CIGNA Dental Benefit Summary

Government of the District of Columbia

PPO Core Network

All deductibles, plan maximums, and service specific maximums (dollar and occurrence) cross accumulate between in and out of network.

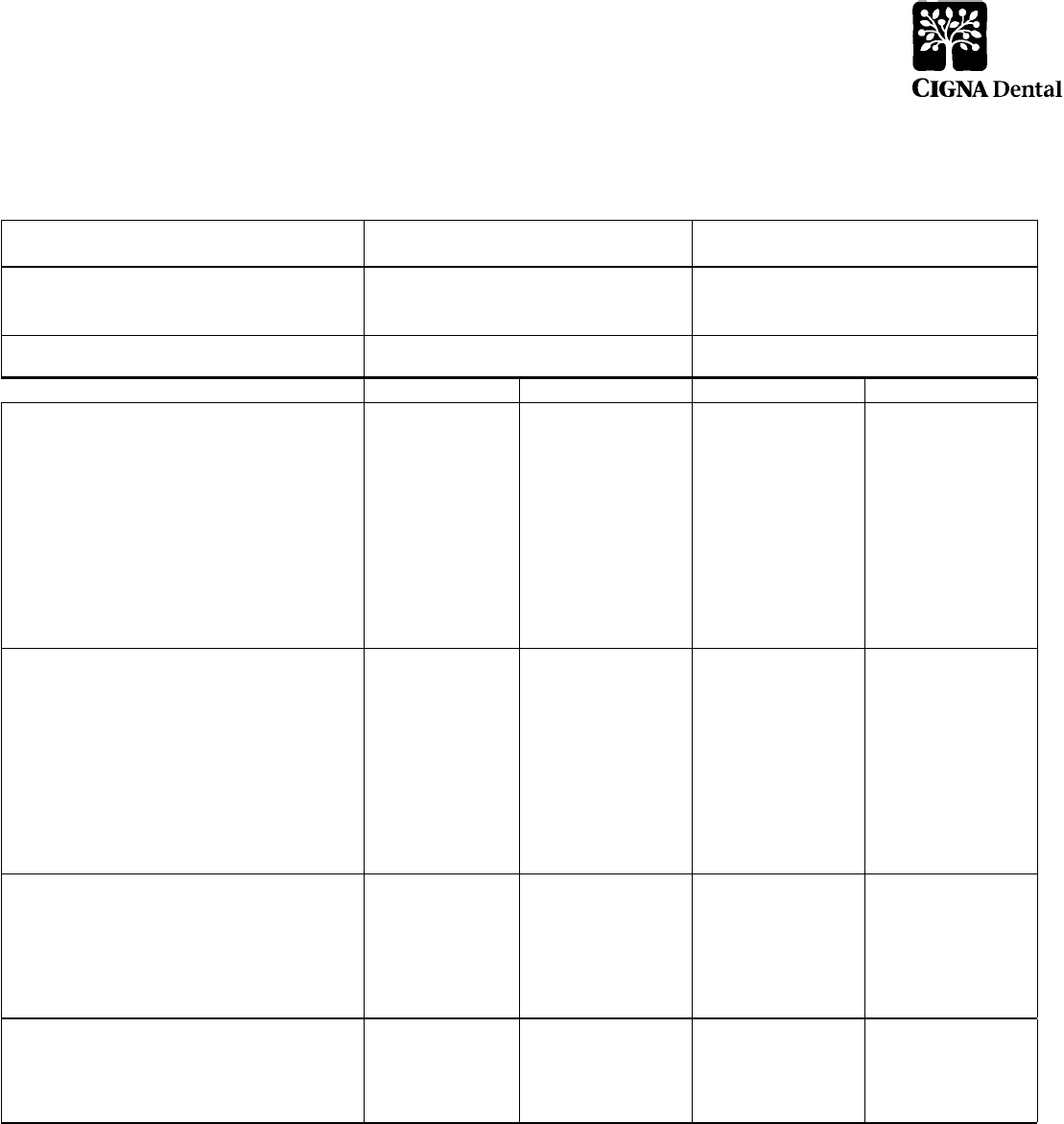

Benefits CIGNA Dental PPO

In-Network Out-of-Network

Calendar Year Maximum

(Class I, II and III expenses)

