Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

1

ADD cover page

June 28, 2024

Version: 7.0

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

2

Coronavirus State and Local Fiscal Recovery Funds

Guidance on Recipient Compliance and Reporting

Responsibilities

On March 11, 2021, the American Rescue Plan Act was signed into law, and established the

Coronavirus State Fiscal Recovery Fund and Coronavirus Local Fiscal Recovery Fund, which

together make up the Coronavirus State and Local Fiscal Recovery Funds (“SLFRF”) program. This

program is intended to provide support to State, territorial, local, and Tribal governments in responding

to the economic and public health impacts of COVID-19 and in their efforts to contain impacts on their

communities, residents, and businesses.

In May 2021, Treasury published the 2021 interim final rule (“2021 IFR”) describing eligible and

ineligible uses of SLFRF, as well as other program requirements. The initial versions of this

Compliance and Reporting guidance reflected the 2021 IFR and its eligible use categories. On

January 6, 2022, the U.S. Department of the Treasury (“Treasury”) adopted the 2022 final rule

implementing the SLFRF program. The 2022 final rule became effective on April 1, 2022. Prior to the

2022 final rule effective date, the 2021 IFR remained in effect; funds used consistently with the 2021

IFR while it was in effect were in compliance with the SLFRF program. However, recipients could

choose to take advantage of the 2022 final rule’s flexibilities and simplifications ahead of the effective

date. Recipients may consult the

Statement Regarding Compliance with the Coronavirus State and

Local Fiscal Recovery Funds Interim Final Rule and Final Rule for more information on compliance

with the 2021 IFR and the 2022 final rule.

On December 29, 2022, the Consolidated Appropriations Act, 2023 was enacted, amending the

SLFRF program to provide additional flexibility for recipients to use SLFRF funds for three new eligible

use categories. The 2023 interim final rule (“2023 IFR”) was published in the federal register on

September 20, 2023. The 2023 IFR became effective upon publication.

In November 2023, Treasury issued an interim final rule (the “Obligation IFR”) to amend the definition

of “obligation” at 31 CFR 35.3 and to provide related clarifications. The Obligation IFR was published

in the federal register on November 20, 2023. The Obligation IFR became effective upon publication.

Treasury published additional guidance clarifying the provisions of the Obligation IFR on March 29,

2024 in Section 17: Obligation of the SLFRF FAQs

.

To support recipients in complying with the 2022 final rule, the 2023 IFR, and the Obligation IFR, this

reporting guidance reflects the 2022 final rule, the 2023 IFR, the Obligation IFR, and subsequent

guidance provided in FAQs. This guidance provides additional detail and clarification for each

recipient’s compliance and reporting responsibilities under the SLFRF program and should be read

in concert with the Award Terms and Conditions, the authorizing statute, the 2022 final rule, the

2023

IFR, the Obligation IFR, other program guidance including the State and Local Fiscal Recovery Funds

Frequently Asked Questions, and other regulatory and statutory requirements, including regulatory

requirements under the Uniform Administrative Requirements, Cost Principles, and Audit

Requirements for Federal Awards (“Uniform Guidance” or 2 CRF Part 200), and 2021 SLFRF

Compliance Supplement – Technical Update, 2022 SLFRF Compliance Supplement, 2023 SLFRF

Compliance Supplement, and 2024 SLFRF Compliance Supplement. Please see the Assistance

Listing in SAM.gov under assistance listing number (formerly known as the CFDA number) 21.027 for

more information.

Please Note: This guidance document applies to the SLFRF program only and does not change or

impact reporting and compliance requirements for the Coronavirus Relief Fund (“CRF”) established

by the CARES Act.

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

3

This guidance includes two parts:

Part 1: General Guidance

This section provides an orientation to recipients’ compliance responsibilities and Treasury’s

expectations and recommends best practices where appropriate under the SLFRF program.

A. Key Principles……………………..…………………………………………………….

P. 4

B. Statutory Eligible Uses………………………………………………………………….

P. 4

C.

Treasury’s 2022 Final Rule, 2023 IFR, and Obligation IFR

..…………….…………

P. 5

D. Uniform Guidance (2 CFR Part 200)……………..……………………………………

P. 8

E.

Award Terms and Conditions………………………………...………………………...

P. 13

Part 2: Reporting Requirements

This section provides information on the reporting requirements for the SLFRF program.

A. Interim Report…...……………..……………………………………………...….

P. 18

B. Project and Expenditure Report…………….…………………………………...…….

P. 19

C. Recovery Plan Performance Report..………………..……………………….….……

P. 40

Appendix 1: Expenditure Categories…………………………………………………….……

P. 48

Appendix 2: Evidenced-Based Intervention Additional Information…………………….….

P. 55

Appendix 3: Expenditure Categories under the 2021 Interim Final Rule………..………..

P. 56

OMB Control Number: 1505-0271

OMB Expiration Date: 04/30/2025

PAPERWORK REDUCTION ACT NOTICE

The information collected will be used for the U.S. Government to process requests for support. The

estimated burden for the collections of information included in this guidance is as follows: 30 minutes

for Title VI Assurances, 2 hours per response for the Interim Report, 6 hours per response for the

Project and Expenditure Report and 100 hours per response for the Recovery Plan Performance

Report (if applicable). Comments concerning the accuracy of this burden estimate and suggestions

for reducing this burden should be directed to the Office of Privacy, Transparency and Records,

Department of the Treasury, 1500 Pennsylvania Ave., N.W., Washington, D.C. 20220. DO NOT send

the form to this address. An agency may not conduct or sponsor, and a person is not required to

respond to, a collection of information unless it displays a valid control number assigned by OMB.

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

4

Part 1: General Guidance

This section provides an orientation on recipients’ compliance responsibilities and Treasury’s

expectations and recommended best practices where appropriate under the SLFRF program.

Recipients under the SLFRF program are the eligible entities identified in sections 602 and 603 of the

Social Security Act as added by section 9901 of the American Rescue Plan Act of 2021 (the “SLFRF

statute”) that receive

an SLFRF award. Subrecipients under the SLFRF program are entities that

receive a subaward from a recipient to carry out the purposes (program or project) of the SLFRF

award on behalf of the recipient.

Recipients are accountable to Treasury for oversight of their subrecipients in accordance with 2 CFR

200.332, including ensuring their subrecipients comply with the SLFRF statute, SLFRF Award Terms

and Conditions, Treasury’s 2021 IFR, 2022 final rule, 2023 IFR, Obligation IFR, other applicable

federal statutes and regulations, and reporting requirements.

A. Key Principles

There are several guiding principles for developing your own effective compliance regimes:

• Recipients and subrecipients are the first line of defense and responsible for ensuring the SLFRF

award funds are not used for ineligible purposes, and there is no fraud, waste, or abuse associated

with their SLFRF award;

• Many SLFRF-funded projects respond to the COVID-19 public health emergency

1

and meet

urgent community needs. Swift and effective implementation is vital, and recipients must balance

facilitating simple and rapid program access widely across the community and maintaining a

robust documentation and compliance regime;

• Treasury encourages recipients to use SLFRF-funded projects to advance shared interests and

promote equitable delivery of government benefits and opportunities to underserved communities,

as outlined in

Executive Order 13985, On Advancing Racial Equity and Support for Underserved

Communities Through the Federal Government; and

• Transparency and public accountability for SLFRF award funds and use of such funds are critical

to upholding program integrity and trust in all levels of government, and SLFRF award funds

should be managed consistent with Administration guidance per Memorandum M-21-20

and

Memorandum M-20-21.

