes companies don’t check your medical record until you file a claim. Then they may try to refuse to pay you

benefits because of information they found in your medical record after you filed your claim. This practice is called

“post-claims underwriting.” It’s illegal in many states. Companies that thoroughly check your health before selling

you a policy aren’t as likely to do post-claims underwriting. No matter how the company underwrites, you must answer

certain questions on your application. When you fill out your application, be sure to answer all questions correctly and

completely. A company depends on the information you put on your application. If the information is wrong, an

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

19

insurance company may decide to rescind (or cancel) your policy and return the premiums you’ve paid. A company

usually can do this only in the first two years after you bought the policy. Most states require the insurance company

to give you a copy of your application when it delivers the policy. Then, you can review your answers again. You

should keep this copy of the application with your insurance papers.

N. What Happens If I Have Preexisting Conditions?

Most long-term care insurance have no limitations on preexisting conditions. However, if you purchased your policy

through your employer and some evidence of good health was waived, a preexisting condition exclusion might apply.

Generally, a preexisting condition is one for which you got medical advice or treatment or had symptoms within six

months before you applied for the policy.

A company that learns about a preexisting condition not disclosed on your application might not pay for long-term

care related to that condition and might even rescind your coverage. A company usually can do this only within two

years after you bought the insurance policy. However, there is usually no time limit if you intentionally don’t tell the

company about a preexisting condition on your application.

O. Can I Renew My Long-Term Care Insurance Policy?

Long-term care insurance is guaranteed renewable. Guaranteed renewable means you can keep your coverage if

you pay your premium on time. This is not a guarantee that you can renew at the same premium. Your premium may

go up over time as your company pays more claims and more expensive claims.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

20

Insurance companies can increase the premiums on guaranteed renewable insurance but only if they increase the

premiums on all policies that are the same in that state. Any such premium increase must be filed and/or approved

by the state insurance department. An insurance company can’t single out an individual for a premium increase, no

matter whether you have filed a claim

or your health has gotten worse. If you buy coverage under a group policy and later leave the group, you may be

able to keep your group coverage or convert it to an individual policy, but you may pay more. You can ask your plan

sponsor or review your Certificate of Coverage to learn whether you have this option.

HOW MUCH DO LONG-TERM CARE INSURANCE POLICIES COST?

A long-term care insurance policy can be expensive. Be sure you can pay the premiums and still afford your other

health insurance and other expenses.

Premiums vary based on a variety of factors. These factors include your age and health when you buy a policy and the

level of coverage, benefits and options you choose. The older you are when you buy long-term care insurance, the

higher your premiums will be, as it’s more likely you’ll need long-term care services. (See “Will I Need or Use Long-

Term Care?” on Page 4.) If you buy at a younger age, your premiums will be lower, but you’ll pay premiums for a

longer period of time. According to recent studies, the average buyer is age 59.

If you buy a policy with a large daily benefit, a longer maximum benefit period or a home health care benefit, it will

cost more. Inflation protection and nonforfeiture benefits mean much higher premiums for long-term care

insurance. Both inflation protection and nonforfeiture benefits can significantly increase your premium.

The table that follows shows examples of how much premiums can vary depending on your age and coverage options.

It shows the average annual premiums for basic long-term care insurance ($200 daily benefit amount; four-year, six-

year and lifetime coverage; and a 20-day elimination period) with and without a 5% compound inflation protection

option and with no nonforfeiture benefit option.

Remember, your actual premium may be very different.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

21

The following table does not account for basic long-term care insurance that is part of a life insurance or annuity policy.

Average Annual Premium for Basic Long-Term Insurance, $200 Daily Benefit

Age When Buy

With Inflation Protection 5% Compounded Per Year

4 Years of Benefits

6 Years of Benefits

Lifetime Benefits

50

$4,349

$5,083

$7.347

60

$5,331

$6,269

$8,927

70

$9,206

$10,549

$15,070

75

$13,500

$15,157

$20,930

With No Inflation Protection – Benefit Stays at $200 per Day

4 Years of Benefits

6 Years of Benefits

Lifetime Benefits

50

$1,294

$1,514

$1,997

60

$2,057

$2,426

$3,307

70

$4,914

$5,834

$7,777

75

$8,146

$8,291

$12,337

Another issue to keep in mind is that long-term care insurance policies may not cover the full cost of your care. For

example, if your policy covers $110 a day in a nursing home, but the total cost of care is $150 a day, you must pay

the difference.