$3,500 $3,500

Annual Deductible

Individual

None None

Family

None None

Reimbursement Levels

**

Based on Reduced Contracted Fees 80th percentile of Reasonable and Customary

Allowances

Plan Pays You Pay Plan Pays You Pay

Class I - Preventive & Diagnostic Care

Oral Exams

Routine Cleanings

Full Mouth X-rays

Bitewing X-rays

Panoramic X-ray

Periapical X-rays

Fluoride Application

Sealants

Space Maintainers

Emergency Care to Relieve Pain

Histopathologic Exams

100% No Charge 90% 10%

Class II - Basic Restorative Care

Fillings

Root Canal Therapy/Endodontics

Osseous Surgery

Periodontal Scaling and Root Planing

Denture Adjustments and Repairs

Oral Surgery – Simple Extractions

Oral Surgery – all except simple extractions

Anesthetics

Surgical Extractions of Impacted Teeth

Repairs to Bridges, Crowns and Inlays

90% 10% 80% 20%

Class III - Major Restorative Care

Crowns

Surgical Implants

Dentures

Bridges

Inlays/Onlays

Prosthesis Over Implant

70% 30% 50% 50%

Class IV - Orthodontia

70% 30% 50% 50%

Lifetime Maximum $3,500 $3,500

Dependent children

to age 25

Dependent children to

age 25

There is no missing tooth limitation included in the plan(s).

Pretreatment review is available on a voluntary basis when extensive dental work in excess of $200 is proposed.

**For services provided by a CIGNA Dental PPO network dentist, CIGNA Dental will reimburse the dentist according to a Contracted Fee Schedule. For services

provided by an out-of-network dentist, CIGNA Dental will reimburse according to Reasonable and Customary Allowances but the dentist may balance bill up to their

usual fees.

CIGNA Dental PPO Exclusions and Limitations

Procedure Exclusions and Limitations

Late Entrants Limit 50% coverage on Class III and IV for 12 or 24 months

Exams Two per Calendar year

Prophylaxis (Cleanings) Two per Calendar year

Fluoride 1 per Calendar year for people under 19

Histopathologic Exams Various limits per Calendar year depending on specific test

X-Rays (routine) Bitewings: 2 per Calendar year

X-Rays (non-routine) Full mouth: 1 every 36 consecutive months., Panorex: 1 every 36 consecutive months

Model Payable only when in conjunction with Ortho workup and extensive Perio treatment

Minor Perio (non-surgical) Various limitations depending on the service

Perio Surgery Various limitations depending on the service

Crowns and Inlays Replacement every 5 years

Bridges Replacement every 5 years

Dentures and Partials Replacement every 5 years

Relines, Rebases Covered if more than 6 months after installation

Adjustments Covered if more than 6 months after installation

Repairs - Bridges Reviewed if more than once

Repairs - Dentures Reviewed if more than once

Sealants Limited to posterior tooth. One treatment per tooth every three years

Space Maintainers Limited to non-Orthodontic treatment

Prosthesis Over Implant 1 per 60 consecutive months is unserviceable and cannot be repaired. Benefits are based on the amount payable for

non-precious metals. No porcelain or white/tooth colored material on molar crowns or bridges

Alternate Benefit When more than one covered Dental Service could provide suitable treatment based on common dental standards, CG will

determine the covered Dental Service on which payment will be based and the expenses that will be included as Covered

Expenses. Resins on posterior teeth will be excluded from Alternate Benefits.

