1

Carbon Border Adjustment Mechanism (CBAM)

Questions and Answers

Last updated on 31 January 2024

1

.

Outline

General ...................................................................................................................................................... 7

1. Why is the EU putting in place a Carbon Border Adjustment Mechanism? ................................. 7

2. What is the current stage of implementation of CBAM?.............................................................. 7

3. How does the CBAM work? .......................................................................................................... 8

4. How does CBAM interact with the EU Emissions Trading System (ETS)? ..................................... 8

5. How is the CBAM compatible with other ETS systems outside the EU?....................................... 9

6. Which sectors does the new mechanism cover and why were they chosen?.............................. 9

7. To which goods does the CBAM Regulation apply? .................................................................... 10

8. Does the CBAM apply to ‘second hand’ goods? ......................................................................... 10

9. Does the CBAM apply to ‘returned goods’? ................................................................................ 10

10. How will the CBAM tackle carbon leakage of finished or semi-finished products? ................... 10

11. Does the CBAM apply to packaging? .......................................................................................... 11

12. Does the CBAM apply to goods produced in EU outermost regions, such as Mayotte or La

Reunion? ............................................................................................................................................. 11

13. Which third countries fall under the scope of the CBAM? ......................................................... 11

14. Do I need to report the import of CBAM goods originating from the UK? ................................. 11

15. What happens during the transitional period? ........................................................................... 11

16. Are there penalties for non-compliance with the CBAM Regulation? ........................................ 12

17. Where can I find detailed information on how to carry out the reporting of embedded

emissions? ........................................................................................................................................... 12

18. Is it mandatory to use the communication template Excel file? ................................................ 12

19. Who is liable in cases where incorrect or insufficient information is submitted?...................... 13

20. I am an importer based in Switzerland, or in the EEA (Norway, Iceland, Liechtenstein). How can

I access the CBAM Transitional Registry? ........................................................................................... 13

21. Who can I contact if I have further, more specific questions? ................................................... 13

1

Compared to the previous version, the main changes concern questions 11, 12, 20, 24, 26, 28, 30, 50, 86, 88, 89,

and 109.

2

Reporting: general issues ........................................................................................................................ 13

22. Who is responsible for the reporting? ........................................................................................ 13

23. Can an importer have several indirect customs representatives, and vice-versa? .................... 14

24. Will companies be allowed to report at centralised level if subsidiaries in the different Member

States have different Economic Operators Registration and Identification (EORI) numbers? ........... 14

25. What are the reporting obligations? By when do I need to submit a report?............................ 15

26. I was unable to submit the first CBAM report within the submission deadline due to technical

errors. What should I do? ................................................................................................................... 15

27. I import very small quantities of CBAM goods. Do these products fall within the scope of the

CBAM Regulation? .............................................................................................................................. 16

28. I am a natural person and have purchased a CBAM good online for my personal use. I later

realised that the good was imported into the EU. Do I need to comply with the CBAM reporting

obligations? ......................................................................................................................................... 16

29. I have not imported CBAM goods during a given reporting quarter. Must I submit a CBAM

report? ................................................................................................................................................ 17

30. Is it mandatory to report the associated operators/installations of the CBAM goods declared?

17

Reporting: responsibilities and procedures ............................................................................................ 17

31. What is the role of the European Commission during the transitional period? ......................... 17

32. What is a national competent authority (NCA)? ......................................................................... 18

33. Do importers of CBAM goods need to be ‘authorised’ in order to import CBAM goods during

the transitional period? ...................................................................................................................... 18

34. Are there verification obligations during the transitional period? ............................................. 18

35. Which embedded emissions need to be reported by each CBAM sector? ................................ 18

36. What information should reporting declarants request from producers in third countries to

ensure they can submit the quarterly CBAM report? ........................................................................ 19

37. What documents in original shall be provided in the quarterly CBAM report? ......................... 20

38. I am both an importer and an indirect customs representative filing CBAM reports for another

importer. Do I file a single CBAM report or two separate CBAM reports? ........................................ 20

39. What is the effective ‘carbon price’ due that I need to report on? ............................................ 20

40. Who will check the accuracy of submitted data and reports? ................................................... 20

41. Is it possible to correct a CBAM report that has already been submitted? ................................ 21

42. Should the report be in English only or is it possible to report in other languages? .................. 21

Reporting: CBAM Transitional Registry ................................................................................................... 21

43. What is the CBAM Transitional Registry? ................................................................................... 21

44. What will the CBAM Transitional Registry be used for? ............................................................. 21

3

45. Is the CBAM Transitional Registry the same as the EU Customs trader portal? ......................... 22

46. Will the data shared in the CBAM Transitional Registry be dealt with confidentiality? ............. 22

47. How can I register as a declarant and access the CBAM Transitional Registry? ......................... 22

48. What CBAM Transitional Registry environments are available? ................................................ 23

49. In a company which is a reporting declarant, who can request access to the Transitional

Registry? .............................................................................................................................................. 23

50. Who can fill in the CBAM report in the CBAM Transitional Registry for the reporting declarant?

23

51. Can companies that are not directly subject to the CBAM also have access to the CBAM

Transitional Registry? .......................................................................................................................... 24

52. How should I fill in the data in the CBAM Transitional Registry? ............................................... 24

Methodology for calculating embedded emissions in CBAM goods in the transitional period ............. 24

53. What is the relevant time period for calculating embedded emissions? Can data from previous

years be used? .................................................................................................................................... 24

54. What are simple and complex goods? ........................................................................................ 25

55. What are direct and indirect emissions? .................................................................................... 25

56. What is the “bubble approach” and how does it work? ............................................................. 25

57. If an imported CBAM good was produced using precursors from the EU (e.g. pig iron) – would

this have to be considered in the calculation? ................................................................................... 25

58. Will the European Commission formally or informally verify the “equivalence” of alternative

methods? ............................................................................................................................................ 26

59. How are indirect emissions for the production of CBAM goods determined? ........................... 26

60. Which emission factors for electricity should be used to determine indirect emissions? ......... 26

61. Can market-based certificates (Guarantee of Origin, Renewable Energy Certificates, etc.) be

used to justify the use of actual emission factors? ............................................................................. 26

62. Should emissions from on-site transportation be included in the calculation? ......................... 27

63. Can carbon capture and use (CCU) / carbon capture and storage (CCS) be used to offset

emissions for the purpose of determining embedded emissions? .................................................... 27

64. My supplier is not sending me the necessary information before the report is due. What

should I do? ......................................................................................................................................... 27

65. What are the default values? How does this work? ................................................................... 27

66. How do you determine default values? ...................................................................................... 28

67. Until which point in time will EU importers be allowed to use alternative monitoring and

reporting methods? ............................................................................................................................ 28

68. How should emissions resulting from the use of biomass be accounted for? ........................... 29

69. How should decimal places and rounding be handled in calculations? ..................................... 29

4

70. Should the gross weight or the net weight of the imported CBAM goods to be used for the

calculation of the embedded emissions? ........................................................................................... 29

71. How to deal with stock items for which there is no emission data available? ........................... 29

72. If a facility is used simultaneously by multiple production processes, how do you attribute the

emissions from that facility to each production process? .................................................................. 29

73. Should saleable off-spec products be considered for the determination of the activity level? . 30

Cement .................................................................................................................................................... 30

74. Is cement defined as a complex good in the scope of the CBAM? ............................................. 30

Fertilisers ................................................................................................................................................. 30

75. Are the exothermic chemical reactions involved in fertilier production accounted for as direct

emissions? ........................................................................................................................................... 30

76. Can CO2 bound in urea be counted as negative emissions? ...................................................... 30

Electricity as CBAM good ........................................................................................................................ 30

77. Who is the CBAM reporting declarant for electricity imports? .................................................. 30

78. What is the difference between the emission factor for electricity and the CO

2

emission factor?

