The Effect of Home-Sharing on House Prices and Rents:

Evidence from Airbnb

∗

Kyle Barron

†

Edward Kung

‡

Davide Proserpio

§

Abstract

We assess the impact of home-sharing on residential house prices and rents. Using a dataset

of Airbnb listings from the entire United States and an instrumental variables estimation strat-

egy, we show that Airbnb has a positive impact on house prices and rents. This effect is stronger

in zipcodes with a lower share of owner-occupiers, consistent with non-owner-occupiers being

more likely to reallocate their homes from the long- to the short-term rental market. At the

median owner-occupancy rate zipcode, we find that a 1% increase in Airbnb listings leads to

a 0.018% increase in rents and a 0.026% increase in house prices. Finally, we formally test

whether the Airbnb effect is due to the reallocation of the housing supply. Consistent with

this hypothesis, we find that, while the total supply of housing is not affected by the entry of

Airbnb, Airbnb listings increase the supply of short-term rental units and decrease the supply

of long-term rental units.

Keywords: Sharing economy, peer-to-peer markets, housing markets, Airbnb

∗

We thank Don Davis, Richard Green, Chun Kuang, Aske Egsgaard, Tom Chang, and seminar participants at

the AREUA National Conference, the RSAI Annual Meetings, the Federal Reserve Bank of San Francisco, the UCI-

UCLA-USC Urban Research Symposium, and the PSI Conference for helpful comments and suggestions. All errors

are our own.

†

NBER; [email protected].

‡

§

1

Electronic copy available at: https://ssrn.com/abstract=3006832

1 Introduction

The sharing economy represents a set of peer-to-peer online marketplaces that facilitate matching

between demanders and suppliers of various goods and services. The suppliers in these markets

are often small (mostly individuals), and they often share excess capacity that might otherwise go

unutilized—hence the term “sharing economy.” Economic theory would suggest that the sharing

economy improves economic efficiency by reducing frictions that cause capacity to go underutilized,

and the explosive growth of sharing platforms (such as Uber for ride-sharing and Airbnb for home-

sharing) testifies to the underlying demand for such markets.

1

The growth of the sharing economy

has also come at the cost of great disruption to traditional markets (Zervas et al., 2017) as well

as new regulatory challenges, leading to contentious policy debates about how best to balance

individual participants’ rights to freely transact, the efficiency gains from sharing economies, the

disruption caused to traditional markets, and the role of the platforms themselves in the regulatory

process.

Home-sharing, in particular, has been the subject of intense criticism. Namely, critics argue

that home-sharing platforms like Airbnb raise the cost of living for local renters while mainly

benefitting local landlords and non-resident tourists.

2

It is easy to see the economic argument. By

reducing frictions in the peer-to-peer market for short-term rentals, home-sharing platforms cause

some landlords to switch from supplying the market for long-term rentals—in which residents are

more likely to participate—to supplying the short-term market—in which non-residents are more

likely to participate. Because the total supply of housing is fixed or inelastic in the short run, this

drives up the rental rate in the long-term market. Concern over home-sharing’s impact on housing

affordability has garnered significant attention from policymakers and has motivated many cities

to impose stricter regulations on home-sharing.

3

1

These frictions could include search frictions in matching demanders with suppliers and information frictions

associated with the quality of the good being transacted or with the trustworthiness of the buyer or seller. See Einav

et al. (2016) for an overview of the economics of peer-to-peer markets including the specific technological innovations

that have facilitated their growth.

2

Another criticism of Airbnb is that the company does not do enough to combat racial discrimination on its

platform (Edelman and Luca, 2014; Edelman et al., 2017) or that it generates negative externalities for neighbors

(Filippas and Horton, 2018) though we will not directly address these issues in this paper.

3

For example, Santa Monica outlaws short-term, non-owner-occupied rentals of fewer than 30 days as does New

York State for apartments in buildings with three or more residences. San Francisco passed a 60-day annual hard

cap on short-term rentals (which was subsequently vetoed by the mayor). It is unclear, however, to what degree to

which these regulations are enforced.

2

Electronic copy available at: https://ssrn.com/abstract=3006832

Whether or not home-sharing increases housing costs for local residents is an empirical question.

There are a few reasons why it might not. The market for short-term rentals may be very small

compared to the market for long-term rentals. In this case, even large changes to the short-term

market might not have a measurable effect on the long-term market. The short-term market could

be small—even if the short-term rental rate is high relative to the long-term rate—if landlords prefer

more reliable long-term tenants and a more stable income stream. Alternatively, it is possible that

home-sharing simply does not cause much reallocation from the long-term rental stock to the short-

term rental stock. Owner-occupiers—those who own the home in which they live—may supply the

short-term rental market with spare rooms and cohabit with guests or they may supply their entire

home during temporary absences,

4

but either way, the participation of owner-occupiers in the short-

term rental market may not cause a reallocation from the long-term rental stock if these housing

units are still primarily used as long-term rentals in the sense that the owners are renting long-term

to themselves. Another type of participation in the short-term rental market that would not result

in reallocation is vacation homes that would not have been rented to long-term tenants anyway,

perhaps due to the restrictiveness of long-term leases causing vacation home-owners to not want to

rent to long-term tenants. In this case, the vacation home units were never part of the long-term

rental stock to begin with. In either case, whether owner-occupiers or vacation-home owners, these

homes would not be made available to long-term tenants independently of the existence of a home-

sharing platform. Instead, home-sharing provides these owners with an income stream for times

when their housing capacity would otherwise be underutilized.