B. Statutory Eligible Uses

As a recipient of an SLFRF award, your organization has substantial discretion to use the award funds

in the ways that best suit the needs of your constituents – as long as such use fits into one of the

following seven statutory categories:

1. To respond to the COVID-19 public health emergency or its negative economic impacts;

2. To respond to workers performing essential work during the COVID-19 public health emergency

by providing premium pay to eligible workers of the recipient that are performing such essential

work, or by providing grants to eligible employers that have eligible workers who perform essential

work;

3. For the provision of government services, to the extent of the reduction in revenue of such

1

The SLFRF rule defines “COVID-19 public health emergency” as “the period beginning on January 27, 2020

and lasting until the termination of the national emergency concerning the COVID-19 outbreak declared

pursuant to the National Emergencies Act.” See 31 CFR 35.3. As discussed in FAQ 4.11, following the

termination of the National Emergency on April 10, 2023, recipients generally may continue to make

investments using their SLFRF funds without changes, with the exception of projects in the premium pay

eligible use category. Please refer to FAQ 4.11 for more information.

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

5

recipient due to the COVID–19 public health emergency, relative to revenues collected in the most

recent full fiscal year of the recipient prior to the emergency;

4. To make necessary investments in water, sewer, or broadband infrastructure;

5. To provide emergency relief from natural disasters or the negative economic impacts of natural

disasters;

6. For projects eligible under the 26 surface transportation programs specified in the 2023 CAA

(Surface Transportation projects); or

7. For projects eligible under Title I of the Housing and Community Development Act of 1974 (Title I

projects).

In addition, sections 602(c)(4) and 603(c)(5) of the Social Security Act, as amended by the

Infrastructure Investment and Jobs Act, provide that SLFRF funds may be used for an authorized

Bureau of Reclamation project for purposes of satisfying any non-Federal matching requirement

required for the project.

Treasury adopted the 2021 IFR in May 2021 and the 2022 final rule

on January 6, 2022 to

implement the first four eligible use categories and other restrictions on the use of funds under the

SLFRF program. The 2022 final rule took effect on April 1, 2022, and the 2021 IFR remained in

effect until that time, although recipients could choose to take advantage of the 2022 final rule’s

flexibilities and simplifications prior to April 1, 2022. Recipients may consult the

Statement

Regarding Compliance with the Coronavirus State and Local Fiscal Recovery Funds Interim Final

Rule and Final Rule for more information on compliance with the 2021 IFR and the 2022 final rule.

On December 29, 2022, the Consolidated Appropriations Act, 2023 was enacted, amending the

SLFRF program to provide additional flexibility for recipients to use SLFRF funds for three new eligible

use categories. The 2023 IFR was published in the Federal Register on September 20, 2023 and

became effective upon publication. The Obligation IFR was published in the Federal Register on

November 20, 2023 and became effective upon publication.

It is the recipient’s responsibility to ensure all SLFRF award funds are used in compliance with the

program’s requirements. In addition, recipients should be mindful of any additional compliance

obligations that may apply – for example, additional restrictions imposed upon other sources of funds

used in conjunction with SLFRF award funds, or statutes and regulations that may independently

apply to water, broadband, and sewer infrastructure projects. Recipients should ensure they maintain

proper documentation supporting determinations of costs and applicable compliance requirements,

and how they have been satisfied as part of their award management, internal controls, and

subrecipient oversight and management.

C. Treasury’s 2022 Final Rule, 2023 IFR, and Obligation IFR

Treasury’s 2022 final rule, 2023 IFR, and Obligation IFR

detail recipients’ compliance responsibilities

and provide additional information on eligible and restricted uses of SLFRF award funds and reporting

requirements.

1. Eligible and Restricted Uses of SLFRF Funds. As described in the SLFRF statute and

summarized above, there are seven eligible uses of SLFRF award funds. As a recipient of an

award under the SLFRF program, your organization is responsible for complying with

requirements for the use of funds. In addition to determining a given project’s eligibility, recipients

are also responsible for determining subrecipients’ or beneficiaries’ eligibility, and must monitor

subrecipients’ use of SLFRF award funds.

To help recipients build a greater understanding of eligible uses, Treasury’s 2022 final rule

and

2023 IFR establish frameworks for determining whether a specific project would be eligible under

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

6

the SLFRF program, including some helpful definitions. For example, Treasury’s 2022 final rule

and 2023 IFR establish:

• A framework for determining whether a project responds to the COVID-19 public health

emergency or its negative economic impacts;

• Definitions of “eligible employers,” “essential work,” “eligible workers,” and “premium pay” for

cases where premium pay is an eligible use;

• The option to select between a standard amount of revenue loss or complete a full revenue

loss calculation of revenue lost due to the COVID-19 public health emergency;

• A framework for necessary water and sewer infrastructure projects that aligns eligible uses

with projects that are eligible under the Environmental Protection Agency’s Drinking Water

and Clean Water State Revolving Funds along with certain additional projects, including a

wider set of lead remediation and stormwater infrastructure projects and aid for residential

wells;

• A framework for necessary broadband projects that allows for projects that are designed to

provide service of sufficient speeds to eligible areas, as well as an affordability requirement

for providers that provide service to households;

• A framework for determining how to provide emergency relief from a natural disaster;

• Three pathways for using SLFRF funds for Surface Transportation projects; and

• A list of eligible Title I projects by reference to the activities that are eligible under the

Community Development Block Program.

Treasury’s 2022 final rule

also provides more information on important restrictions on use of

SLFRF award funds, including that recipients other than Tribal governments may not deposit

SLFRF funds into a pension fund; and recipients that are States or territories may not use SLFRF

funds to offset a reduction in net tax revenue resulting from the recipient’s change in law,

regulation, or administrative interpretation. In addition, recipients may not use SLFRF funds

directly to service debt, satisfy a judgment or settlement, or contribute to a “rainy day” fund.

Recipients should refer to Treasury’s 2022 final rule for more information on these restrictions and

to the 2023 IFR for how these restrictions apply to the eligible uses added by the Consolidated

Appropriations Act, 2023.

Treasury’s 2022 final rule outlines that funds available under the “revenue loss” eligible use

category (sections 602(c)(1)(C) and 603(c)(1)(C) of the Social Security Act) generally may be

used to meet the non-federal cost-share or matching requirements of other federal programs.

However, the 2022 final rule notes that SLFRF funds may not be used as the non-federal share

for purposes of a state’s Medicaid and CHIP programs because the Office of Management and

Budget (“OMB”) has approved a waiver as requested by the Centers for Medicare & Medicaid

Services pursuant to 2 CFR 200.102 of the Uniform Guidance and related regulations. If a

recipient seeks to use SLFRF funds to satisfy match or cost-share requirements for a federal grant

program, it should first confirm with the relevant awarding agency that no waiver has been granted

for that program, that no other circumstances enumerated under 2 CFR 200.306(b) would limit

the use of SLFRF funds to meet the match or cost-share requirement, and that there is no other

statutory or regulatory impediment to using the SLFRF funds for the match or cost-share

requirement. Treasury’s 2023 IFR outlines that under the Surface Transportation projects eligible

use category, recipients may use SLFRF funds to satisfy non-federal cost share requirements for

certain programs under Pathway Three. In addition, under the Title I projects eligible use category,

recipients may use SLFRF funds to satisfy the non-federal share requirements of a federal

financial assistance program in support of activities that would be eligible under the CDBG and

ICDBG programs.

SLFRF funds beyond those that are available under the circumstances described above may not

be used to meet the non-federal match or cost-share requirements of other federal programs,

other than as specifically provided for by statute. For example, the Infrastructure Investment and

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

7

Jobs Act provides that SLFRF funds may be used to meet the non-federal match requirements of

authorized Bureau of Reclamation projects and certain broadband deployment projects.

Treasury’s 2023 IFR describes the additional statutory restrictions that apply to the Surface

Transportation projects and Title I projects eligible use categories. First, the total amount of SLFRF

funds that a recipient may use for Surface Transportation projects and Title I projects, taken

together, cannot exceed the greater of $10 million and 30% of a recipient’s SLFRF allocation.