31

79. Which CO

2

emission factors should be used? ............................................................................. 31

80. What are the requirements to report actual embedded emissions of electricity, the so called

“conditionality”? ................................................................................................................................. 31

81. Is transit through non-EU countries considered for reporting on electricity in the CBAM? ...... 32

82. Which are the system boundaries to determine the embedded emissions of electricity? ........ 32

Hydrogen ................................................................................................................................................. 32

83. What is the connection between hydrogen as a CBAM good and the Renewable Energy

Directive (EU) 2018/2001 (‘RED II’))? .................................................................................................. 32

Iron and steel .......................................................................................................................................... 32

84. When calculating the embedded emission of steel products, are auxiliary processes such as

lime kilns or coke oven plants plants included in the boundary calculation? .................................... 32

85. Do iron ore pellets fall within the scope of CBAM? .................................................................... 33

86. What should be filled in the field "steel mill identification number" in the CBAM report? ....... 33

Aluminium/Steel ..................................................................................................................................... 33

87. Should the specific embedded emissions of aluminium/steel goods be determined separately

for different alloy grades?................................................................................................................... 33

Customs .................................................................................................................................................. 33

88. Can an importer use different customs representatives for the customs declaration and the

CBAM reporting? ................................................................................................................................. 33

5

89. What happens if an indirect customs representative does not agree to carry out CBAM

reporting obligations? ......................................................................................................................... 34

90. Can a direct customs representative be a CBAM reporting declarant for companies established

in the territory of the EU? ................................................................................................................... 36

91. Will customs representatives have the obligation to check if their client is a CBAM-registered

declarant prior to making a customs declaration on their behalf for CBAM goods? ......................... 36

92. My company is registered in one EU Member State but imports CBAM goods through multiple

Member States. Should I compile all these imports into one single quarterly report? ..................... 36

93. Are goods transiting in the EU to be reported on under CBAM? ............................................... 37

94. Will the CBAM reporting obligation apply to CBAM goods that have entered free circulation

within the EU due to non-compliance with a customs procedure other than import (e.g., temporary

admission), and for which all duties and taxes have already been paid through the said non-

compliance procedure? ...................................................................................................................... 37

95. Do I need to report on CBAM goods that are placed under the inward processing regime? .... 37

96. There is a tariff suspension on the CBAM good that I have imported. Am I exempt from the

CBAM? ................................................................................................................................................. 38

97. What happens if indirect customs representatives agree to act as reporting declarants only for

some goods but not for others? Do they need to submit two different customs declarations, one for

the goods for which they act as reporting declarant and one for which they do not? ...................... 38

Definitive period ..................................................................................................................................... 38

98. How will the CBAM work in practice during the definitive period? ........................................... 38

99. What obligations will importers of CBAM goods have during the definitive period? ................ 39

100. After 2026, are you going to prohibit the import of CBAM items if the EU importers is not an

authorised CBAM declarant? .............................................................................................................. 39

101. How can the CBAM report be submitted during the definitive period? ..................................... 39

102. How will I get access to the CBAM Registry in the definitive period? ........................................ 39

103. What will be the role of the European Commission during the definitive period? .................... 40

104. Will the EU expand the scope of the CBAM? .............................................................................. 40

105. How will a CBAM declarant become ‘authorised’ and what is the timeline for its authorisation

during the definitive period? .............................................................................................................. 40

106. How can EU importers ensure that they receive the information they need from their non-EU

exporters to be able to use the new system correctly? ..................................................................... 40

107. How will the reliability of the reported information be ensured?.............................................. 41

108. How will the accreditation of verifiers work? ............................................................................. 41

109. How will I be able to find accredited CBAM verifiers? ................................................................ 41

110. How will free allocation be accounted for in the calculation of the CBAM obligation to be paid?

41

7

General

Please note that this FAQ document is mainly focusing on the transitional phase of the Carbon

Border Adjustment Mechanism (CBAM), which entered into force on 1 October 2023.

Nonetheless, several questions concerning the definitive period (starting in January 2026) are

also addressed.

1. Why is the EU putting in place a Carbon Border Adjustment Mechanism?

• The EU is at the forefront of international efforts to fight climate change. The European

Green Deal set out a clear path towards achieving the EU's ambitious target of a 55% net

reduction in greenhouse gas emissions compared to 1990 levels by 2030, and to become

climate-neutral by 2050. In July 2021, the Commission made its Fit for 55 policy proposals

to turn this ambition into reality, further establishing the EU as a global climate leader.

Since then, those policies have taken shape through negotiations with co-legislators, the

European Parliament and the Council, and many have now been signed into EU law. This

includes the EU’s Carbon Border Adjustment Mechanism (CBAM).

• As the EU raises its climate ambition and less stringent environmental and climate policies

prevail in some non-EU countries, there is a strong risk of so-called ‘carbon leakage' – i.e.

companies based in the EU could move carbon-intensive production abroad to take

advantage of laxer standards, or EU products could be replaced by more carbon-intensive

imports. Such carbon leakage can shift emissions outside of Europe and therefore

seriously undermine the EU’s as well as global climate efforts. The CBAM will support the

EU’s increased climate ambition and ensure that climate action is not undermined by

production relocating to countries with less ambitious policies.

2. What is the current stage of implementation of CBAM?

• The European Parliament and the Council of the European Union, as co-legislators, signed

the CBAM Regulation (EU) 2023/956 on 10 May 2023. The CBAM entered into application

in its transitional period on 1 October 2023, with the first quarterly reports due by 31

January 2024. The set of rules and requirements for the reporting of emissions under

CBAM are further specified in Implementing Regulation (EU) 2023/1773 laying out

reporting rules during the transitional period. The Commission has set up the transitional

CBAM registry, is preparing further secondary legislation, and carrying out the planned

analysis. The definitive period of CBAM will enter into force in January 2026.

• The European Commission has made available detailed guidance for the application of

CBAM during the transitional period. These include detailed manuals, webinars, e-

learnings, and other materials. All information supporting the implementation can be

accessed on the Commission’s CBAM webpage.