In this paper, we study the effect of home-sharing on residential house prices and rents using

a comprehensive dataset of all U.S. properties listed on Airbnb, the world’s largest home-sharing

platform. The data are collected from public-facing pages on the Airbnb website between 2012 and

the end of 2016, covering the entire United States. From this data, we construct a panel dataset of

Airbnb listings at the zipcode-year-month level. From Zillow, a website specializing in residential

real estate transactions, we obtain a panel of house price and rental rate indices, also at the zipcode-

year-month level. Zillow provides a platform for matching buyers and sellers in the housing market

and landlords with tenants in the long-term rental market; thus, their price measures reflect sale

4

A frequently cited example is that of the flight attendant who rents out his or her home on Airbnb while traveling

for work.

3

Electronic copy available at: https://ssrn.com/abstract=3006832

prices and rental rates in the market for long-term housing. Finally, we supplement this data with

a rich set of time-varying zipcode characteristics collected from the Census Bureau’s American

Community Survey (ACS) and a set of variables correlated with tourism demand such as hotel

occupancy rates from STR, airport travelers from the Bureau of Transportation Statistics (BTS),

and hotels’ online reviews from TripAdvisor.

In the raw correlations, we find that the number of Airbnb listings in zipcode i in year-month

t is positively associated with both house prices and rental rates. In a baseline OLS regression

with no controls, we find that a 1% increase in Airbnb listings is associated with a 0.1% increase

in rental rates and a 0.18% increase in house prices. Of course, these estimates should not be

interpreted as causal and may instead be picking up spurious correlations. For example, cities that

are growing in population likely have rising rents, house prices, and numbers of Airbnb listings

at the same time. We therefore exploit the panel nature of our dataset to control for unobserved

zipcode level effects and arbitrary city level time trends. We include zipcode fixed effects to absorb

any permanent differences between zipcodes while fixed effects at the Core Based Statistical Area

(CBSA)-year-month level control for any shocks to housing market conditions that are common

across zipcodes within a CBSA.

5

We further control for unobserved zipcode-specific, time-varying factors using an instrumental

variable that is plausibly exogenous to local zipcode level shocks to the housing market. To con-

struct the instrument, we exploit the fact that Airbnb is a young company that has experienced

explosive growth over the past five years. Figure 1 shows worldwide Google search interest in Airbnb

from 2008 to 2016. Demand fundamentals for short-term housing are unlikely to have changed so

drastically from 2008 to 2016 as to fully explain the spike in interest, so most of the growth in

Airbnb search interest is likely driven by information diffusion and technological improvements to

Airbnb’s platform as it matures as a company. Neither of these should be correlated with local zip-

code level unobserved shocks to the housing market. By itself, global search interest is not enough

for an instrument because we already control for arbitrary CBSA level time trends. We therefore

interact the Google search index for Airbnb with a measure of how “touristy” a zipcode is in a

base year, 2010. We define “touristy” to be a measure of a zipcode’s attractiveness for tourists and

5

The CBSA is a geographic unit defined by the U.S. Office of Management and Budget that roughly corresponds

to an urban center and the counties that commute to it.

4

Electronic copy available at: https://ssrn.com/abstract=3006832

proxy for it using the number of establishments in the food service and accommodations industry.

6

These include eating and drinking places as well as hotels, bed and breakfasts, and other forms

of short-term lodging. The identifying assumptions of our specification are that: 1) Landlords in

more touristy zipcodes are more likely to switch into the short-term rental market in response to

learning about Airbnb than landlords in less touristy zipcodes and 2) ex-ante levels of touristiness

are not systematically correlated with ex-post unobserved shocks to the housing market at the

zipcode level that are also correlated in time with Google search interest for Airbnb. We discuss

the instrument, its construction, and exercises supporting the exclusion restriction in more detail

in Sections 5, 5.1, and in the Appendix B.

Using this instrumental variable, we estimate that for zipcodes with the median owner-occupancy

rate (72%), a 1% increase in Airbnb listings leads to a 0.018% increase in the rental rate and a

0.026% increase in house prices. We also find that the effect of Airbnb listings on rental rates and

house prices is decreasing in the owner-occupancy rate. For zipcodes with a 56% owner-occupancy

rate (the 25th percentile), the effect of a 1% increase in Airbnb listings is 0.024% for rents and

0.037% for house prices. For zipcodes with an 82% owner-occupancy rate (the 75th percentile),

the effect of a 1% increase in Airbnb listings is only 0.014% for rents and 0.019% for house prices.

These results are robust to a number of sensitivity and robustness checks that we discuss in detail

in Sections 5.1 and 6.2.

The fact that the effect of Airbnb is moderated by the owner-occupancy rate suggests that the

effect of Airbnb could be driven by non-owner occupiers being more likely (because of Airbnb) to

reallocate their housing units from the long- to the short-term rental market. We directly test this

hypothesis using the same instrumental strategy described above and data on various measures of

housing supply that we collected from the American Community Survey. We find that: (i) the total

housing stock (which is the sum of all renter-occupied, owner-occupied, and vacant units) is not

affected by the entry of Airbnb, (ii) an increase in Airbnb listings leads to an increase in the number

of units held vacant for recreational or seasonal use,

7

(iii) an increase in Airbnb listings leads to a

decrease in the number of units available to long-term renters, and (iv) the above effects on supply

6

We focus on tourism because Airbnb has historically been frequented more by tourists than business travelers.

Airbnb has said that 90% of its customers are vacationers but is attempting to gain market share in the business

travel sector.

7

According to Census methodology, units without a usual tenant but rented occassionally to Airbnb guests would

be classified as vacant for recreational or seasonal use. We describe the data in more detail in Section 6.4.