Second, recipients using SLFRF funds for Surface Transportation projects and Title I projects

must supplement, and not supplant, other federal, state, territorial, Tribal, and local government

funds (as applicable) otherwise available for such uses. For the Surface Transportation projects

eligible use category, recipients using funds for projects eligible for Urbanized Formula Grants,

Fixed Guideway Capital Investment Grants, Formula Grants for Rural Areas, State of Good Repair

Grants, or Grants for Buses and Bus Facilities may not use SLFRF funds for operating expenses

of these projects.

2. Eligible Costs Timeframe. For eligible use categories described in the 2022 final rule, your

organization, as a recipient of an SLFRF award, may use SLFRF funds to cover eligible costs that

your organization incurred during the period that begins on March 3, 2021 and ends on December

31, 2024, as long as the award funds for the obligations incurred by December 31, 2024 are

expended by December 31, 2026. Costs incurred for projects by the recipient State, territorial,

local, or Tribal government prior to March 3, 2021 are not eligible, as provided for in Treasury’s

2022 final rule.

For eligible use categories described in the 2023 IFR, recipients may use SLFRF funds for the

three new eligible uses for costs incurred beginning December 29, 2022. Consistent with the

existing eligible uses, recipients must obligate SLFRF funds for the new eligible uses by December

31, 2024. Recipients must expend SLFRF funds obligated to provide emergency relief from

natural disasters by December 31, 2026. Recipients must expend SLFRF funds obligated for

Surface Transportation projects and Title I projects by September 30, 2026. Costs for projects

described in the 2023 IFR that are incurred by the recipient State, territorial, local, or Tribal

government prior to December 29, 2022 are not eligible under these three eligible use categories.

Recipients may, in certain circumstances, use SLFRF award funds for the eligible use

categories described in Treasury’s 2022 final rule for costs incurred prior to March 3, 2021.

Specifically,

a. Public Health/Negative Economic Impacts: Recipients may use SLFRF award funds to

provide assistance to households, small businesses, and nonprofits to respond to the public

health emergency or negative economic impacts of the pandemic – such as rent, mortgage,

or utility assistance – for costs incurred by the beneficiary (e.g., a household) prior to March

3, 2021, provided that the recipient State, territorial, local or Tribal government did not incur

the cost of providing such assistance prior to March 3, 2021.

b. P

remium Pay: Recipients may provide premium pay retrospectively for work performed at

any time during the COVID-19 public health emergency. Such premium pay must be “in

addition to” wages and remuneration already received and the obligation to provide such

premium pay must not have been incurred by the recipient prior to March 3, 2021.

c. R

evenue Loss: Recipients have broad discretion to use funds for the provision of

government services to the extent of reduction in revenue. While calculation of lost revenue

is based on the recipient’s revenue in the last full fiscal year prior to the COVID-19 public

health emergency, use of funds for government services must be forward looking for costs

incurred by the recipient after March 3, 2021.

d. I

nvestments in Water, Sewer, and Broadband: Recipients may use SLFRF award funds to

make necessary investments in water, sewer, and broadband infrastructure. Recipients may

use SLFRF award funds to cover costs incurred for eligible projects planned or started prior

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

8

to March 3, 2021, provided that the project costs covered by the SLFRF award funds were

not incurred by the recipient prior to March 3, 2021.

Any funds not obligated or expended for eligible uses by the timelines above must be returned

to Treasury, including any unobligated or unexpended funds that have been provided to

subrecipients and contractors as part of the award closeout process pursuant to 2 C.F.R.

200.344(d). For the purposes of determining expenditure eligibility, “incurred” means the

recipient has incurred an obligation. See 31 CFR 35.3 and 35.5(b).

As discussed in FAQ 17.19, after the December 31, 2024 obligation deadline, recipients may

have excess funds that were obligated as of the deadline but ultimately not expended on an

eligible activity. While recipients may not incur new obligations for the use of SLFRF funds after

December 31, 2024, recipients may reclassify SLFRF funds from a reported activity to another

project that would be eligible under the program rules (including the requirement that the

recipient incurred an obligation for the project by December 31, 2024), regardless of whether

those project(s) were reported to Treasury by the obligation deadline. Treasury will add new

functionalities in the January 31, 2025 Project & Expenditure Report to enable recipients to add

and reclassify funds to project(s) for which an obligation was incurred by December 31, 2024.

3. Reporting. Generally, recipients must submit one initial Interim Report, quarterly or annual Project

and Expenditure reports which include subaward reporting, and in some cases annual Recovery

Plan reports. Treasury’s 2022 final rule, 2023 IFR, Obligation IFR, and Part 2 of this guidance

provide more detail around SLFRF reporting requirements.

4. Expenditure Categories. Treasury’s 2022 final rule provides flexibility and simplicity for recipients

to fight the pandemic and support families and businesses struggling with its impacts, maintain

vital services amid revenue shortfalls, and build a strong, resilient, and equitable recovery. As

such, recipients report on a broad set of eligible uses and associated Expenditure Categories

(“EC”), which began with the April 2022 Project and Expenditure Report. Appendix 1 includes the

ECs, as well as a reference to previous ECs used for reporting under the 2021 IFR.

The 2023 IFR implements the amendments to the SLFRF program made by the Consolidated

Appropriations Act, 2023, which provides additional flexibility for recipients to use SLFRF funds to

respond to natural disasters, build critical infrastructure, and support community development.

The additional ECs associated with the 2023 IFR began with the October 2023 Project and

Expenditure Report. These ECs also may be found in Appendix 1.

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

9

D. Uniform Administrative Requirements

The SLFRF awards are generally subject to the requirements set forth in the Uniform Guidance. In all

instances, your organization should review the Uniform Guidance requirements applicable to your

organization’s use of SLFRF funds, and SLFRF-funded projects. Additional details about applicability

of certain provisions of the Uniform Guidance may be found in:

• SLFRF 2022 final rule;

• SLFRF Assistance Listing

;

• SLFRF FAQs, including FAQ 4.9, 10.1, and Section 13; and

• SLFRF 2023 IFR.

The following sections provide a general summary of your organization’s compliance responsibilities

under applicable statutes and regulations, including the Uniform Guidance, as described in the most

recent compliance supplement issued by OMB. Note that the descriptions below are only general

summaries and all recipients and subrecipients are advised to carefully review the Uniform Guidance

requirements and any additional regulatory and statutory requirements applicable to the program.

1. Allowable Activities. Each recipient should review program requirements, including Treasury’s

2022 final rule, 2023 IFR, Obligation IFR, SLFRF FAQs, and the recipient’s Award Terms and

Conditions, to determine and record eligible uses of SLFRF funds. Per 2 CFR 200.303, your

organization must develop and implement effective internal controls to ensure that funding

decisions under the SLFRF award constitute eligible uses of funds, and document determinations.

2. Allowable Costs/Cost Principles. As outlined in the Uniform Guidance at 2 CFR Part 200,

Subpart E regarding Cost Principles, allowable costs are based on the premise that a recipient is

responsible for the effective administration of Federal awards, application of sound management

practices, and administration of Federal funds in a manner consistent with the program objectives

and terms and conditions of the award. Recipients must implement robust internal controls and

effective monitoring to ensure compliance with the Cost Principles, which are important for

building trust and accountability. Please note that as outlined in FAQ 13.15

, only a subset of the

Uniform Guidance requirements at 2 CFR Part 200 Subpart E (Cost Principles) applies to

recipients’ use of funds in the revenue loss eligible use category.

SLFRF funds may be, but are not required to be, used along with other funding sources for a given

Assistance Listing

The Assistance Listing for the Coronavirus State and Local Fiscal Recovery Funds

(SLFRF) was published May 28, 2021 on SAM.gov under Assistance Listing Number

(“ALN”), formerly known as CFDA Number, 21.027.