REMEMBER: Medications and therapies increase your total daily costs. Consider the long-term care costs in your state

when you choose the amount of coverage to buy.

NOTE: Don’t be misled by the term “level premium.” You may be told that your long-term care insurance premium

is “level.” That doesn’t mean it will never increase. For almost all long-term care insurance policies, companies can’t

guarantee that premiums will never increase. Many states have adopted regulations that don’t let insurance

companies use the word “level” to sell guaranteed renewable policies. Companies must tell consumers that

premiums may go up. Look for that information on the outline of coverage and the policy’s face page when you

shop.

When you buy a long-term care policy, think about how much your income is. How much can you afford to spend on

a long-term care insurance policy now? A rule of thumb is that you may not be able to afford the policy if the

premiums will be more than 7% of your income. Also, try to think about what your future income and living expenses

are likely to be and how much premium you could pay then. If you don’t expect your income to increase and you can

barely afford the premium now, it probably isn’t a good idea to buy a policy.

As you decide what you can afford, consider the effect if the premium goes up in the future. While a company can’t raise

premiums because you filed a claim or your health changed, the company can raise the premiums for an entire class

of policies. Again, it probably isn’t a good idea to buy a policy if you are not confident that you will be able to afford

the premiums on an ongoing basis.

A. What Options Do I Have to Pay the Premiums on the Policy?

If you decide you can afford to buy a long-term care insurance policy, there are two main ways you can pay your

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

22

premiums: the continuous payment option and the limited payment option. Not every company offers the limited

payment option in every state. Ask your state insurance department what options your state allows. (See the list of

state insurance departments, agencies on aging and state health insurance assistance programs starting on Page 51.)

Premiums usually are less with the continuous payment option. Under this option, you pay the premiums on your

policy—typically monthly, quarterly, or once or twice a year—until you trigger your benefits. The company can’t

cancel the policy unless you don’t pay the premiums.

Some companies offer a limited payment option to pay premiums. Under this option, you pay premiums for a set time

period in one of the following ways:

• Single pay. You make one lump-sum payment.

• 10-pay and 20-pay. You pay premiums for either 10 or 20 years, and nothing after that. You might choose this

option if your income will be lower in 10 or 20 years.

• Pay-to-65. You pay premiums until you’re age 65 and nothing after that.

With any of these payment options, neither you nor the company can cancel the policy after you make the last

premium payment. Limited payment option policies are more expensive than continuous payment policies,

because you’re paying a greater portion of your premium with each payment. Unless the contract fixes your premium

for the payment period, your premium could increase. Despite the higher cost, some consumers want the

guaranteed fixed payment and no-cancel features. Ask your tax advisor for information about the tax treatment of

limited payment options.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

23

B. If I Already Own a Policy, Should I Switch Policies or Upgrade the Coverage I Have Now?

Before you switch to a new long-term care insurance policy, be sure it’s better than the one you have now. Even

if your agent now works for a different company, think carefully before you make any changes. Switching may be

right for you if your old policy requires you to stay in the hospital or to receive other types of care before it pays

benefits. Before you decide to change, though, first ask if you can upgrade the coverage on the policy you

already have. For example, you might add inflation protection or take off the requirement that you stay in the

hospital. It might cost less to improve a policy you have now than to buy a new one. If not, you could replace your

current policy with one that gives you more benefits, or even add a second policy. Be sure to talk about any changes

in your coverage with a trusted family member or friend. Also, be sure you’re in good health and can qualify for

another policy.

If you decide to switch to a new long-term care insurance policy, be sure the company accepts your application and

issues the new policy before you cancel the old one. When you cancel a policy in the middle of its term, many

companies won’t give back any premiums you’ve paid. If you switch policies, you may not have coverage for

preexisting conditions for a certain period.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

24

WHAT SHOPPING TIPS SHOULD I KEEP IN MIND?