5

Electronic copy available at: https://ssrn.com/abstract=3006832

are smaller for zipcodes with a higher owner-occupancy rate. These results are consistent with

the hypothesis that Airbnb increases rents and house prices by causing a reallocation of housing

supply from the long-term rental market to the short-term rental market. Moreover, the size of

the reallocation is greater in zipcodes with fewer owner-occupiers because, intuitively, non-owner-

occupiers may be more likely to reallocate. Finally, it is worth mentioning that we cannot rule out

the possibility of other effects of Airbnb such as any of the positive or negative externalities; thus,

our results should be interpreted as the estimated net effect with evidence for the presence of a

reallocation channel.

2 Related literature

We are aware of only two other academic papers that directly study the effect of home-sharing on

housing costs, and both of them focus on a specific U.S. market. Lee (2016) provides a descriptive

analysis of Airbnb in the Los Angeles housing market while Horn and Merante (2017) use Airbnb

listings data from Boston in 2015 and 2016 to study the effect of Airbnb on rental rates. Using

a fixed effect model, they find that a one standard deviation increase in Airbnb listings at the

census tract level leads to a 0.4% increase in asking rents. In our data, we find that a one standard

deviation increase in listings at the within-CBSA zipcode level in 2015-2016 implies a 0.54% increase

in rents.

We contribute—and differentiate from previous work—to the literature concerning the effect

of home-sharing on housing costs in several important ways. First, we present the first estimates

of the effect of home-sharing on house prices and rents that use comprehensive data from across

the United States. Second, we are able to exploit the panel structure of our dataset to control

for unobserved neighborhood heterogeneity as well as arbitrary city-level time trends. Moreover,

we identify a plausible instrument for Airbnb supply and conduct several exercises to support its

validity. These exercises reassure us that the measured association between Airbnb and house prices

and rents is likely causal. Third, we show that the effect of Airbnb is strongly moderated by the

rate of owner-occupiers, a finding consistent with the hypothesis that the Airbnb effect operates

through the reallocation of housing supply from the long- to the short-term rental market. Fourth,

we provide direct evidence in support of this hypothesis by showing that Airbnb is associated with

6

Electronic copy available at: https://ssrn.com/abstract=3006832

a decrease in long-term rentals supply and an increase in short-term rentals supply while having no

association with changes in the total housing supply. Fifth, by showing that the effects of Airbnb

are moderated by the owner-occupancy rate, our results highlight the importance of the marginal

homeowner in terms of reallocation (since owner-occupiers are much less likely to reallocate their

housing to the permanent short-term rental stock). Thus, the marginal propensity of homeowners

to reallocate housing from the long- to the short-term rental market is a key elasticity determining

the overall effect of home-sharing.

Our paper also contributes to the growing literature on peer-to-peer markets. Such literature

covers a wide array of topics, from the effect of the sharing economy on labor market outcomes

(Chen et al., 2017; Hall and Krueger, 2017; Angrist et al., 2017), to entry and competition (Gong et

al., 2017; Horton and Zeckhauser, 2016; Li and Srinivasan, 2019; Zervas et al., 2017), to trust and

reputation (Fradkin et al., 2017; Proserpio et al., 2017; Zervas et al., 2015). Because the literature

on the topic is quite vast, here we focus only on papers that are closely related to ours and refer

the reader to Einav et al. (2016) for an overview of the economics of peer-to-peer markets and to

Proserpio and Tellis (2017) for a complete review of the literature on the sharing economy.

Closely related to the marketing literature and this work we find papers that study the effects

of the entry of peer-to-peer markets and the competition that they generate. Gong et al. (2017),

for example, provide evidence that the entry of Uber in China increased the demand for new cars;

Farronato and Fradkin (2018), Li and Srinivasan (2019), and Zervas et al. (2017) study the effect

of Airbnb on the hotel industry; however, each one of them focuses on a different question. Zervas

et al. (2017) focus on the subsitution patterns between Airbnb and hotels, and show that, after

Airbnb entry in Texas, hotel revenue dropped. Moreover, the authors show that this negative

effect is stronger in periods of peak demand. Farronato and Fradkin (2018) focus instead on the

gains in consumer welfare generated by the entry of Airbnb in 50 U.S. markets. Finally, Li and

Srinivasan (2019) study how the flexible nature of Airbnb listings affects hotel demand in different

markets. The authors show that, in response to the entry of Airbnb, some hotels may benefit

from moving away from seasonal pricing. Our paper looks at a somewhat unique context in this

literature because we focus on the effect of the sharing economy on the reallocation of goods from

one purpose to another, which may cause local externalities. Local externalities are present here

because the suppliers are local and the demanders are non-local; transactions in the home-sharing

7

Electronic copy available at: https://ssrn.com/abstract=3006832

market, therefore, involve a reallocation of resources from locals to non-locals.

8

Our contribution

is therefore to study this unique type of sharing economy in which public policy may be especially

salient.

Finally, our work is related to papers studying the consequences of what happens when a online

platform lowers the cost to entry for suppliers. For example, both Kroft and Pope (2014) and

Seamans and Zhu (2013) study the impact of Craiglist on the newspaper industry and find a

substantial substitution effect between the two.

The rest of the paper is organized as follows. In Section 3, we discuss the economics of home-

sharing and how home-sharing might be expected to affect housing markets. In Section 4, we

describe the data we collected from Airbnb and present some basic statistics. In Section 5, we

describe our methodology and present exercises in support of the exclusion restriction of our in-

strument In Section 6, we discuss the results and present several robustness checks to reinforce the

validity of our results. Section 7 discusses our findings, the limitations of our work, and provides

concluding remarks.