The assistance listing includes helpful information including program purpose, statutory

authority, eligibility requirements, and compliance requirements for recipients. The ALN is

the unique 5-digit number assigned to identify a federal assistance listing, and can be used

to search for federal assistance program information, including funding opportunities,

spending on USASpending.gov, or audit results through the Federal Audit Clearinghouse.

To expedite payments and meet statutory timelines Treasury issued initial payments under

an existing ALN, 21.019, assigned to the CRF. If you have already received funds or

captured the initial number in your records, please update your systems and reporting to

reflect the new ALN 21.027 for the SLFRF program. Recipients must use ALN 21.027

for all financial accounting, subawards, and associated program reporting

requirements for the SLFRF awards.

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

10

project. Recipients should note that SLFRF funds available under the “revenue loss” eligible use

category generally may be used to meet the non-federal cost-share or matching requirements of

other federal programs. If a recipient seeks to use SLFRF funds to satisfy match or cost-share

requirements for a federal grant program, the recipient should first confirm with the relevant

awarding agency that no waiver has been granted for that program, that no other circumstances

enumerated under 2 CFR 200.306(b) would limit the use of SLFRF funds to meet the match or

cost-share requirement, and that there is no other statutory or regulatory impediment to using the

SLFRF funds for the match or cost-share requirement. For instance, recipients should note that

SLFRF funds may not be used as the non-federal share for purposes of a state’s Medicaid and

CHIP programs because OMB has approved a waiver from this provision as requested by the

Centers for Medicare & Medicaid Services pursuant to 2 CFR 200.102 of the Uniform Guidance

and related regulations.

Treasury’s 2023 IFR outlines that under the Surface Transportation projects eligible use category,

recipients may use SLFRF funds to satisfy non-federal cost share requirements for certain

programs under Pathway Three. In addition, under the Title I projects eligible use category,

recipients may use SLFRF funds to satisfy the non-federal share requirements of a federal

financial assistance program in support of activities that would be eligible under the CDBG and

ICDBG programs.

SLFRF funds beyond those that are available under the circumstances described above may not

be used to meet the non-federal match or cost-share requirements of other federal programs,

other than as specifically provided for by statute. As an example, the Infrastructure Investment

and Jobs Act provides that SLFRF funds may be used to meet the non-federal match requirements

of authorized Bureau of Reclamation projects and certain broadband deployment projects.

Recipients should consult the 2022 final rule for further details if they seek to utilize SLFRF funds

as a match for these projects.

Treasury’s 2022 final rule, 2023 IFR, program guidance, and the Uniform Guidance outline the

types of costs that are allowable, including certain audit costs. For example, per 2 CFR 200.425,

a reasonably proportionate share of the costs of audits required by the Single Audit Act

Amendments of 1996 are allowable; however, costs for audits that were not performed in

accordance with 2 CFR Part 200, Subpart F and the Compliance Supplement are not allowable.

Please see 2 CFR Part 200, Subpart E regarding the Cost Principles for more information.

a. Administrative costs: Recipients may use funds for administering the SLFRF program,

including costs of consultants to support effective management and oversight, including

consultation for ensuring compliance with legal, regulatory, and other requirements.

2

Further, costs must be reasonable and allocable as outlined in 2 CFR 200.404 and 2 CFR

200.405. Pursuant to the SLFRF Award Terms and Conditions, recipients are permitted to

charge both direct and indirect costs to their SLFRF award as administrative costs as long

as they are accorded consistent treatment per 2 CFR 200.403. Direct costs are those that

are identified specifically as costs of implementing the SLFRF program objectives, such as

contract support, materials, and supplies for a project. Indirect costs are general overhead

costs of an organization where a portion of such costs are allocable to the SLFRF award

such as the cost of facilities or administrative functions like a director’s office.

34

Each

category of cost should be treated consistently in like circumstances as direct or indirect, and

recipients may not charge the same administrative costs to both direct and indirect cost

categories, or to other programs. If a recipient has a current Negotiated Indirect Costs Rate

2

Recipients also may use SLFRF funds directly for administrative costs to improve the design and execution

of programs responding to the COVID-19 pandemic and to administer or improve the efficacy of programs

addressing the public health emergency or its negative economic impacts. 31 CFR 35.6(b)(3)(ii)(E)(3).

3

2 CFR 200.413 Direct Costs.

4

2 CFR 200.414 Indirect Costs.

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

11

Agreement (“NICRA”) established with a Federal cognizant agency responsible for

reviewing, negotiating, and approving cost allocation plans or indirect cost proposals, then

the recipient may use its current NICRA. Alternatively, if the recipient does not have a

NICRA, the recipient may elect to use the de minimis rate of 10 percent of the modified total

direct costs pursuant to 2 CFR 200.414(f).

b. Salaries and Expenses: In general, certain employees’ wages, salaries, and covered

benefits are an eligible use of SLFRF award funds. Please see Treasury’s 2022 final rule for

details.

3. Cash Management. SLFRF payments made to recipients are not subject to the requirements of

the Cash Management Improvement Act and Treasury’s implementing regulations at 31 CFR Part

205 or 2 CFR 200.305(b)(8)-(9).

As such, recipients can place funds in interest-bearing accounts, do not need to remit interest to

Treasury, and are not limited to using that interest for eligible uses under the SLFRF award.

4. Eligibility and Unique Entity Identifier Requirements. Under the SLFRF program, recipients

are responsible for ensuring that award funds are used for eligible purposes. Accordingly,

recipients must develop and implement policies and procedures, and retain records, to determine

and monitor implementation of criteria for determining the eligibility of beneficiaries and/or

subrecipients. Your organization, and if applicable, the subrecipient(s) administering a program

on behalf of your organization, will need to develop and maintain procedures for obtaining

information evidencing a given beneficiary’s, subrecipient’s, or contractor’s eligibility, including

ensuring subrecipients and contractors are in good standing in accordance with 2 CFR 200.214

and 2 CFR Part 200, Appendix II, paragraph (H).

Further, recipients and subrecipients are required to obtain a valid Unique Entity Identifier (UEI),

which is assigned by SAM.gov. Pursuant to the award term regarding 2 CFR Part 25, Appendix

A, which is incorporated by reference in the SLFRF Financial Assistance Agreement, recipients

are required to maintain current information in SAM.gov for the duration of the period of

performance of the SLFRF award. A recipient may not make a subaward to a subrecipient unless

that subrecipient has obtained and provided to the recipient a UEI. Subrecipients are not required

to complete full SAM.gov registration to obtain a UEI. A UEI is not required with respect to

beneficiaries and contractors. Implementing risk-based due diligence for eligibility determinations

is a best practice to augment your organization’s existing controls.

As discussed in item 11 below, recipients may obligate SLFRF funds by entering into an

interagency agreement with a unit of government, and may choose to treat that unit of government

as a subrecipient. If a recipient chooses to treat the counterparty to the interagency agreement as

a subrecipient, then the recipient must also provide a UEI for that entity. If a recipient chooses to

treat the counterparty as a part of the recipient government, the recipient is not required to provide

a UEI for that entity.

5. Property Management. Any purchase of real or personal property with SLFRF funds must be

consistent with the Uniform Guidance at 2 CFR Part 200, Subpart D, unless stated otherwise by

Treasury. For example, as outlined in FAQ 13.15

, only a subset of the Uniform Guidance

requirements at 2 CFR Part 200 Subpart D (Post Federal Award Requirements) applies to

recipients’ use of funds in the revenue loss eligible use category. Furthermore, as outlined in FAQ

13.16, Treasury has clarified the use and disposition requirements for real and personal property,

supplies, and equipment purchased with SLFRF funds.

6. Matching, Level of Effort, Earmarking. There are no matching, level of effort, or earmarking

compliance responsibilities associated with the SLFRF award. See Section C.1 (Eligible and

Restricted Uses of SLFRF Funds) for a discussion of restrictions on use of SLFRF funds. Please

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

12

see 2. Allowable Costs/Cost Principles above for information on the use of SLFRF funds for non-

Federal match or cost-sharing requirements in other Federal programs.