8

3. How does the CBAM work?

• The CBAM has been designed to comply with the EU’s international commitments and

obligations including World Trade Organisation (WTO) rules. The CBAM system mirrors

the EU ETS and works as follows:

o CBAM is applied on the actual embedded emissions in the goods imported in the

EU, determined according to a methodology that is in line with the reporting of

emissions under the EU ETS for the production of the same goods in the EU.

o As from the entry into force of the definitive period of CBAM in 2026, EU importers

will buy CBAM certificates corresponding to the carbon price that would have

been paid, had the goods been produced under the EU's carbon pricing rules.

o Conversely, if a non-EU producer has already paid a carbon price in a third country

on the embedded emissions for the production of the imported goods, the

corresponding cost can be fully deducted from the CBAM obligation.

• The CBAM will therefore help reduce the risk of carbon leakage while encouraging both,

producers in non-EU countries to green their production processes as well as countries to

introduce carbon pricing measures.

• To provide businesses and other countries with legal certainty and stability, the CBAM is

being phased in gradually and initially applies only to a selected number of goods in

sectors at high risk of carbon leakage: iron/steel, cement, fertilisers, aluminium, hydrogen

and electricity. In the transitional period, which started on 1 October 2023, a reporting

system applies for those goods with the objective of facilitating a smooth roll-out and to

facilitate dialogue with third countries. Importers will start paying the CBAM financial

adjustment in 2026.

4. How does CBAM interact with the EU Emissions Trading System (ETS)?

• The EU Emissions Trading System (ETS) is the world's first international emissions trading

scheme and the EU's flagship policy to combat climate change. It sets a cap on the amount

of greenhouse gas emissions that can be released from power production and large

industrial installations. Allowances must be bought on the ETS trading market, though a

certain number of free allowances is distributed to industry to prevent carbon leakage. In

order to step up the incentive to decarbonise, the CBAM will progressively be introduced

as free allowances are reduced. Under the EU ETS, the number of free allowances declines

over time for all sectors. For CBAM sectors, the decline accelerates as from 2026, so that

the ETS can have maximum impact in fulfilling the EU’s ambitious climate goals. At the

same time, the CBAM financial adjustment is phased in according to a gradual schedule.

• The CBAM will be based on a system of certificates corresponding to embedded emissions

in CBAM products imported into the EU. The CBAM departs from the ETS in some limited

areas where it was needed, as it is not a ‘cap and trade' system. For example, and unlike

the EU ETS, an unlimited number of certificates can be purchased. Nevertheless, the price

of CBAM certificates will mirror the ETS allowance price.

9

• Once the full CBAM regime becomes operational in 2026, the system will adjust to reflect

the revised EU ETS, in particular when it comes to the reduction of available free

allowances in the sectors covered by the CBAM. This means that the CBAM will only begin

to apply to the products covered, and in direct proportion to the reduction of free

allowances allocated under the ETS for those sectors. Put simply, until free allowances in

CBAM sectors are completely phased out in 2034, the CBAM will apply only to the

proportion of emissions that does not benefit from free allowances under the EU ETS,

thus ensuring that importers are treated in an even-handed way compared to EU

producers.

5. How is the CBAM compatible with other ETS systems outside the EU?

• The CBAM will ensure that imported goods will get “no less favourable treatment” than

EU products, thanks in particular to three CBAM design features:

o the CBAM takes into consideration “actual values” of embedded emissions,

meaning that decarbonising efforts of companies exporting to the EU will lead to

a lower CBAM payment;

o the price of the CBAM certificates to be purchased for the importation of the

CBAM goods will be the same as for EU producers under the EU Emissions Trading

System (EU ETS); and

o the effective carbon prices paid outside the EU will be deducted from the

adjustment to avoid a double price.

• This carbon price paid in a third country could for example be due to an established

emissions trading system. The Commission will, before the end of the transitional period,

adopt secondary legislation to design the rules and processes to take into account the

effective carbon price paid abroad. During the transitional period, reporting declarants

need to report the carbon price due in a country of origin for the embedded emissions in

the imported goods, taking into account any rebate or other form of compensation

available.

6. Which sectors does the new mechanism cover and why were they chosen?

• The CBAM initially applies to imports of goods in the following sectors:

• Cement

• Iron and Steel

• Aluminium

• Fertilisers

• Hydrogen

• Electricity

• These sectors were selected following specific criteria, in particular their high risk of

carbon leakage and high emission intensity which will eventually – once fully phased in –

10

represent more than 50% of the emissions of the industry sectors covered by the ETS. In

the future, the CBAM may be extended to other ETS sectors.

7. To which goods does the CBAM Regulation apply?

• The CBAM Regulation applies to CN codes (Combined Nomenclature), which adds two

digits to the HS code and is used as a commodity code for exports outside the EU.

• All goods for which the embedded emissions must be reported are listed in Annex I to the

CBAM Regulation. These are called ‘CBAM goods’.

• Sectors such as ‘iron and steel’ are mentioned only for informational purposes. For

example, this means that imports of ammonia (CN code 2814 10 00 or 2814 20 00 under

the fertilizer sector) are covered by the CBAM Regulation even if the ammonia is not used

to produce fertilisers.

8. Does the CBAM apply to ‘second hand’ goods?

• The CBAM Regulation applies to all goods that are imported into the EU, namely released

for free circulation in the EU single market.

9. Does the CBAM apply to ‘returned goods’?

• Returned goods are goods defined in Article 203 of the Union Customs Code (Regulation

(EU) No 952/2013). They are goods that are released for free circulation and benefit from

duty exemption because they were Union goods before, either because they have

originally been exported as Union goods or because they were previously released for

free circulation, and because they fulfil certain conditions (e.g. they are released for free

circulation within three years after they were previously exported). The conditions under

which those goods qualify as returned goods are laid down in the customs legislation, and

competent customs authorities assess whether these conditions are fulfilled when the

goods are declared for release for free circulation in the EU.

• During the transitional period, CBAM reporting obligations do not apply to returned

goods. As a result, the embedded emissions of these goods do not need to be included in

the quarterly CBAM report.

• During the definitive period, reporting declarants will have to report returned goods - of

a non-EU customs origin

2

- in their annual CBAM declaration, however they must input

‘zero’ for the total embedded emissions corresponding to those goods.

10. How will the CBAM tackle carbon leakage of finished or semi-finished

products?

• The CBAM applies mostly to basic materials and basic material goods, but also to some

finished/downstream products, such as fasteners (CN code 7318 XX XX).

2

The customs status refers to the status of goods as Union or non-Union goods, according to Art. 5(22) of the

Union Customs Code (Regulation EU 952/2013). The customs status is independent from and does not affect the

origin of the goods.

11

• The CBAM Regulation will be reviewed at the end of the transitional period to assess,

based on selected criteria, if additional goods and sectors within the ETS could be added.

11. Does the CBAM apply to packaging?

• The CBAM reporting obligation applies if the CN code of the packaging is given in the

customs declaration and is covered by Annex I to the CBAM Regulation.

12. Does the CBAM apply to goods produced in EU outermost regions, such as

Mayotte or La Reunion?