3 Theory

The market for long and short-term rentals is traditionally viewed as segmented on both the

supply and demand side. On the demand side, the demanders for short-term rentals are tourists,

visitors, and business travelers while the demanders for long-term rentals are local residents. On

the supply side, the suppliers of short-term rentals are traditionally hotels and bed and breakfasts

while the suppliers of long-term rentals are local landlords. Local residents who own their own

homes (owner-occupiers) are on both the demand and the supply side for long-term rentals (they

rent to themselves.)

Segmentation exists between the long- and short-term markets despite the fundamental simi-

larity in the product being offered (i.e., space and shelter). The segmentation may exist for a few

reasons. First, short-term demanders may have very different needs than long-term demanders.

Short-term demanders may only require a bed and a bathroom while long-term demanders may

8

This may not be seen as a real economic cost, though a shift of welfare from locals to non-locals is important

for public policy because policy is set locally. Some have also argued that home-sharing can create a real negative

spillover for neighbors (Filippas and Horton, 2018).

8

Electronic copy available at: https://ssrn.com/abstract=3006832

also require a kitchen and a living area. Second, the legal environment is very different for short

and long-term demanders. Long-term tenants are typically afforded rights and protections that are

not available to short-term visitors. Because of this segmentation, the unit price of renting exhibits

a term structure with the price of a short-term rental typically being much higher than the price

of a long-term rental. Marketplaces for long- and short-term rentals have historically remained

separate due to this segmentation.

Effects of home-sharing: Housing supply reallocation and expansion

With the advent of home-sharing, segmentation on the supply side is becoming blurred. Because

of home-sharing platforms like Airbnb, it is now much easier for properties that were traditionally

used only for long-term rental to now also be used for short-term rental.

9

Now that it has become easier for owners of traditionally long-term housing to supply the

short-term market, what can we expect the effects to be? First, we can expect some owners of

traditionally long-term housing to switch from supplying a long-term demander to supplying short-

term demanders. In the short run, the supply of housing and of hotels is inelastic, so this reduces

the supply of housing available in the long-term rental market and increases the supply of rooms

in the short-term rental market. This, in turn, pushes up rents in the long-term rental market

and pushes down rents in the short-term rental market (Horn and Merante, 2017; Zervas et al.,

2017). To the extent that search and matching frictions exist in both rental markets, this should

also reduce the vacancy rate in the long-term rental market and increase the vacancy rate in the

short-term rental market.

In the long run, we may also expect a supply response. The quantity of homes that are able

to supply both long- and short-term renters (i.e., homes traditionally built for long-term housing)

would be expected to increase in the long-run, while the quantity of hotel rooms that are only

able to supply the short-term market should decrease. The degree to which there will be quantity

adjustments will depend on the amount of land available in the city and the stringency of land use

regulations as well as the cost of construction (Gyourko and Molloy, 2015).

The size of the price and quantity response to home-sharing will also depend on the degree to

9

Home-sharing platforms greatly reduce traditional frictions that previously prevented some homeowners from

participating in the short-term rental market such as transactional frictions associated with trust (Einav et al., 2016).

9

Electronic copy available at: https://ssrn.com/abstract=3006832

which owners of traditionally long-term rental housing reallocate to the short-term rental market.

There are many reasons why an owner would choose not to reallocate. First and foremost, the

owner may live in her home. Thus, the owner will not reallocate from the long-term market (where

she rents to herself) to the short-term market. She may still participate in the short-term market by

selling unused capacity such as spare rooms or time when she is away, but this does not constitute

a reallocation from the long-term rental stock to the short-term rental stock because those spare

units of capacity would not have been allocated to a long-term tenant anyway and therefore does

not push up long-term rental rates. However, the allocation of spare capacity to the short-term

rental market, which constitutes a pure supply expansion, can reduce prices in the short-term rental

market.

10

Second, the owner may not reallocate from the long-term market to the short-term market

because the costs outweigh the benefits. There could be many costs associated with supplying the

short-term rental market. Short-term renters may annoy neighbors, thus reflecting poorly on the

host and reducing his social capital in the community. In some cases, an owner may be bound

against renting to short-term renter by a homeowners’ association. Short-term renters may also

be more likely than long-term renters to cause property depreciation. A property owner may also

prefer the steadier stream of payments offered by a long-term tenant over the lumpier stream of

payments offered by sporadic visitors booking the home for short stays. Owners who simply choose

not to use the short-term market will cause no reallocation and therefore have no effect on prices

in either the long-term or the short-term rental markets.

Finally, it is worth pointing out that reallocation from the long-term rental stock to the short-

term rental stock does not require that expected rents in the short-term rental market be higher

than expected rents in the long-term rental market. There may be reasons for preferring to rent

short-term instead of long-term even if the expected rents from short-term are lower, as may be

the case according to Coles et al. (2017). One reason could be that the owner does not like the

restrictiveness of a long-term lease. Even if the owner does not plan to use the property as a

primary residence or a vacation home, not renting to a long-term tenant increases the option value

for other uses such as letting family or friends stay or even holding out for higher long-term rents

10

If the owner-occupier is currently allocating spare rooms to the long-term market (i.e., by having a roommate)

and then decides to stop renting to a roommate and instead use Airbnb, then this would constitute a reallocation.

10

Electronic copy available at: https://ssrn.com/abstract=3006832

in the future while capitalizing on surges in short-term demand.