7. Period of Performance. Your organization should also develop and implement internal controls

related to activities occurring outside the period of performance. For eligible uses under the 2022

final rule, all funds remain subject to statutory and regulatory requirements that they must be used

for costs incurred by the recipient during the period that begins on March 3, 2021, and ends on

December 31, 2024, and that award funds for the financial obligations incurred by December 31,

2024 must be expended by December 31, 2026. For eligible uses under the 2023 IFR, recipients

may use SLFRF funds for costs incurred beginning December 29, 2022. Consistent with the

existing eligible uses, recipients must obligate SLFRF funds for the new eligible uses by December

31, 2024. Recipients must expend SLFRF funds obligated to provide emergency relief from

natural disasters by December 31, 2026. Recipients must expend SLFRF funds obligated for

Surface Transportation projects and Title I projects by September 30, 2026.

Any funds not

expended must be returned to Treasury as part of the award closeout process pursuant to 2 C.F.R.

200.344(d).

8. Procurement, Suspension & Debarment. Recipients are responsible for ensuring that any

procurement using SLFRF funds, or payments under procurement contracts using such funds,

are consistent with the procurement standards set forth in the Uniform Guidance at 2 CFR 200.317

through 2 CFR 200.327, unless stated otherwise by Treasury. As outlined in FAQ 13.15

, only a

subset of the Uniform Guidance requirements at 2 CFR Part 200 Subpart D (Post Federal Award

Requirements) applies to recipients’ use of funds in the revenue loss eligible use category. The

procurement standards set forth in the Uniform Guidance at 2 CRF 200.317 through 2 CRF

200.327 are not included in FAQ 13.15’s list of applicable Subpart D requirements that apply to

recipients’ use of funds in the revenue loss eligible use category.

The Uniform Guidance establishes in 2 CFR 200.319 that all procurement transactions for

property or services must be conducted in a manner providing full and open competition,

consistent with standards outlined in 2 CFR 200.320, which allows for non-competitive

procurements only in certain circumstances. Recipients must have and use documented

procurement procedures that are consistent with the standards outlined in 2 CFR 200.317 through

2 CFR 200.320. In addition, the Uniform Guidance at 2 CFR 200.214, 2 CFR Part 180, and

Treasury’s implementing regulations at 31 CFR Part 19, prohibit recipients from entering into

contracts with suspended or debarred parties. The procurement standards outlined in the Uniform

Guidance require an infrastructure for competitive bidding and contractor oversight, including

maintaining written standards of conduct. Your organization must ensure adherence to all

applicable local, State, and federal procurement laws and regulations.

9. Program Income. Generally, program income includes, but is not limited to, income from fees for

services performed, the use or rental of real or personal property acquired under Federal awards,

and principal and interest on loans made with Federal award funds. Program income does not

include interest earned on advances of Federal funds, rebates, credits, discounts, or interest on

rebates, credits, or discounts. Recipients of SLFRF funds should calculate, document, and record

the organization’s program income. Additional controls that your organization should implement

include written policies that explicitly identify appropriate allocation methods, accounting

standards and principles, compliance monitoring checks for program income calculations, and

records.

As discussed in SLFRF FAQ 17.21, program income includes that which is earned between the

December 31, 2024, obligation deadline and the end of the period of performance on December

31, 2026. As with all award funds, such program income may only be used to cover an obligation

that was incurred by December 31, 2024.

The Uniform Guidance outlines the requirements that pertain to program income at 2 CFR

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

13

200.307. Treasury has clarified in its FAQs that recipients may add program income to the Federal

award. Any program income generated from SLFRF funds must be used for the purposes and

under the conditions of the Federal award. Further, FAQ 4.9 provides additional information about

program income requirements applicable to certain eligible uses, and FAQ 13.15 clarifies that only

a subset of the Uniform Guidance requirements at 2 CFR 200 Subpart D (Post Federal Award

Requirements) applies to recipients’ use of funds in the revenue loss eligible use category. The

list of applicable Subpart D requirements in FAQ 13.15 does not include the program income

requirements in 2 CFR 200.307.

10. Reporting. All recipients of federal funds must complete financial, performance, and compliance

reporting as required and outlined in Part 2 of this guidance. Expenditures may be reported on a

cash or accrual basis, as long as the methodology is disclosed and consistently applied. Reporting

must be consistent with the definition of expenditures pursuant to 2 CFR 200.1. Your organization

should appropriately maintain accounting records for compiling and reporting accurate, compliant

financial data, in accordance with appropriate accounting standards and principles.

In addition, where appropriate, your organization needs to establish controls to ensure completion

and timely submission of all mandatory performance and/or compliance reporting. See Part 2 of

this guidance for a full overview of recipient reporting responsibilities.

Consolidated jurisdictions or other types of jurisdictions that received multiple SLFRF allocations

(e.g., a county and city with a consolidated government) are only required to file once per reporting

period, and such reports will cover the total SLFRF allocations received by the jurisdiction. This

includes non-entitlement units of local government (“NEUs”) and/or units of general local

government located within counties that are not units of general local government. In addition,

the total SLFRF allocations across all sources for a given jurisdiction will be used to identify that

jurisdiction’s Reporting Tier.

11. Subrecipient Monitoring. SLFRF recipients that are pass-through entities as described under 2

CFR 200.1 are required to manage and monitor their subrecipients to ensure compliance with

requirements of the SLFRF award pursuant to 2 CFR 200.332 regarding requirements for pass-

through entities.

First, your organization must clearly identify to the subrecipient: (1) that the award is a subaward

of SLFRF funds; (2) any and all compliance requirements for use of SLFRF funds; and (3) any

and all reporting requirements for expenditures of SLFRF funds.

Next, your organization will need to evaluate each subrecipient’s risk of noncompliance based on

a set of common factors. These risk assessments may include factors such as prior experience

in managing Federal funds, previous audits, personnel, and policies or procedures for award

execution and oversight. Ongoing monitoring of any given subrecipient should reflect its assessed

risk and include monitoring, identification of deficiencies, and follow-up to ensure appropriate

remediation.

Accordingly, your organization should develop written policies and procedures for subrecipient

monitoring and risk assessment and maintain records of all award agreements identifying or

otherwise documenting subrecipients’ compliance obligations.

Recipients should note that NEUs are not subrecipients under the SLFRF program. They are

SLFRF recipients that report directly to Treasury.

Recipients should also note that subrecipients do not include individuals and organizations that

received SLFRF funds as end users. Such individuals and organizations are beneficiaries and not

subject to audit pursuant to the Single Audit Act and 2 C.F.R. Part 200, Subpart F.

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

14

Many recipients may choose to provide a subaward or contract to other entities to provide services

to other end users. For example, a recipient may provide a subaward to a nonprofit to provide

homeless services to individuals experiencing homelessness. In this case, the subaward to a

nonprofit is based on the services that the recipient intends to provide (assistance to households

experiencing homelessness), and the nonprofit is serving as the subrecipient, providing services

on behalf of the recipient. Subrecipients are subject to an audit pursuant to the Single Audit Act

and 2 CFR part 200, subpart F regarding audit requirements, whereas contractors are not subject

to an audit pursuant to the Single Audit Act and 2 CFR part 200, subpart F regarding audit

requirements.

Please note that as outlined in FAQ 13.14, recipients’ use of funds in the revenue loss eligible use

category does not give rise to subrecipient relationships. As a result, subaward reporting is not

required for projects in the revenue loss eligible use category. While there is no federal program

or purpose to carry out in the same way that there is for the other SLFRF expenditure categories,

these funds retain their federal character and recipients remain subject to laws and regulations

applicable to Federal financial assistance programs.