• The CBAM Regulation applies only to CBAM goods originating in third countries and

imported into the customs territory of the Union. The list of territories which comprise

the EU customs territory is included in Article 4 of the Union Customs Code (Regulation

(EU) No 952/2013). La Réunion, Mayotte, Guadeloupe and Martinique are part of the EU

customs territory, and therefore the CBAM Regulation does not apply to goods produced

in these territories.

13. Which third countries fall under the scope of the CBAM?

• In principle, imports of goods from all non-EU countries are covered by the CBAM.

However, certain third countries who participate in the EU ETS or have an emission

trading system linked to it are excluded from the CBAM, so that a carbon price is not paid

twice for the same product. This is the case for members of the European Economic Area

(EEA) and Switzerland.

• The CBAM applies to electricity generated in and imported from third countries including

those that wish to integrate their electricity markets with the EU. If those electricity

markets are fully integrated and provided that certain strict obligations and commitments

are implemented, the concerned countries could be exempted from the CBAM. If that is

the case, the EU will review any exemptions in 2030, at which point those partners should

have put in place the decarbonisation measures they have committed to, and an

emissions trading system equivalent to the EU's.

14. Do I need to report the import of CBAM goods originating from the UK?

• Embedded emissions from goods originating from the UK will need to be reported during

the transitional period.

15. What happens during the transitional period?

• During the transitional period, which started on 1 October 2023 and finishes at the end

of 2025, the reporting declarant (which could be the importer or the indirect customs

representative) must report at the end of each quarter emissions embedded in CBAM

goods imported quarterly, without paying a financial adjustment, giving time for the final

system to be put in place.

12

• Reporting declarants should get in touch with the national competent authority in the

country where they are established to gain access to the CBAM Transitional Registry,

which will be used to submit CBAM quarterly reports.

• The first CBAM quarterly report was due by 31 January 2024 and it covers the reporting

period 1 October 2023 – 31 December 2023.

16. Are there penalties for non-compliance with the CBAM Regulation?

• Yes. Reporting of embedded emissions in CBAM goods from 1 October 2023 is

compulsory. Reporting declarants may face penalties ranging between EUR 10 and EUR

50 per tonne of unreported emissions.

• In the case of missing, incorrect, or incomplete CBAM reports, the National Competent

Authority (NCA) may initiate a correction procedure, granting reporting declarants the

possibility to rectify potential errors.

• The NCA shall apply penalties apply where a) the reporting declarant has not taken the

necessary steps to comply with the obligation to submit a CBAM report, or b) where the

CBAM report is incorrect or incomplete, and the reporting declarant has not taken the

necessary steps to correct the CBAM report after the competent authority initiated the

correction procedure.

17. Where can I find detailed information on how to carry out the reporting of

embedded emissions?

• All the required information to carry out the reporting is set out in the Implementing

Regulation (EU) 2023/1773 setting out reporting rules for the transitional period.

Commission services published (and will periodically update) two guidance documents

(one for importers of CBAM goods and one for third-country producers) as well as one

optional communication template to facilitate the exchange of information between

producers and importers. You may find these documents on the CBAM webpage:

https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en.

• The guidance document for EU importers will be made available in the 24 official EU

languages. The Guidance document for non-EU producers will be made available in

English, French, German, Polish, Spanish, Italian, Arabic, Hindi, Korean, Mandarin, Turkish,

and Ukrainian.

• The CBAM website also contains webinars, e-learnings, and other materials.

18. Is it mandatory to use the communication template Excel file?

• No, the use of the communication template is not compulsory but recommended.

• The communication template is a tool that allows operators to determine the embedded

emissions in CBAM goods according to the methodology specified in Implementing

Regulation (EU) 2023/1773. The template ensures that all relevant source streams and

emission sources, electricity consumption as well as relevant precursors are taken into

account for the calculation.

13

• The template contains a worksheet ‘Summary_Communication’ that contains all

information needed by the reporting declarant. This worksheet thus facilitates the

communication between third-country producers and importers (or their

representatives).

19. Who is liable in cases where incorrect or insufficient information is

submitted?

• Liability lies with the reporting declarant. This may be either the importer or the indirect

customs representative. The national competent authority is responsible for engaging in

the appropriate dialogue with the reporting declarant and may impose penalties.

20. I am an importer based in Switzerland, or in the EEA (Norway, Iceland,

Liechtenstein). How can I access the CBAM Transitional Registry?

• No CBAM reporting obligation applies to CBAM goods imported into Switzerland or the

EEA. Importers based in these countries cannot gain access to the CBAM Transitional

Registry.

• However, CBAM goods imported into the EU Customs Union fall under the scope of the

CBAM Regulation and must be reported on by a reporting declarant. If an importer of

CBAM goods into the EU is based in Switzerland or in the EEA, the reporting declarant for

CBAM purposes must be an indirect customs representative hired by the importer. The

reporting declarant will be the one receiving access credentials to the Transitional CBAM

Registry.

21. Who can I contact if I have further, more specific questions?

• The relevant national competent authorities and ultimately the Commission remain at

your disposal to address any doubts you may have on the CBAM implementation.

• The list of national competent authorities is published and continuously updated on the

dedicated CBAM webpage of the Commission: Carbon Border Adjustment Mechanism

(europa.eu).

Reporting: general issues

22. Who is responsible for the reporting?

• Customs authorities will inform customs declarants of their obligation to report

information during the transitional period. The reporting declarant will either be the

importer or the indirect customs representative depending on who lodges the customs

declaration. Customs authorities are free to choose in what form they inform reporting

declarants of their reporting obligations.

• The person responsible for the reporting obligation can be one of the following:

1. the importer when (i) the importer lodges a customs declaration for release for free

circulation of goods in its own name and on its own behalf; and when (ii) the importer

14

is also the declarant holding an authorisation to lodge a customs declaration and

declares the importation of goods;

2. the indirect customs representative, when the customs declaration is lodged by the

indirect customs representative appointed in accordance with Article 18 of Regulation

(EU) No 952/2013; in cases where the importer is established outside of the Union; or

when an indirect customs representative has agreed to the reporting obligations in

accordance with Article 32 of Regulation 2023/956, in case where the importer is

established within the EU. The appointed indirect customs representative shall be

established in the EU and comply with the conditions for customs representatives

determined by the concerned Member State (see Article 18 of Regulation (EU) No

952/2013).

23. Can an importer have several indirect customs representatives, and vice-

versa?

• The importer is free to use different indirect customs representatives, each being

accountable for the specific CBAM goods that they have introduced in their customs

declaration. Each representative will show their own EORI number at the customs, which

is the evidence of who is responsible for the CBAM reporting obligation. Therefore, there

can be no double-counting of embedded emissions.

• An indirect customs representative can also carry out the CBAM reporting obligation and

act as reporting declarant for multiple importers. In such case, the indirect customs

representative must still submit one single quarterly CBAM report containing all the

CBAM goods for which he has carried out the customs declaration. He cannot submit

several quarterly CBAM reports for a single reporting period.