Effects of home-sharing: Externalities and option value

Besides reallocation of housing supply, home-sharing can affect long-term rental rates in a few other

ways. First, there may be both positive and negative externalities. On the positive side, home-

sharing may draw tourist money into the neighborhood, increasing revenues to local businesses and

increasing the demand for space in the neighborhoods. This would have the effect of increasing both

long and short-term rental rates. Farronato and Fradkin (2018) and Coles et al. (2017) document

that home-sharing has drawn tourists into neighborhood that previously had very few, and Alyakoob

and Rahman (2018) find a positive relation between Airbnb and restaurant employment. On the

negative side, the tourists that home-sharing draws in may be unpleasant or noisy. This can make

the neighborhood a more unpleasant place to live, thus decreasing rents. In local debates over

Airbnb, this has proven to be an unexpectedly salient point (Filippas and Horton, 2018).

Second, if tenants themselves are able to sell unused capacity in the short-term market, even

while under a long-term rental lease, then this would increase the demand for renting. In the short

run where supply is inelastic, this would push up rents in the long-term rental market. The degree

to which rents are increased depends on the degree to which tenants are willing and able to sell

unused capacity.

11

In the long-run, this effect could lead to further expansion in housing supply.

So far, the discussion has focused on rental rates. Since buying a house can be viewed as

purchasing the present value of future rental payments, house prices should be equal to the ex-

pected present value of rents for a similar unit, adjusted for any tax implications, borrowing costs,

maintenance costs, and physical depreciation (Poterba, 1984). Thus, any effect of home-sharing

on long-term rental rates will be directly capitalized into house prices. However, because home-

sharing also allows the homeowner to sell unused capacity on the short-term market, it should have

an additional effect of increasing prices even further than the direct effect on rents.

Finally, we note that it is possible that home-sharing externalities differentially affect homeown-

ers and renters. For example, homeowners may be more sensitive to noisy neighbors than renters. If

such were the case, then the net effect of home-sharing on the price-to-rent ratio could be negative

11

In practice, this will depend on the laws of individual cities and the types of leases landlords sign with tenants,

and the enforceability of any associated clauses.

11

Electronic copy available at: https://ssrn.com/abstract=3006832

even though the increased option value of using spare capacity would increase it.

Effects of home-sharing: Other effects

Finally, we note two other effects that home-sharing may have on short and long-term rental

markets. First, in the long-run, home-sharing may change the characteristics of the housing stock.

For example, by increasing the option value of spare capacity, home-sharing may cause future homes

to be built with spare capacity in mind. There may be an increase in the supply of homes with

accessory dwelling units that are optimized for delivery to short-run tenants with the main unit

simultaneously being occupied by the owner.

Second, home-sharing may change the short-run supply elasticity of short-term rentals. Without

home-sharing, the short-run supply of short-term rentals is inelastic because there is only a fixed

number of hotel rooms in any given neighborhood. High development costs and regulations make

it difficult to adjust this number quickly. Home-sharing increases the flexibility of traditionally

long-term housing to freely move between the long and short-term rental markets, thus leading to a

more elastic supply in the short-term market that is able to quickly expand in response to surges in

demand and then quickly contract when the surge is over. Farronato and Fradkin (2018) document

this phenomenon and evaluate its welfare implications.

Summary

To summarize, we have argued that home-sharing will have the following effects. First, it will cause

a reallocation from the long-term housing supply to the short-term rental market. In the short-run,

this will push up rental rates and house prices, and decrease vacancy rates in the long-term market.

In the long-run, this could lead to an increase in housing supply, depending on the housing supply

curve of the market. Second, the size of the reallocation effect will depend on the propensity of

homeowners to reallocate housing from the long-term market to the short-term market in response

to home-sharing. The effect of home-sharing will be smaller when there are fewer homeowners

choosing to reallocate. Third, rents and prices should both increase due to the increased option

value of spare housing capacity, with prices increasing more than rents, thus leading to an increased

price-to-rent ratio. Countervailing these three effects (which are all positive on prices and rents)

is the possibility of negative externalities. If home-sharing makes the neighborhood less desirable

12

Electronic copy available at: https://ssrn.com/abstract=3006832

to live in, then this could have a negative effect on rents and prices. If homeowners are especially

sensitive to these externalities, home-sharing could decrease the price-to-rent ratio. On the other

hand, there could also be positive externalities that have the opposite effects.

The predicted effects of home-sharing on rental rates and house prices is therefore ambiguous.

In this paper, we aim simply to test for the net effect. We will find that the net effect is positive

on rental rates, house prices, and the price-to-rent ratio in a way that is consistent with both the

reallocation channel and with increasing the option value of spare capacity. We also provide some

direct evidence of the reallocation channel. However, we cannot rule out the potential for other

effects like externalities, nor do we disentangle the size of the various channels. It is also worth

mentioning that, in this paper, we focus only on short-run effects. This choice is dictated by two

reasons: First, home-sharing is a relatively new phenomenon, and Airbnb itself is only a decade

old. Cities are still actively grappling with how to respond to home-sharing, and so we believe

that it is too early to look for long-run effects. Second, in this paper, we do not find any empirical

evidence that Airbnb (as yet) is associated with changes to the total housing supply, though we do

find evidence for reallocation of housing from long-term rental stock to short-term rental stock.

4 Data and Background on Airbnb

4.1 Background on Airbnb

Recognized by most as the pioneer of the sharing economy, Airbnb is a peer-to-peer marketplace for

short-term rentals, where the suppliers (hosts) offer different kinds of accommodations (i.e. shared

rooms, entire homes, or even yurts and treehouses) to prospective renters (guests). Airbnb was

founded in 2008 and has experienced dramatic growth, going from just a few hundred hosts in 2008

to over three million properties supplied by over one million hosts in 150,000 cities and 52 countries

in 2017. Over 130 million guests have used Airbnb, and with a market valuation of over $31B,

Airbnb is one of the world’s largest accommodation brands.