As discussed in SLFRF FAQ 17.6, Treasury considers an interagency agreement, including an

agreement in the form of a memorandum of understanding, to constitute a “transaction requiring

payment” similar to a contract or subaward and therefore an obligation for purposes of the

SLFRF rule, if the agreement satisfies certain conditions. If a recipient has not yet provided

funds to a unit of its government and would like to do so for that unit to carry out an eligible

project and count as an obligation, the recipient may do so under FAQ 17.6.

If a recipient previously entered into an agreement with a unit of its government and reported

that arrangement as a subaward, then the recipient may maintain that treatment or revise its

reporting to reflect an interagency agreement, as long as the requirements of FAQ 17.6 are

met. If the recipient is reporting the arrangement as a subaward, the recipient should note that

the subrecipient monitoring and other requirements applicable to subawards at 2 CFR Part 200

continue to apply. In either case, the use of funds must be appropriately managed and overseen

in accordance with the program’s award terms and conditions, including the requirements at 2

CFR 200.329 or 2 CFR 200.331, as applicable.

If a recipient obligates funds via an interagency agreement with an agency, department, or part of

government according to the provisions described in FAQ 17.6

or 17.23, that agency, department,

or part of government may itself enter into subawards and contracts. Because the interagency

agreement is considered an obligation, the obligation deadline does not apply to that agency,

department, or part of government.

12. Special Tests and Provisions. From time-to-time, Treasury may issue subregulatory guidance

as well as frequently asked questions.

Across each of the compliance requirements above, Treasury has described some best practices

for development of internal controls in Table 1 below, with an example of each best practice.

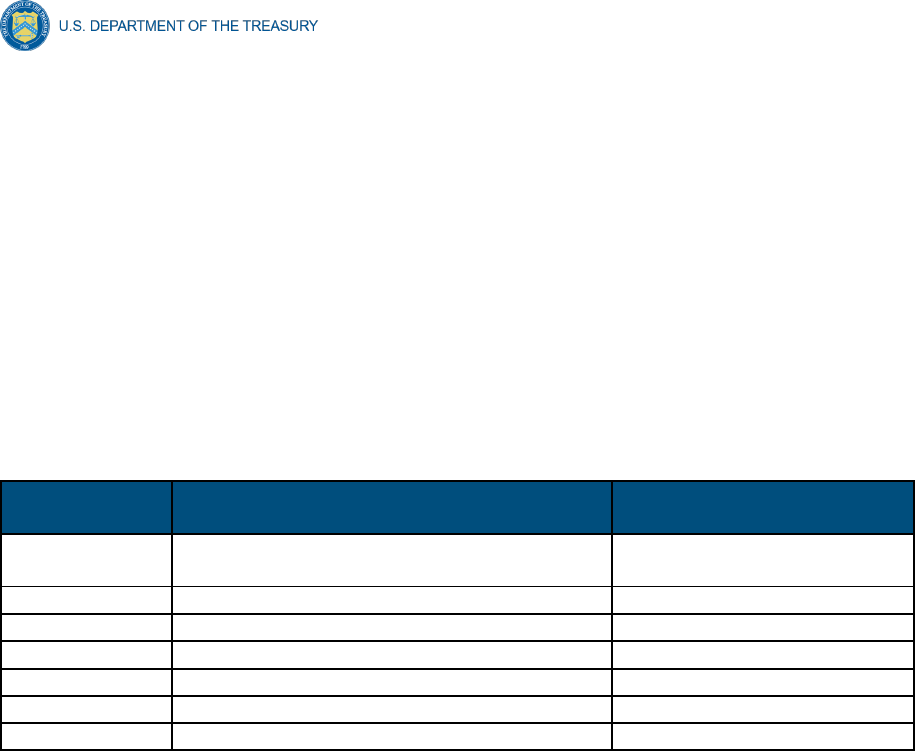

Table 1: Internal controls best practices

Best Practice

Description

Example

Written policies and

procedures

Formal documentation of

recipient policies and

procedures

Documented procedure for

determining worker eligibility

for premium pay

Written standards of

conduct

Formal statement of

mission, values, principles,

and professional standards

Documented code of

conduct / ethics for

subcontractors

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

15

Best Practice

Description

Example

Risk-based due diligence

Pre-payment validations

conducted according to an

assessed level of risk

Enhanced eligibility review

of subrecipient with

imperfect performance

history

Risk-based compliance

monitoring

Ongoing validations

conducted according to an

assessed level of risk

Higher degree of monitoring

for projects that have a

higher risk of fraud, given

program characteristics

Record maintenance and

retention

Creation and storage of

financial and non-financial

records.

Storage of all subrecipient

payment information.

E. Award Terms and Conditions

The Award Terms and Conditions of the SLFRF financial assistance agreement sets forth the

compliance obligations for recipients pursuant to the SLFRF statute, the Uniform Guidance,

Treasury’s 2022 final rule, 2023 IFR, the Obligation IFR, and other applicable federal laws and

regulations. Recipients should ensure they remain in compliance with all Award Terms and

Conditions. These obligations include the following items in addition to those described above:

1. SAM.gov Requirements. All eligible recipients are required to have an active registration with

the System for Award Management (“SAM”) (https://www.sam.gov

) pursuant to 2 CFR Part 25.

To ensure timely receipt of funding, Treasury has stated that NEUs who have not previously

registered with SAM.gov may do so after receipt of the award, but before the submission of

mandatory reporting.

5

2. Recordkeeping Requirements. Generally, your organization must maintain records and financial

documents for five years after all funds have been expended or returned to Treasury, as outlined

in paragraph 4.c. of the Award Terms and Conditions. Treasury may request transfer of records

of long-term value at the end of such period. Wherever practicable, such records should be

collected, transmitted, and stored in open and machine-readable formats.

Your organization must agree to provide or make available such records to Treasury upon request,

and to the Government Accountability Office (“GAO”), Treasury’s Office of Inspector General

(“OIG”), and their authorized representative in order to conduct audits or other investigations.

3. Single Audit Requirements. Recipients and subrecipients that expend more than $750,000 in

Federal awards during their fiscal year will be subject to an audit under the Single Audit Act and

its implementing regulation at 2 CFR Part 200, Subpart F regarding audit requirements.

6

Note that

the Compliance Supplement provides information on the existing, important compliance

requirements that the federal government expects to be considered as a part of such audit. For

example, the SLFRF Compliance Supplement describes an alternative to the Single Audit for

eligible recipients. Recipients should consult the Compliance Supplement for more information

about the alternative compliance examination engagement. The Compliance Supplement is

routinely updated, and is made available in the Federal Register and on OMB’s website:

https://www.whitehouse.gov/omb/office-federal-financial-management/

Recipients and

subrecipients should consult the Federal Audit Clearinghouse to see examples of Single Audit

submissions.

5

See flexibility provided in https://www.whitehouse.gov/wp-content/uploads/2021/03/M_21_20.pdf.

6

For-profit entities that receive SLFRF subawards are not subject to Single Audit requirements. However,

they are subject to other audits as deemed necessary by authorized governmental entities, including Treasury

and Treasury’s OIG.

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

16

4. Civil Rights Compliance. Recipients of Federal financial assistance from the Treasury are

required to meet legal requirements relating to nondiscrimination and nondiscriminatory use of

Federal funds. Those requirements include ensuring that entities receiving Federal financial

assistance from the Treasury do not deny benefits or services, or otherwise discriminate on the

basis of race, color, national origin (including limited English proficiency), disability, age, or sex

(including sexual orientation and gender identity), in accordance with the following authorities:

Title VI of the Civil Rights Act of 1964 (Title VI) Public Law 88-352, 42 U.S.C. 2000d-1 et seq.,

and the Department's implementing regulations, 31 CFR part 22; Section 504 of the Rehabilitation

Act of 1973 (Section 504), Public Law 93-112, as amended by Public Law 93-516, 29 U.S.C. 794;

Title IX of the Education Amendments of 1972 (Title IX), 20 U.S.C. 1681 et seq., and the

Department's implementing regulations, 31 CFR part 28; Age Discrimination Act of 1975, Public

Law 94-135, 42 U.S.C. 6101 et seq., and the Department implementing regulations at 31 CFR

part 23.