24. Will companies be allowed to report at centralised level if subsidiaries in

the different Member States have different Economic Operators

Registration and Identification (EORI) numbers?

• In principle, CBAM goods are attributed to a CBAM reporting declarant through the EORI

number provided to the customs authorities. This means that by default, the CBAM

reports for the different subsidiaries (with different EORI numbers) will be done

separately.

• However, multiple group entities of the same multinational corporation can appoint one

single indirect customs representative to carry out customs obligations and the related

CBAM obligations at a centralised level for all group entities.

• It is also possible that one group entity acts as indirect customs representative for the

CBAM goods imported by all other group entities. However, the general rule still applies:

indirect customs representatives which act as reporting declarants and submit CBAM

reports must also carry out the customs obligations related to the goods covered by the

CBAM report.

15

• Further, it would also be possible for one group entity to submit CBAM reports as service

provider for other group entities of the same multinational corporation. This is in principle

possible, but (i) the other group entities would remain reporting declarants for the goods

they imported and would therefore remain legally liable for the CBAM report, and (ii) the

group entity acting as service provider would need to submit a separate CBAM report for

the goods imported by each group entity, including for the goods it has imported itself.

25. What are the reporting obligations? By when do I need to submit a report?

During the transitional period of the CBAM, from 1 October 2023 until 31 December 2025, the

importer shall submit a CBAM report on a quarterly basis. This report shall include the

information on the goods imported during the previous quarter and should not be submitted

later than one month after the end of that quarter. The reporting calendar during the transitional

period is outlined below:

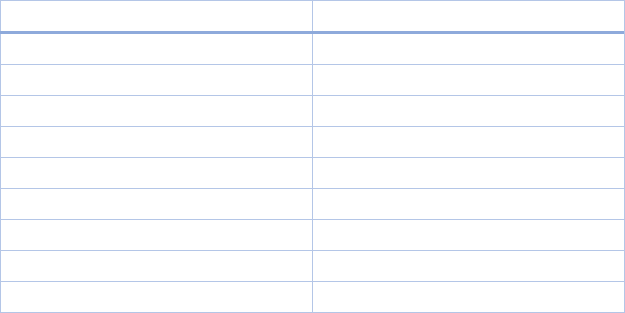

REPORTING PERIOD

SUBMISSION DUE BY

2023: October – December

2024: January 31

2024: January – March

2024: April 30

2024: April – June

2024: July 31

2024: July – September

2024: October 31

2024: October – December

2025: January 31

2025: January – March

2025: April 30

2025: April – June

2025: July 31

2025: July – September

2025: October 31

2025: October – December

2026: January 31

The report shall include the information referred to in Article 35 of the Regulation:

• the total quantity of each type of CBAM good;

• the actual total embedded emissions;

• the total indirect emissions;

• the carbon price due in a country of origin for the embedded emissions in the imported

goods (including its relevant precursors where applicable), taking into account any rebate

or other form of compensation available.

26. I was unable to submit the first CBAM report within the submission

deadline due to technical errors. What should I do?

• If a reporting declarant is unable to submit a CBAM report within the submission deadline

due to technical errors, delayed submission can be requested via the CBAM Transitional

Registry.

16

• The option to "request delayed submission (technical error)" will be available in the CBAM

Transitional Period from 1st February 2024. After the request is made, reporting

declarants will have 30 days to submit their CBAM report.

• Without prejudice to the “request delayed submission”, in line with the Implementing

Regulation 2023/1773, reporting declarants may subsequently modify and correct their

first three CBAM reports until 31 July 2024.

• In accordance with the guidance provided to National Competent Authorities (NCAs), no

penalties will be imposed on reporting declarants who have experienced difficulties in

submitting their first CBAM report.

27. I import very small quantities of CBAM goods. Do these products fall within

the scope of the CBAM Regulation?

• Small quantities of imported goods falling in the scope of the CBAM may be automatically

treated as exempt from the CBAM Regulation provided that the de minimis exemption

applies. In such case, there is no reporting obligation.

• The de minimis exemption applies to consignments in which the total intrinsic value of

the CBAM goods does not exceed EUR 150. Therefore, the overall value of the total CBAM

goods in one consignment has to be considered, and if that value is above EUR 150, then

the de minimis exemption does not apply. To illustrate, consider the following two cases:

o Case 1: In my consignment, I have X non-CBAM goods, each of a nominal value of

Y EUR. They are not relevant for the application of the de minimis exemption. I

also have one transport container of Portland cement identified by its CN code

(2523 21 00) for which the value does not exceed 150. The de minimis exemption

applies.

o Case 2: In my consignment, I have X non-CBAM goods, each of a nominal value of

Y EUR. They are not relevant for the application of the de minimis exemption. I

also carry one tonne of white Portland cement (CN code 2523 21 00) and one

tonne of other Portland cement (CN code 2523 29 00). The value of each CBAM

good is EUR 120. The total value of the CBAM goods in my consignment is above

EUR 150 and therefore the de minimis exemption does not apply.

28. I am a natural person and have purchased a CBAM good online for my

personal use. I later realised that the good was imported into the EU. Do I

need to comply with the CBAM reporting obligations?

• The CBAM mostly applies to basic materials and basic material goods such as steel or

cement, and only to a limited number of finished products. If the total intrinsic value of

the CBAM goods in the consignment does not exceed EUR 150, the de minimis exemption

applies.

• Secondly, individuals usually purchase goods from a seller established in the EU, who will

import the good through a courier. The courier would lodge the customs declaration in

the name of the seller, who is considered the ‘reporting declarant’ for CBAM purposes. In

17

such case, individuals will not appear anywhere in the customs declaration and the CBAM

Regulation does not apply to them.

29. I have not imported CBAM goods during a given reporting quarter. Must I

submit a CBAM report?

• If you have not imported (meaning released for free circulation) any CBAM goods during

a given quarter, then you should not submit any CBAM report for this given quarter.

30. Is it mandatory to report the associated operators/installations of the

CBAM goods declared?

• As a general rule, it is mandatory for reporting declarants to report information on the

operators/installations where the CBAM goods were produced.

• By derogation from this rule, reporting declarants may decide not to provide this

information for imports occurring until 30 June 2024 if the embedded emissions were

determined using other methods pursuant to Art. 4(3) of Implementing Regulation (EU)

2023/1773, including default values made available and published by the Commission.

• It is not mandatory to add the operators/installations to the installation/operator registry

available within the CBAM Transitional Registry. This is an optional functionality designed

to ease the burden in the case of multiple reporting. Therefore, data on

operators/installations can be filled in directly in the CBAM report without being

previously recorded in the installation/operator registry.

Reporting: responsibilities and procedures

31. What is the role of the European Commission during the transitional

period?

The Commission will have the following tasks during the transitional period:

• Manage the CBAM Transitional Registry.

• Review CBAM reports communicated by reporting declarants, and communicate to the

national competent authorities a list of reports for which it has reasons to believe they

are not compliant with the CBAM rules.

• Monitor the implementation of CBAM, progress, and risks of circumvention, as well as

analyse the impact of CBAM on exports, downstream products, trade flows and least

developed countries (LDCs).