4.2 Airbnb listings data

Our main source of data comes directly from the Airbnb website. We collected consumer-facing

information about the complete set of Airbnb properties located in the United States and about

13

Electronic copy available at: https://ssrn.com/abstract=3006832

the hosts who offer them. The data collection process spanned a period of approximately five years,

from mid-2012 to the end of 2016. We performed scrapes at irregular intervals between 2012 to

2014 and at a weekly interval starting January 2015.

12

Our scraping algorithm collected all listing information available to users of the website, in-

cluding the property location, the daily price, the average star rating, a list of photos, the guest

capacity, the number of bedrooms and bathrooms, a list of amenities such as WiFi and air condi-

tioning, etc., and the list of all reviews from guests who have stayed at the property.

13

Airbnb host

information includes the host name and photograph, a brief profile description, and the year-month

in which the user registered as a host on Airbnb.

Our final dataset contains detailed information about 1,097,697 listings and 682,803 hosts span-

ning a period of nine years, from 2008 to 2016. Because of Airbnb’s dominance in the home-sharing

market, we believe that this data represents the most comprehensive picture of home-sharing in

the U.S. ever constructed for independent research.

4.3 Calculating the number of Airbnb listings, 2008-2016

Once we have collected the data, the next step is to define a measure of Airbnb supply. This task

requires two choices: First, we need to choose the geographic granularity of our measure; second,

we need to define the entry and exit dates of each listing in the Airbnb platform. Regarding

the geographic aggregation, we conduct our main analysis at the zipcode level for a few reasons.

First, it is the lowest level of geography for which we can reliably assign listings without error

(other than user input error).

14

Second, neighborhoods are a natural unit of analysis for housing

markets because there is significant heterogeneity in housing markets across neighborhoods within

cities but comparatively less heterogeneity within neighborhoods. Zipcodes will be our proxy for

neighborhoods. Third, conducting the analysis at the zipcode level as opposed to the city level helps

with identification. This is due to our ability to compare zipcodes within cities, thus controlling for

any unobserved city level factors that may be unrelated to Airbnb but that affect all neighborhoods

12

In their paper, Horn and Merante (2017) incorrectly state that our Airbnb dataset comes form InsideAirbnb.com

(probably referencing an older version of this paper), but, in fact, the current results are based on data that one of

the authors of this paper scraped and collected.

13

Airbnb does not reveal the exact street address or coordinates of the property for privacy reasons; however, the

listing’s city, street, and zipcode correspond to the property’s real location.

14

Airbnb does report the latitude and longitude of each property but only up to a perturbation of a few hundred

meters. So it would be possible, but complicated, to aggregate the listings to finer geographies with some error.

14

Electronic copy available at: https://ssrn.com/abstract=3006832

within a city such as a city-wide shock to labor productivity.

The second choice, how to determine the entry and exit date of each listing, comes less naturally.

First, our scraping algorithm did not constantly monitor a listing’s status to determine whether it

was active or not but rather obtained snapshots of the properties available for rent in the US at

different points in time until the end of 2014 and at the weekly level starting in 2015. Second, even

if it did so, measuring active supply would still be challenging.

15

Thus, to construct the number of

listings going back in time, we employ a variety of methods following Zervas et al. (2017), which

we summarize in Table 1.

Table 1: Methods for Computing the Number of Listings

Listing is considered active ...

Method 1 starting from host join date

Method 2 for 3 months after host join date and after every guest review

Method 3 for 6 months after host join date and after every guest review

Method 1 is our preferred choice to measure Airbnb supply and will be our main independent

variable in all the analyses presented in this paper. This measure computes a listing’s entry date

as the date its host registered on Airbnb and assumes that listings never exit. The advantage of

using the host join date as the entry date is that for a majority of listings, this is the most accurate

measure of when the listing was first posted. The disadvantage of this measure is that it is likely

to overestimate the listings that are available on Airbnb (and accepting reservations) at any point

in time. However, as discussed in Zervas et al. (2017), such overestimation would cause biases only

if, after controlling for several zipcode characteristics, it is correlated with the error term.

16

Aware of the fact that method 1 is an imperfect measure of Airbnb supply, we also experiment

with alternative definitions of Airbnb listings’ entry and exit. Methods 2 and 3 exploit our knowl-

edge of each listing’s review dates to determine whether a listing is active. The heuristic we use

is as follows: A listing enters the market when the host registers with Airbnb and stays active for

15

Estimating the number of active listings is a challenge even for Airbnb. Despite the fact that Airbnb offers an

easy way to unlist properties, many times hosts neglect to do so, creating “stale vacancies” that seem available for

rent but in actuality are not. Fradkin (2015), using proprietary data from Airbnb, estimates that between 21% and

32% of guest requests are rejected due to this effect.

16

The absence of bias in this measure is also confirmed by Farronato and Fradkin (2018) where using Airbnb

proprietary data resulted in the same estimates obtained by Zervas et al. (2017) (where the data collection and

measures of Airbnb supply are similar to those used in this paper).

15

Electronic copy available at: https://ssrn.com/abstract=3006832

m months. We refer to m as the listing’s Time To Live (TTL). Each time a listing is reviewed,

the TTL is extended by m months from the review date. If a listing exceeds the TTL without any

reviews, it is considered inactive. A listing becomes active again if it receives a new review. In our

analysis, we test two different TTLs, 3 months and 6 months.

Despite the fact that our different measures of Airbnb supply rely on different heuristics and

data, because of Airbnb’s tremendous growth, all our measures of Airbnb supply are extremely

correlated. The correlation between method 1 and each other measure is above 0.95 in all cases. In

the Appendix, we present robustness checks of our main results to the different measures of Airbnb

supply discussed above and show that results are qualitatively and quantitatively unchanged.