Here are some points to keep in mind as you shop.

Ask questions.

If you have questions about the agent, the insurance company or the policy, contact your state insurance

department or insurance counseling program. (See the list of state insurance departments, agencies on aging and

state health insurance assistance programs starting on Page 51.) Be sure the company is reputable and licensed to

sell long-term care insurance policies in your state.

Check with several companies and agents.

It’s wise to contact several companies (and agents) before you buy. Compare benefits, the types of facilities you

have to be in to get coverage, the limits on your coverage, what’s not covered and, of course, the premiums. Policies

that have the same coverage and benefits may not cost the same. (See the Personal Assessment and Long-Term Care

Policy Checklist starting on Page 40.)

Check out the companies’ premium increase histories.

Ask companies whether they’ve increased the premiums on the long-term care insurance policies they sell. Ask to

see a company’s personal worksheet that includes the company’s premium increase history. (See the Long-Term Care

Insurance Personal Worksheet on Page 47.)

Some state insurance departments prepare a consumer guide for long-term care insurance each year. These guides

may include an overview of long-term care insurance, a list of companies selling long-term care insurance in your

state, the types of benefits and policies you can buy (both as an individual and as a member of a group) and a

premium increase history of each company that sells long-term care insurance in that state. Some guides even include

examples of different coverage types and combinations and premiums to help you compare policies. Contact your

state insurance department or insurance assistance program for this information. (See the list of state insurance

departments, agencies on aging and state health insurance assistance programs starting on Page 51.)

Take your time and compare outlines of coverage.

Ask for an outline of coverage, which describes the policy’s benefits and points out important features. Compare outlines

of coverage for several policies, making sure they are similar (if not the same). In most states, the agent must provide

an outline of coverage when he or she first contacts you. Never let anyone pressure or scare you into making a quick

decision. Don’t buy a policy the first time you see an agent.

A SHOPPER’S GUIDE TO LONG-TERM CARE INSURANCE

©2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

25

Understand the policies.

Be sure you know what the policy covers and what it doesn’t. If you have any questions, call the insurance company

before you buy.

If any information confuses you or is different from the information in the company literature, don’t hesitate to call

or write the company to ask your questions. Don’t trust any sales presentation or literature that claims you have

only one chance to buy a policy.

Some companies sell their policies through agents, while others sell their policies through the mail, skipping agents

entirely. No matter how you buy your policy, check with the company if you don’t understand how the policy works.

Talk about the policy with a trusted family member or friend. You also may want to contact your state insurance

department or state health insurance assistance program (SHIP). (See the list of state insurance departments,

agencies on aging and state health insurance assistance programs starting on Page 51.)

Don’t be misled by advertising.

Most celebrity endorsers are professional actors paid to advertise. They aren’t insurance experts. Medicare doesn’t

endorse or sell long-term care insurance policies. Be wary of any advertising that suggests Medicare is involved.

Don’t trust cards you get in the mail that look like official government documents until you check with the

government agency identified on the card. Insurance companies or agents trying to find buyers may have sent them.

Be careful if anyone asks you questions over the telephone about Medicare or your insurance. They may sell any

information you give to long-term care insurance marketers, who might call you, come to your home or try to sell

you insurance by mail.

Be sure you put correct and complete information on your application

Don’t be misled by long-term care insurance marketers who say your medical history isn’t important—it is! Give

correct information. If an agent fills out the application for you, don’t sign it until you’ve read it. Be sure that

all of the medical information is accurate and complete. If it isn’t and the company used that information to decide

whether to insure you, it could refuse to pay your claims and even cancel your policy.

Never pay in cash.

Use a check, an electronic bank draft made payable to the insurance company or a credit card.

Be sure to get the name, address, and telephone number of the agent and the company.

Get a local or toll-free number for both the agent and the company.

If you don’t get your policy within 60 days, contact the company or agent.

You have a right to expect prompt delivery of your policy. When you get it, keep it somewhere you can easily find it.

Tell a trusted family member or friend where it is.