• Prepare secondary legislation in the form of implementing acts:

o In mid-2023 on the transitional period (art. 35), reporting obligations and

reporting infrastructure.

o In mid-2024 on the authorisation of declarants (art. 5 and 17), and the CBAM

registry (art. 14).

18

o In mid-2025 implementing acts on indirect emissions (annex IV), verification (art.

8), accreditation of verifiers (art. 18) carbon price paid (art. 9), information for

customs (art. 25), continental shell (art. 2), average ETS price (art. 21), CBAM

declaration (art. 6), methodology (art. 7) and free allocations (art. 31).

• Prepare secondary legislation in the form of delegated acts during mid-2025 for the

accreditation of verifiers (art. 18) and the selling and repurchasing of certificates (art. 20).

If necessary, the Commission will also prepare delegated acts on exempted countries,

rules on electricity and anti-circumvention.

• Set up the Common Central Platform where the sale, repurchase of certificates will take

place in the definitive period.

32. What is a national competent authority (NCA)?

• Each Member State has designated a national competent authority (NCA), which will carry

out the functions and duties as defined in Regulation (EU) 2023/956. In short, NCAs are

responsible for checking the quality of the CBAM quarterly report (with support from the

Commission) and engage, where needed, in a dialogue with reporting declarants. NCAs

ultimately ensure compliance with CBAM rules and they may impose penalties. Finally,

from 2025 onwards, for the definitive period, NCAs will grant the status of ‘authorised

CBAM declarant’.

• The list of national competent authorities is published and continuously updated on the

dedicated CBAM webpage of the Commission: Carbon Border Adjustment Mechanism

(europa.eu). The competent NCA is the NCA of the Member State of establishment of the

reporting declarant.

33. Do importers of CBAM goods need to be ‘authorised’ in order to import

CBAM goods during the transitional period?

• Importers of CBAM goods do not need to be authorised during the transitional period in

order to import these goods into the EU. Customs will inform importers of CBAM goods

of their reporting obligations at the moment of import.

34. Are there verification obligations during the transitional period?

• No, verification by an external independent body will only be mandatory from 2026.

Secondary legislation for the definitive period will follow in the coming years which will

define the rules for verification of emissions based on the data collected during the

transitional period from EU importers.

35. Which embedded emissions need to be reported by each CBAM sector?

• The following table provides an overview of the specific emissions and greenhouse gases

covered and how direct and indirect emissions are determined for each sector falling

under the CBAM scope. Each sector’s particularities have been taken into account when

19

designing the methods for reporting and calculating embedded emissions in these goods

while mirroring the EU Emissions Trading System:

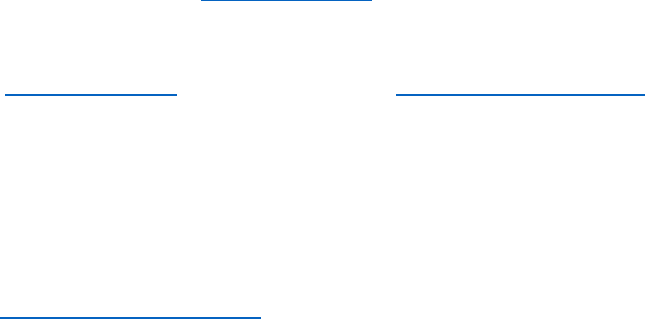

Issue

CBAM good

Cement

Fertilisers

Iron/Steel

Aluminium

Hydrogen

Electricity

Reporting

metrics

(per) Tonne of good (per) MWh

Greenhouse

gases covered

Only

CO

2

CO

2

(plus

nitrous

oxide for

some

fertiliser

goods)

Only CO

2

CO

2

(plus

perfluorocar

bons (PFCs)

for some

aluminium

goods)

Only CO

2

Only CO

2

Emission

coverage

during

transitional

period

Direct and indirect Only direct

Emission

coverage

during

definitive

period

Direct and indirect Only direct, subject to review Only direct

Determination

of direct

embedded

emissions

Based on actual emissions, but estimations (including default

values) can be used for up to 100% of the specific direct

embedded emissions for imports until 30 June 2024 (i.e. CBAM

reports due until 31 July 2024) and for up to 20% of the total

specific embedded emissions for imports until 31 December 2025

Based on

default

values,

unless

several

cumulative

conditions

are met

Determination

of indirect

embedded

emissions

Based on actual electricity consumption and default emission

factors for electricity, unless conditions are met (i.e. direct

technical connection or power purchase agreement). Estimations

(including default values) can be used for up to 100% of the

specific indirect embedded emissions for imports until 30 June

2024

Not

applicable

36. What information should reporting declarants request from producers in

third countries to ensure they can submit the quarterly CBAM report?

• The CBAM declarant must submit in the CBAM report the information contained in Annex

I to the Implementing Regulation.

20

• In order to ensure that they possesses all the required information, the reporting

declarant should request from the producer the information contained in Annex IV of the

aforementioned Implementing Regulation. The Commission services have compiled this

information into an optional communication template (in Excel format) to facilitate the

communication of information to between operators and importers. This template is

available on the Commission webpage.

37. What documents in original shall be provided in the quarterly CBAM

report?

• No document in original needs to be provided. The reporting declarant must only submit

the required information for the quarterly CBAM report through the CBAM Transitional

Registry.

• According to the principle of transparency outlined in Annex III section A.2 of the

Implementing Regulation, complete and transparent records shall be kept at the

installation of all data relevant for determining embedded emissions of the goods

produced, including necessary supporting documents, for at least 4 years after the

reporting period. Those records may be disclosed to the reporting declarant. Such records

may be requested by EU Member States in case of a review of the quarterly CBAM report.

38. I am both an importer and an indirect customs representative filing CBAM

reports for another importer. Do I file a single CBAM report or two separate

CBAM reports?

• A reporting declarant can act both as importer (company A, importing steel) and as

indirect customs representative (for company B, importing aluminium). In such case, the

reporting declarant must still submit one single quarterly CBAM report containing all the

CBAM good for which he has carried out the customs declaration.

39. What is the effective ‘carbon price’ due that I need to report on?

• As indicated in the CBAM Regulation, a carbon price is the monetary amount paid in a

third country, under a carbon emissions reduction scheme, which can adopt various forms

such as a tax, levy, fee or emission allowances under a greenhouse gas emissions tradig

system, calculated on greenhouse gases covered by such a measure, and released during

the production of goods.

• During the transitional period, reporting declarants must report the effective carbon price

due in the jurisdiction where the CBAM good was produced. During the definitive period,

the disclosure of this information will give importers a rebate, to avoid double pricing of

embedded emissions.

40. Who will check the accuracy of submitted data and reports?

• During the transitional period, and in line with Articles 11 of the Implementing Regulation,

the Commission will conduct a first screening of the CBAM reports, and communicate to

21

the competent national authority a list of incomplete or suspicious reports (i.e. when the

Commission has reasons to believe they have failed to comply with the CBAM Regulation).