17

4.4 Zillow: rental rates and house prices

Zillow.com is an online real estate company that provides estimates of house and rental prices

for over 110 million homes across the U.S. In addition to giving value estimates of homes, Zillow

provides a set of indexes that track and predict home values and rental prices at a monthly level

and at different geographical granularities.

For house prices, we use the Zillow Home Value Index (ZHVI) that estimates the median

transaction price for the actual stock of homes in a given geographic unit and point in time. The

advantage of using the ZHVI is that it is available at the zipcode-month level for over 13,000

zipcodes.

For rental rates, we use the Zillow Rent Index (ZRI). Like the ZHVI, Zillow’s rent index is meant

to reflect the median monthly rental rate for the actual stock of homes in a geographic unit and

point in time. Crucially, Zillow’s rent index is based on rental list prices and is therefore a measure

of prevailing rents for new tenants. This is the relevant comparison for a homeowner deciding

whether to place her unit on the short-term or long-term market. Moreover, because Zillow is not

considered a platform for finding short-term housing, the ZRI should be reflective of rental prices in

the long-term market.

18

For each zipcode, we calculate the price-to-rent ratio as simply the ZHVI

17

One additional source of error in our computations is listings that were posted and then taken down between

2008 and 2011 since we did not start scraping until 2012. However, the number of such listings is likely to be small,

as shown in Figure 3. Moreover, our regressions use only data starting in 2011, so the influence on our results is likely

minimal. Further, as we show in Table 15 of the Appendix, our results are robust to the exclusion of early years.

18

Since the ZHVI and ZRI measure medians, our results only apply to the middle of the housing market. In the

Appendix, we explore effects on different segments of the housing market and find that the effects are qualitatively

similar.

16

Electronic copy available at: https://ssrn.com/abstract=3006832

divided by the ZRI.

4.5 Other data sources

We supplement the above data with several additional sources.

Variables used for the instrument We use monthly Google Trends data for the search term

“airbnb”, which we downloaded directly from Google. This index measures how often people

worldwide search for the term “airbnb” on Google and is normalized to have a value of 100 at

the peak month. We use the Census’s Zipcode Business Patterns data to measure the number of

establishments in the food services and accommodations industry (NAICS code 72) for each zipcode

in 2010.

Zipcode level time-varying characteristics We collect from the American Community Survey

(ACS) zipcode level annual estimates of median household income, population, share of 25-60 years

old with bachelors’ degrees or higher, and employment rate. From the ACS, we also obtain zipcode

level annual estimates of the number of housing units occupied by their owners or renters, and the

number of vacant units. The ACS also reports the reason a housing unit is vacant (for example,

whether the owner is holding it vacant so that he or she can use it occassionally for recreation or

whether it is vacant and currently looking for a tenant). We can therefore calculate the owner-

occupancy rate as the share of occupied units that are occupied by owners and the total housing

stock as the sum of owner-occupied units, renter-occupied units, and vacant units.

Proxies for tourism demand We obtained hotel occupancy rates at the CBSA-year-month

level from STR, a company that tracks hotel performance worldwide. We collected the number of

incoming airport travelers for all airports in the United States from the Bureau of Transportation

Statistics. Finally, we collected the complete set of hotel and restaurant reviews for all the hotels

and restaurants available on TripAdvisor. This data amount to about 18 million hotel reviews from

88,000 accommodation properties (hotels, inns, B&Bs) and about 25 million restaurant reviews

from about 478,000 restaurants from 2001 to the beginning of 2017 (2019 for restaurant reviews).

17

Electronic copy available at: https://ssrn.com/abstract=3006832

4.6 Summary statistics

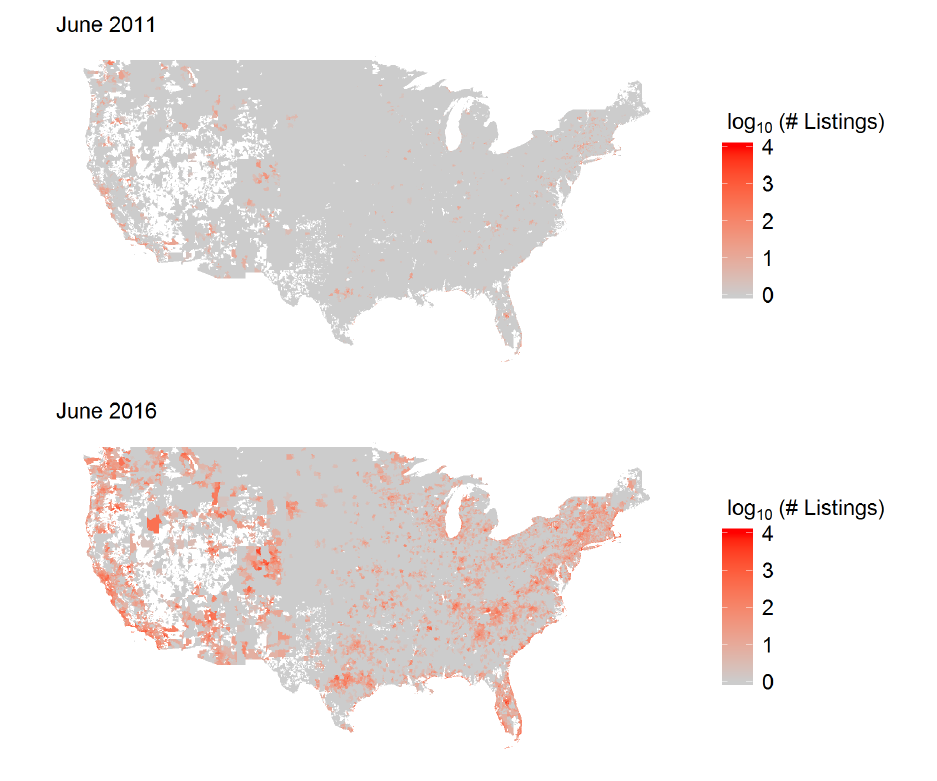

Figure 2 shows the geographic distribution of Airbnb listings in June 2011 and June 2016. The map