In order to carry out its enforcement responsibilities under Title VI of the Civil Rights Act, Treasury

will collect and review information from recipients to ascertain their compliance with the applicable

requirements before and after providing financial assistance. Treasury’s implementing

regulations, 31 CFR part 22, and the Department of Justice (DOJ) regulations,

Coordination of

Non-discrimination in Federally Assisted Programs, 28 CFR part 42, provide for the collection of

data and information from recipients (see 28 CFR 42.406). Treasury may request that non-tribal

recipients submit data for post-award compliance reviews, including information such as a

narrative describing their Title VI compliance status. As explained in Treasury FAQ 12.1, the

award terms and conditions for Treasury’s pandemic recovery programs, including the SLFRF

program, do not impose antidiscrimination requirements on Tribal governments beyond what

would otherwise apply under federal law.

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

17

Part 2: Reporting Guidance

There are three types of reporting requirements for the SLFRF program. The report requirements are

approved and documented under OMB PRA number - OMB # 1505-0271.

• Interim Report: Provide initial overview of status and uses of funding. This is a one-time report.

See Section A, page 18.

• Project and Expenditure Report: Report on projects funded, expenditures, and contracts and

subawards equal to or greater than $50,000, and other information. See Section B, page 19.

• Recovery Plan Performance Report: The Recovery Plan Performance Report (the “Recovery

Plan”) will provide information on the projects that large recipients are undertaking with program

funding and how they plan to ensure program outcomes are achieved in an effective, efficient,

and equitable manner. It will include key performance indicators identified by the recipient and

some mandatory indicators identified by Treasury. The Recovery Plan will be posted on the

website of the recipient as well as provided to Treasury. See Section C, page 40.

The reporting threshold is based on the total award amount allocated by Treasury under the SLFRF

program, not the funds received by the recipient as of the time of reporting.

States and territories are also required to submit information on their distributions to NEUs. Please

refer to Section D for additional details.

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

18

Table 2: Reporting requirements by recipient type

Tier Recipient Interim Report

Project and

Expenditure

Report

Recovery Plan

Performance

Report

1

States, U.S. territories,

metropolitan cities and

counties with a

population that exceeds

250,000 residents

By August 31,

2021 or 60

days after

receiving

funding if

funding was

received by

October 15,

with

expenditures by

category.

Note: NEUs

were not

required to

submit an

Interim Report

By January 31,

2022, and then the

last day of the

month after the end

of each quarter

thereafter

Note: NEUs were

not required to

submit a Project

and Expenditure

Report on January

31, 2022. The first

reporting date for

NEUs was April 30,

2022.

By August 31,

2021 or 60 days

after receiving

funding, and

annually

thereafter by

July 31

2

Metropolitan cities and

counties with a

population below

250,000 residents that

are allocated more than

$10 million in SLFRF

funding, and NEUs that

are allocated more than

$10 million in SLFRF

funding

3

Tribal Governments that

are allocated more than

$30 million in SLFRF

funding

4

Tribal Governments that

are allocated less than

$30 million in SLFRF

funding

By April 30, 2022,

and then annually

thereafter

5

Metropolitan cities and

counties with a

population below

250,000 residents that

are allocated less than

$10 million in SLFRF

funding, and NEUs that

are allocated less than

$10 million in SLFRF

funding

Note: Based on the period of performance, reports will be collected through April 30, 2027. See the specific due

dates listed in Sections B and C.

As mentioned above, the total SLFRF allocations across all sources for a given jurisdiction will be

used to identify that jurisdiction’s Reporting Tier, beginning in April of 2022. Treasury may reach out

to jurisdictions to update Reporting Tiers.

The remainder of this document describes these reporting requirements. User guides describing how

and where to submit required reports are posted at www.treasury.gov/SLFRPReporting

and updated

on a regular basis.

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

19

A. Interim Report

Note: The Interim Reports were submitted under the 2021 IFR.

States, U.S. territories, metropolitan cities, counties, and Tribal governments were required to submit

a one-time interim report with expenditures

7

by Expenditure Category covering the period from March

3rd to July 31, 2021, by August 31, 2021 or sixty (60) days after first receiving funding if the recipient’s

date of award was between July 15, 2021 and October 15, 2021. The recipient was required to enter

obligations

8

and expenditures and, for each, select the specific expenditure category from the

available options. See Appendix 3 for Expenditure Categories applicable for the Interim Report.

1. Required Programmatic Data

Recipients were also required to provide the following information if they had or planned to have

expenditures in the following Expenditure Categories.

a. Revenue replacement (EC 6.1

9

): Key inputs into the revenue replacement formula in the 2021

IFR and estimated revenue loss due to the COVID-19 public health emergency calculated using

the formula in the 2021 IFR as of December 31, 2020.

• Base year general revenue (e.g., revenue in the last full fiscal year prior to the public health

emergency)

• Fiscal year end date

• Growth adjustment used (either 4.1 percent or average annual general revenue growth over

3 years prior to pandemic)

• Actual general revenue as of the twelve months ended December 31, 2020

7

For purposes of reporting in the SLFRF portal, an expenditure is the amount that has been incurred as a

liability of the entity (the service has been rendered or the good has been delivered to the entity).

8

For purposes of reporting in the SLFRF portal, an obligation is an order placed for property and services,

contracts and subawards made, and similar transactions that require payment.

9

See Appendix 3 for the full Expenditure Category (EC) list. Please note that Appendix 3 includes the

expenditure categories under the 2021 IFR, applicable to the Interim Report.

Comparison to reporting for the CRF

This guidance does not change the reporting or compliance requirements pertaining to

the CRF. Reporting and compliance requirements for the SLFRF are separate from

CRF reporting requirements. Differences between CRF and SLFRF include:

• Project, Expenditure, and Subaward Reporting: The SLFRF reporting

requirements leverage the existing reporting regime used for CRF to foster

continuity and provide many recipients with a familiar reporting mechanism. The

data elements for the Project and Expenditure Report will largely mirror those used

for CRF, with some minor exceptions noted in this guidance. The users’ guide will

describe how reporting for CRF funds will relate to reporting for the SLFRF.

• Timing of Reports: CRF reports were due within 10 days of each calendar quarter

end. For quarterly reporters, SLFRF reporting will be due the last day of the month

following the end of the period covered. For annual reporters, SLFRF reporting will

be due on an annual schedule (see table in Section B below).

• Program and Performance Reporting: The CRF reporting did not include any

program or performance reporting. To build public awareness and accountability

and allow Treasury to monitor compliance with eligible uses, some program and

performance reporting is required for SLFRF.

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

20

• Estimated revenue loss due to the COVID-19 public health emergency as of December 31,

2020

• An explanation of how revenue replacement funds were allocated to government services

(Note: additional instructions was provided in the user guide)

In calculating general revenue and the other items discussed above, recipients should have

used audited data if it was available. When audited data was not available, recipients were not

required to obtain audited data if substantially accurate figures could be produced on an

unaudited basis. Recipients should have used their own data sources to calculate general

revenue and did not need to rely on revenue data published by the Census Bureau. Treasury

acknowledges that due to differences in timing, data sources, and definitions, recipients’ self-

reported general revenue figures may differ from those published by the Census Bureau.

Recipients were permitted to provide data on a cash, accrual, or modified accrual basis,

provided that recipients are consistent in their choice of methodology throughout the covered

period and until reporting is no longer required. Recipients’ reporting should align with their own

financial reporting.