It is then up to the competent national authority to decide whether to initiate a review as

well as a potential correction procedure, which may ultimately lead to penalties.

41. Is it possible to correct a CBAM report that has already been submitted?

• Article 9 of the Implementing Regulation provides that a CBAM report that has already

been submitted may still be corrected until two months after the end of the reporting

quarter.

• For the first two quarterly reports, the Implementing Regulation allows for a longer period

for corrections up until the deadline for submitting the third quarterly report. This means

that the reports due by 31 January and 30 April may be subsequently corrected until 31

July 2024.

42. Should the report be in English only or is it possible to report in other

languages?

• Reporting is possible in all 24 EU languages.

Reporting: CBAM Transitional Registry

43. What is the CBAM Transitional Registry?

• In order to ensure an efficient implementation of reporting obligations, the Commission

has developed an electronic database, which will collect the information reported during

the transitional period. The CBAM Transitional Registry is a standardised and secured

electronic database containing common data elements for reporting in the transitional

period, and to provide for access, case handling and confidentiality. The CBAM

Transitional Registry is the basis for the development and establishment of the CBAM

Registry pursuant to Article 14 of Regulation (EU) 2023/956.

• Importers may connect to the CBAM Transitional Registry through this link:

https://customs.ec.europa.eu/taxud/uumds/cas

44. What will the CBAM Transitional Registry be used for?

• The CBAM Transitional Registry shall enable communication between the Commission,

the competent authorities, customs authorities of the Member States and reporting

declarants.

• The CBAM Transitional Registry will not be used for enforcement, as the information

collected will solely serve to feed onto the data analysis and collection during the

transitional period.

22

45. Is the CBAM Transitional Registry the same as the EU Customs trader

portal?

• The CBAM Transitional Registry for reporting declarants runs independently of the EU

Customs Trader Portal (EUCTP). However existing importers that will be also acting as

CBAM Declarants may be able to use their existing user account if the EU Member State

allows it. Depending on the Member State, specific access to the CBAM module may need

to be requested.

46. Will the data shared in the CBAM Transitional Registry be dealt with

confidentiality?

• According to Article 14 of the CBAM Regulation, the information contained in the CBAM

registry “shall be confidential, with the exception of the names, addresses and contact

information of the operators and the location of installations in third countries”. Article

13 of the CBAM Regulation and Article 15 of the Implementing Regulation laying down

reporting obligations for the transitional period include an obligation of professional

secrecy to information acquired by the competent national authority.

• Some of the requested information is necessary to substantiate the reported level of

emissions, particularly in the absence of verification by external and independent

verifiers. However, it is also important to keep in mind that a lot of the data which may

be requested by the importer and considered sensitive is optional. For example, Annex IV

of the Implementing Regulation contains information on the “recommended

communication from operators of installations to reporting declarants” but only the

information contained in Annex I needs to be provided. The CBAM Transitional Registry

specifies which are the mandatory and optional entries.

• In the optional Excel template which operators and importers may use to exchange

information during the transitional period, operators of installations have the possibility

to decide whether they want to share the full, detailed information (optional) or only the

synthesis tabs necessary to submit the CBAM declaration. There is a degree of flexibility

allowing operators not to disclose the data they may consider sensitive. On the basis of

this experience, the Commission will also reflect on the information that has to be

disclosed in the reports and by the external verifiers in the definitive regime.

• The Commission is considering, for the definitive period, options for providing separate

access to the Registry to producers for them to submit information directly through the

Registry, without a possibility for reporting declarants to see the specific information.

47. How can I register as a declarant and access the CBAM Transitional

Registry?

• When they intend to become reporting declarant for CBAM purposes, economic

operators must contact the national competent authority (NCA) of the Member State

where they are established. The provisional list of NCAs is published and continuously

23

updated on the dedicated CBAM webpage of the Commission: Carbon Border Adjustment

Mechanism (europa.eu).

• In each Member State, the NCA is also responsible for providing reporting declarants with

access to the CBAM Transitional Registry. In some cases, a new CBAM specific account

with new login credentials will be required. In other cases, existing accounts for accessing

custom systems may be used. In the case of Spain, for instance, access to the CBAM

Transitional Registry is granted exclusively via the customs domain. Please contact your

NCA for further details on the login credentials in your case.

48. What CBAM Transitional Registry environments are available?

• There is a production and a conformance CBAM registry environment available for CBAM

reporting declarants.

• The conformance environment can be used as test environment for familiarisation with

the CBAM quarterly report form and the user interface of the CBAM Registry.

• A separate registration is required (same email may be used) in each environment for

security reasons. For both environments, it is the respective NCA that provides reporting

declarants with the access details.

• Link to the production CBAM Transitional Registry: https://cbam.ec.europa.eu/declarant

• Link to the conformance CBAM Transitional Registry:

https://conformance.cbam.ec.europa.eu/declarant

49. In a company which is a reporting declarant, who can request access to the

Transitional Registry?

• Any physical person that can prove he/she represents the legal person can contact the

National Competent Authority (NCA) of the Member State where that legal person is

established to request access to the CBAM Registry as CBAM reporting declarant. The

NCA is responsible for verifying the legitimacy of the requests and grant CBAM Declarant

access permissions. The owner of the account that will be granted CBAM Declarant access

by the NCA is responsible to keep the account confidential and delegate the access to

additional accounts (employees) of the company.

50. Who can fill in the CBAM report in the CBAM Transitional Registry for the

reporting declarant?

• Multiple Transitional Registry user accounts can be linked to the same EORI number as

long as these accounts are from employees of the responsible reporting declarant (i.e.

the importer or indirect customs representative). However only one user will be able to

edit a particular CBAM quarterly report in the CBAM Transitional Registry at a given time.

• The reporting declarant can delegate access to the Transitional Registry to a service

provider, who can fill in the CBAM report in the name and on behalf of the reporting

declarant. The delegation in such cases follows the delegation model “Employer -

Employee”, where “Employer” is either the importer or an indirect customs

24

representative and “Employee” is the service provider. Note that in this case both the

importer-employer (EO) and the provider-employee (EMPL) users will need to be

configured by the Member States in UUM&DS and the importer will be responsible to

delegate (via UUM&DS) the CBAM Declarant access to the Service Provider (when the

Service Provider connects to the CBAM Registry as employee he is using the EORI of the

importer that has delegated the access).

51. Can companies that are not directly subject to the CBAM also have access

to the CBAM Transitional Registry?

• No, the access to the CBAM Transitional Registry is limited to reporting declarants,

competent authorities in the Member States, customs authorities and the European

Commission.

52. How should I fill in the data in the CBAM Transitional Registry?

• The quarterly reports need to be filled-in per importer, per CN code and per installation.

There are two ways to fill in the data in the CBAM Transitional Registry:

o Reporting declarants can manually fill in the data directly within the interface in

the CBAM Transitional Registry.

o Alternatively, reporting declarants can use an XML structure to upload CBAM

quarterly reports. Once an XML file is uploaded successfully, a new draft quarterly

report will be created and can be submitted via the CBAM Registry user interface.