Benefit Exclusions:

• Services performed primarily for cosmetic reasons

• Replacement of a lost or stolen appliance

• Replacement of a bridge or denture within five years following the date of its original installation

• Replacement of a bridge or denture which can be made useable according to accepted dental standards

• Procedures, appliances or restorations, other than full dentures, whose main purpose is to change vertical dimension, diagnose or treat conditions of TMJ, stabilize

periodontally involved teeth, or restore occlusion

• Veneers of porcelain or acrylic materials on crowns or pontics on or replacing the upper and lower first, second and third molars

• Bite registrations; precision or semi-precision attachments; splinting

• Instruction for plaque control, oral hygiene and diet

• Dental services that do not meet common dental standards

• Services that are deemed to be medical services

• Services and supplies received from a hospital

• Charges which the person is not legally required to pay

• Charges made by a hospital which performs services for the U.S. Government if the charges are directly related to a condition connected to a military service

• Experimental or investigational procedures and treatments

• Any injury resulting from, or in the course of, any employment for wage or profit

• Any sickness covered under any workers' compensation or similar law

• Charges in excess of the reasonable and customary allowances

• To the extent that payment is unlawful where the person resides when the expenses are incurred;

• Procedures performed by a Dentist who is a member of the covered person's family (covered person's family is limited to a spouse, siblings, parents, children,

grandparents, and the spouse's siblings and parents);

• For charges which would not have been made if the person had no insurance;

• For charges for unnecessary care, treatment or surgery;

• To the extent that you or any of your Dependents is in any way paid or entitled to payment for those expenses by or through a public program, other than

Medicaid;

• To the extent that benefits are paid or payable for those expenses under the mandatory part of any auto insurance policy written to comply with a“no-fault”

insurance law or an uninsured motorist insurance law. Connecticut General Life Insurance Company will take into account any adjustment option chosen under

such part by you or any one of your Dependents.

• In addition, these benefits will be reduced so that the total payment will not be more than 100% of the charge made for the Dental Service if benefits are provided

for that service under this plan and any medical expense plan or prepaid treatment program sponsored or made available by your Employer.

This benefit summary highlights some of the benefits available under the proposed plan. A complete description regarding the terms of coverage, exclusions

andlimitations, including legislated benefits, will be provided in your insurance certificate or plan description. Benefits are insured and/or administered by Connecticut

General Life Insurance Company.

CIGNA Dental refers to the following operating subsidiaries of CIGNA Corporation: Connecticut General Life Insurance Company, and CIGNA Dental Health, Inc.,

and its operating subsidiaries and affiliates. The CIGNA Dental Care plan is provided by CIGNA Dental Health Plan of Arizona, Inc., CIGNA Dental Health of

California, Inc., CIGNA Dental Health of Colorado, Inc., CIGNA Dental Health of Delaware, Inc., CIGNA Dental Health of Florida, Inc., a Prepaid Limited Health

Services Organization licensed under Chapter 636, Florida Statutes, CIGNA Dental Health of Kansas, Inc. (Kansas and Nebraska), CIGNA Dental Health of Kentucky,

Inc., CIGNA Dental Health of Maryland, Inc., CIGNA Dental Health of Missouri, Inc., CIGNA Dental Health of New Jersey, Inc., CIGNA Dental Health of North

Carolina, Inc., CIGNA Dental Health of Ohio, Inc., CIGNA Dental Health of Pennsylvania, Inc., CIGNA Dental Health of Texas, Inc., and CIGNA Dental Health of

Virginia, Inc. In other states, the CIGNA Dental Care plan is underwritten by Connecticut General Life Insurance Company or CIGNA HealthCare of Connecticut, Inc.

and administered by CIGNA Dental Health, Inc. The term “DHMO” is used to refer to product designs that may differ by state of residence of enrollee, including but

not limited to, prepaid plans, managed care plans, and plans with open access features.The CIGNA Dental PPO is underwritten and/or administered by Connecticut

General Life Insurance Company with network management services provided by CIGNA Dental Health, Inc. For Arizona/Louisiana residents the dental PPO plan is

known as CG Dental PPO. In Texas, CIGNA Dental's network-based indemnity plan is known as CIGNA Dental Choice. The CIGNA Traditional plan is underwritten

or administered by Connecticut General Life Insurance Company. In Arizona and Louisiana, the CIGNA Traditional plan is referred to as CG Traditional.

BSD21755 © 2010 CIGNA