In calculating general revenue, recipients should have excluded all intergovernmental transfers

from the federal government. This includes, but is not limited to, federal transfers made via a

State to a locality pursuant to the CRF or SLFRF. To the extent federal funds are passed

through States or other entities or intermingled with other funds, recipients should have

attempted to identify and exclude the federal portion of those funds from the calculation of

general revenue on a best-efforts basis.

Consistent with the broad latitude provided to recipients to use funds for government services to

the extent of reduction in revenue, recipients were required to submit a description of services

provided. This description may be in narrative or in another form, and recipients were

encouraged to report based on their existing budget processes and to minimize administrative

burden. For example, a recipient with $100 in revenue replacement funds available could

indicate that $50 were used for law enforcement operating expenses and $50 were used for

pay-go building of sidewalk infrastructure. As discussed in the 2021 IFR, these services can

include a broad range of services but may not be used directly for pension deposits or debt

service.

Reporting requirements did not require tracking the indirect effects of Fiscal Recovery Funds,

apart from the restrictions on use of Fiscal Recovery Funds to offset a reduction in net tax

revenue. In addition, recipients were required to indicate that Fiscal Recovery Funds were not

used to make a deposit in a pension fund.

B. Project and Expenditure Report

All recipients are required to submit Project and Expenditure Reports.

Note on NEUs: To facilitate reporting, each NEU will need an NEU Recipient Number. This is a unique

identification code for each NEU assigned by the State or territory to the NEU as part of its request

for funding.

1. Quarterly Reporting

The following recipients are required to submit quarterly Project and Expenditure Reports:

• States and U.S. territories

• Tribal governments that are allocated more than $30 million in SLFRF funding

• Metropolitan cities and counties with a population that exceeds 250,000 residents

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

21

• Metropolitan cities and counties with a population below 250,000 residents that are allocated more

than $10 million in SLFRF funding and NEUs that are allocated more than $10 million in SLFRF

funding

For these recipients, the initial quarterly Project and Expenditure Report covered three calendar

quarters from March 3, 2021 to December 31, 2021 and was required to be submitted to Treasury by

January 31, 2022. The subsequent quarterly reports cover one calendar quarter and must be

submitted to Treasury by the last day of the month following the end of the period covered. Quarterly

reports are not due concurrently with applicable annual reports. Table 3 summarizes the quarterly

report timelines:

Table 3: Quarterly Project and Expenditure Report Timeline

Report

Year

Quarter

Period Covered

Due Date

1

2021

2 – 4

March 3 – December 31

January 31, 2022

2

2022

1

January 1 – March 31

April 30, 2022

3

2022

2

April 1 – June 30

July 31, 2022

4

2022

3

July 1 – September 30

October 31, 2022

5

2022

4

October 1 – December 31

January 31, 2023

6

2023

1

January 1 – March 31

April 30, 2023

7

2023

2

April 1 – June 30

July 31, 2023

8

2023

3

July 1 – September 30

October 31, 2023

9

2023

4

October 1 – December 31

January 31, 2024

10

2024

1

January 1 – March 31

April 30, 2024

11

2024

2

April 1 – June 30

July 31, 2024

12

2024

3

July 1 – September 30

October 31, 2024

13

2024

4

October 1 – December 31

January 31, 2025

14

2025

1

January 1 – March 31

April 30, 2025

15

2025

2

April 1 – June 30

July 31, 2025

16

2025

3

July 1 – September 30

October 31, 2025

17

2025

4

October 1 – December 31

January 31, 2026

18

2026

1

January 1 – March 31

April 30, 2026

19

2026

2

April 1 – June 30

July 31, 2026

20

2026

3

July 1 – September 30

October 31, 2026

21

2026

4

October 1 – December 31

April 30, 2027

2. Annual Reporting

The following recipients are required to submit annual Project and Expenditure Reports:

• Tribal governments that are allocated less than $30 million in SLFRF funding

• Metropolitan cities and counties with a population below 250,000 residents that are allocated less

than $10 million in SLFRF funding and NEUs that are allocated less than $10 million in SLFRF

funding

For these recipients, the initial Project and Expenditure Report covered from March 3, 2021 to March

31, 2022 and was required to be submitted to Treasury by April 30, 2022. The subsequent annual

reports cover one calendar year and must be submitted to Treasury by April 30. Table 4 summarizes

the annual report timelines:

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

22

Table 4: Annual Project and Expenditure Report timeline

Report

Period Covered

Due Date

1

March 3, 2021 – March 31, 2022

April 30, 2022

2

April 1, 2022 – March 31, 2023

April 30, 2023

3

April 1, 2023 – March 31, 2024

April 30, 2024

4

April 1, 2024 – March 31, 2025

April 30, 2025

5

April 1, 2025 – March 31, 2026

April 30, 2026

6

April 1, 2026 – December 31, 2026

April 30, 2027

3. Required Information

The following information is required in Project and Expenditure Reports for both quarterly and annual

reporting:

Projects: Provide information on all SLFRF funded projects. Projects are defined as a grouping of

closely related activities that together are intended to achieve a specific goal or are directed toward

a common purpose. These activities can include new or existing eligible government services or

investments funded in whole or in part by SLFRF funding. For each project, the recipient is required

to enter the project name, identification number (created by the recipient), project expenditure

category (see Appendix 1), description, and status of completion. Project descriptions must

describe the project in sufficient detail to provide an understanding of the major activities that will

occur, and must be between 50 and 250 words.

Project descriptions for the emergency relief from natural disasters eligible use category must

describe the natural disaster the recipient is responding to, including the type of event, and how

the emergency relief is related to and reasonably proportional to the natural disaster.

a. Projects should be defined to include only closely related activities directed toward a common

purpose. Recipients should review the Required Programmatic Data described in 3.g. below and

define their projects at a sufficient level of granularity.

Note: For each project, the recipient is asked to select the appropriate Expenditure Category based

on the scope of the project (see Appendix 1). Projects should be scoped to align to a single

Expenditure Category. For select Expenditure Categories, the recipient also is asked to provide

additional programmatic data (described further below).

b. Obligations and Expenditures: Once a project is entered the recipient will be able to report on the

project’s obligations and expenditures. Recipients will be asked to report:

• Current period obligation

• Cumulative obligation

• Current period expenditure

• Cumulative expenditure

c. Estimates: As discussed in SLFRF FAQs 17.8, 17.11, and 17.16, among others, recipients may

document an obligation incurred by December 31, 2024 to expend SLFRF funds in 2025 and 2026

by reporting an estimate to Treasury of future expenses. Recipients are not required to submit

estimates for the costs discussed below; rather, they must submit such estimates if they want to

use, to cover such costs, any funds that they would otherwise have to return to Treasury after 2024

as unobligated. As discussed below, the estimate will be reported in both the obligation amount

for a particular project and as a separate line item within the project for the specific type of estimate.

1. Personnel Costs

Coronavirus State and Local Fiscal Recovery Funds

Compliance and Reporting Guidance

23

For projects involving personnel costs to be expended in 2025 and 2026 for positions

established and filled by December 31, 2024, recipients may report an estimate of such

expenses and retain funds that they would otherwise have to return to Treasury after 2024 as

unobligated. See SLFRF FAQs 17.7 and 17.8 for additional details about determining this

amount and preparing the estimate. Recipients should only report an estimate if funds are not

obligated for those personnel costs through another mechanism, such as through a subaward,

contract, or interagency agreement. For each project’s reported obligation, the estimate must

be limited to estimated personnel costs associated with the individual project and may not

include estimated costs associated with other projects.

For this estimate, recipients will be asked to report:

• Estimated personnel expenditures in 2025 and 2026

• Current period expenditures pursuant to the estimate*

• Cumulative expenditures pursuant to the estimate*

• Number of full-time-equivalent (FTE) positions for which funds are obligated

• Explanation of how the estimate was determined