A supporting XLS file, which can be used to fill in the quarterly report using XML,

was published on the Commission’s CBAM website.

• There are mandatory and optional fields. In the CBAM Transitional Registry, mandatory

fields are marked with an asterisk (*). Mandatory fields will also be indicated in the

supporting XLS file.

• Detailed information on how to fill in the report, and how to use the XSD file, can be found

in the CBAM Transitional Registry user manual for Declarants.

• A draft report can be saved even without all the mandatory elements provided. However,

to submit the report all mandatory elements need to be provided.

Methodology for calculating embedded emissions in CBAM goods

in the transitional period

53. What is the relevant time period for calculating embedded emissions? Can

data from previous years be used?

• The default reporting period, i.e. the reference period for operators for determining

embedded emissions, is a calendar year. However, it may be justified to use other periods

(such as a fiscal year) provided that they ensure similar coverage and cover at least 3

months. More details can be found in the Guidance documents under Section 4.3.4 (for

EU-importers)/ Section 4.3.3 (for non-EU installations).

25

• For the CBAM report due in the first quarter of the year, the data of the previous year

should be used. In cases where such data are not yet available until the end of

January/February, data of the year before could be used.

54. What are simple and complex goods?

• There are two types of CBAM goods, simple and complex ones. “Simple goods” are

produced from input materials that are considered to have zero embedded emissions

under the CBAM reporting methodology. Therefore, the embedded emissions of simple

CBAM goods are based entirely on the emissions occurring during their production.

• For “complex goods”, it is necessary to include the embedded emissions of relevant

precursors, themselves in the scope of CBAM, if used in the production process. Relevant

precursor materials refer to those raw materials used in the production of complex CBAM

goods that are CBAM goods themselves. In the cement sector, a typical example for a

precursor is cement clinker, which is the main constituent of Portland cement.

55. What are direct and indirect emissions?

• Direct emissions cover the emissions generated during the production processes of CBAM

goods, including from the production of heating and cooling, irrespective of the location

of the production of the heating and cooling. This means that when the production of

heating and cooling takes place outside the installations, the resulting emissions are

counted as direct emissions.

• Indirect emissions cover the production of electricity that is consumed during the

production of CBAM goods.

• The embedded direct and indirect emissions of relevant precursors are also taken into

account when determining the specific embedded direct and indirect emissions of CBAM

goods.

• During the transitional phase, for monitoring purposes, importers are required to report

both direct and indirect emissions for all goods falling under the scope of CBAM. During

the definite phase starting on 1 January 2026, the CBAM scope is limited to direct

emissions for iron/steel, aluminium and hydrogen, while importers of cement and

fertilisers will have to declare both direct and indirect emissions.

56. What is the “bubble approach” and how does it work?

• If an installation produces a complex good and its precursor and where this precursor is

wholly used to produce the complex good, a joint (single) production process system

boundary may be defined within the installation (see further explanations in the guidance

documents).

57. If an imported CBAM good was produced using precursors from the EU

(e.g. pig iron) – would this have to be considered in the calculation?

• Yes, relevant precursors produced in the EU also need to be accounted for in the

determination of the embedded emissions.

26

• Note, however, that if a precursor stems from EU production, the carbon price already

paid in the EU may also be reflected in the CBAM report. (Find more details on the report

of the effective carbon price paid in the Guidance document for non-EU installations

Section 6.10.).

58. Will the European Commission formally or informally verify the

“equivalence” of alternative methods?

• The transitional period is a learning phase for everyone, including for Commission services

and national competent authorities. If the alternative methods do not meet the standards

included in Article 4(2) of the Implementing Regulation, and especially for imports after

30 June 2024, then such calculation method may be rejected. The national competent

authority would start a dialogue with the reporting declarant to obtain more accurate

data.

59. How are indirect emissions for the production of CBAM goods determined?

• Indirect emissions are determined by multiplying the electricity consumed to produce a

CBAM good with a relevant emission factor. The emission factor could be based on the

electricity grid or represent an actual emission factor.

60. Which emission factors for electricity should be used to determine indirect

emissions?

• For the transitional period, the default emission factors for electricity are based on data

from the International Energy Agency (IEA) covering a 5-year average. They are provided

per country by the Commission in the CBAM Transitional Registry.

• Alternatively, any other emission factor of the country of origin grid may be used if it is

based on publicly available data. Both the emission factor for electricity or the CO

2

emission factor may be used.

• Actual emission factors for electricity may be used in the case of a direct technical link

between the electricity-generating source and the installation producing the CBAM good

or in the case of a power purchase agreement between the electricity producer and

consumer.

61. Can market-based certificates (Guarantee of Origin, Renewable Energy

Certificates, etc.) be used to justify the use of actual emission factors?

• During the transitional period, the general rule for the emission factor for electricity is to

use default values which will be provided by the Commission. However, actual emission

factors for electricity can be used if the relevant conditions are met (i.e., existence of a

direct technical link or a power purchase agreement, as explained above).

• Market-based specific emission factors, determined for example by Guarantees of Origin

or Green Certificates cannot be used to justify the use of actual emission factors.

27

• Further information can be found in Section D.2 of Annex III to the CBAM Implementing

Regulation and in the guidance document for non-EU installations, Section 6.7.3.2.

62. Should emissions from on-site transportation be included in the

calculation?

• Emissions resulting from transport on conveyor belts, in pipelines and using other

stationary equipment are included. Emissions resulting from the use of mobile machinery

(trucks, forklifts etc.) are excluded. These are the same rules as in the EU ETS.

63. Can carbon capture and use (CCU) / carbon capture and storage (CCS) be

used to offset emissions for the purpose of determining embedded

emissions?

• Carbon capture and use/storage (CCUS) are techniques that become increasingly

available on the markets to reduce carbon dioxide emissions. Such emission reductions

can be taken into account when determining embedded emissions in CBAM goods,

provided that certain criteria are met. These conditions are spelled out in Annex III,

Section B.8.2 to the Implementing Regulation (Section 6.5.6.2 of the guidance provides

more explanations). The conditions are essentially that the captured carbon dioxide is

used to produce products in which it is permanently chemically bound or that the

captured carbon dioxide is transferred to a long-term geological storage site.

64. My supplier is not sending me the necessary information before the report

is due. What should I do?

• A good cooperation between third-country producers and reporting declarants is crucial.

The Commission has published guidance and templates to help producers determine

embedded emissions of the goods they produce.

• Ultimately, the reporting declarant is the one who bears the responsibility for ensuring

the completeness and correctness of the CBAM reports. The reporting declarant is liable

and may be subject to penalties in the case of non-respect of the CBAM reporting

obligations.

• During part of the transitional period (until mid-2024), declarants may rely on default

values, which are further elaborated on in the question "What are the default values?

How does this work?”.

65. What are the default values? How does this work?

• Until 30 June 2024 (i.e. CBAM reports due until 31 July 2024), for each import of goods

for which the reporting declarant does not have all the information, the reporting