shows significant geographic heterogeneity in Airbnb listings with most Airbnb listings occurring in

large cities and along the coasts. Moreover, there exists significant geographic heterogeneity in the

growth of Airbnb over time. From 2011 to 2016, the number of Airbnb listings in some zipcodes

grew by a factor of 30 or more; in others, there was no growth at all. Figure 3 shows the total

number of Airbnb listings over time in our dataset using methods 1-3. Using method 1 as our

preferred method, we observe that from 2011 to 2016, the total number of Airbnb listings grew by

a factor of 30, reaching over 1 million listings in 2016.

Table 2 gives a sense of the size of Airbnb relative to the housing stock at the zipcode level, for

the 100 largest CBSAs by population in our data. Even in 2016, Airbnb remains a small percentage

of the total housing stock for most zipcodes. The median ratio of Airbnb listings to housing stock

is 0.21%, and the 90th percentile is 1.88%. When comparing to the stock of vacant homes, Airbnb

begins to appear more significant. The median ratio of Airbnb listings to vacant homes (either

for long- or short-term rental) is 2.63%, and the 90th percentile is 20%. Perhaps the most salient

comparison—at least from the perspective of a potential renter—is the number of Airbnb listings

relative to the stock of homes listed as vacant and for rent (which are part of the long-term rental

supply). This statistic reaches 13.7% in the median zipcode in 2016 and 129% in the 90th percentile

zipcode. This implies that in the median zipcode, a local resident looking for a long-term rental

unit will find that about 1 in 8 of the potentially available homes are being placed on Airbnb instead

of being made available to long-term residents. Framed in this way, concerns about the effect of

Airbnb on the housing market do not appear unfounded.

5 Methodology

Let Y

ict

be either the price index or the rent index for zipcode i in CBSA c in year-month t, let

Airbnb

ict

be a measure of Airbnb supply, and let oorate

ic,2010

be the owner-occupancy rate in

18

Electronic copy available at: https://ssrn.com/abstract=3006832

2010.

19

We assume the following causal relationship between Y

ict

and Airbnb

ict

:

ln Y

ict

= α + βAirbnb

ict

+ γAirbnb

ict

× oorate

ic,2010

+ X

ict

η +

ict

(1)

where X

ict

is a vector of observed time-varying zipcode characteristics and

ict

contains unobserved

factors that may additionally influence Y

ict

. These factors could include anything that affects the

underlying desirability to live in zipcode i such as changes to local labor market conditions or

changes to local amenities like public school quality. If the unobserved factors are uncorrelated

with Airbnb

ict

, conditional on X

ict

, then we can consistently estimate β and γ by OLS. However,

ict

and Airbnb

ict

may be correlated through unobserved factors at the zipcode, city, and time

levels. We allow

ict

to contain unobserved zipcode level factors δ

i

, and unobserved time-varying

factors that affect all zipcodes within a CBSA equally, θ

ct

. Writing:

ict

= δ

i

+ θ

ct

+ ξ

ict

, Equation

(1) becomes:

ln Y

ict

= α + βAirbnb

ict

+ γAirbnb

ict

× oorate

ic,2010

+ X

ict

η + δ

i

+ θ

ct

+ ξ

ict

. (2)

Even after controlling for unobserved factors at the zipcode and CBSA-year-month level, there

may still be some unobserved zipcode-specific, time-varying factors contained in ξ

ict

that are corre-

lated with Airbnb

ict

. To address this issue, we construct an instrumental variable that is plausibly

uncorrelated with local shocks to the housing market at the zipcode level, ξ

ict

, but likely to affect

the number of Airbnb listings.

Our instrument begins with the worldwide Google Trends search index for the term “airbnb”, g

t

,

which measures the quantity of Google searches for “airbnb” in year-month t. Such trends represent

a measure of the extent to which awareness of Airbnb has diffused to the public, including both

demanders and suppliers of short-term rental housing. Figure 1 plots g

t

from 2008 to 2016, and it

is representative of the explosive growth of Airbnb over the past ten years. Crucially, the search

index is not likely to be reflective of growth in overall tourism demand because it is unlikely to

have changed so much over this relatively short time period. Moreover, it should not be reflective

19

We use the owner-occupancy rate in 2010 to minimize concerns about endogeneity of the owner-occupancy rate.

However, the results are robust to using the contemporaneous owner-occupancy rate as calculated from ACS 5-year

estimates from 2011 to 2016.

19

Electronic copy available at: https://ssrn.com/abstract=3006832

of overall growth in the supply of short-term housing, except to the extent that it is driven by

Airbnb.

20

The CBSA-year-month fixed effects θ

ct

already absorb any unobserved variation at the year-

month level. Therefore, to complete our instrument, we interact g

t

with a measure of how attractive

a zipcode is for tourists in base year 2010, h

i,2010

. We measure “touristiness” using the number of

establishments in the food services and accommodations industry (NAICS code 72) in a specific

zipcode. Zipcodes with more restaurants and hotels may be more attractive to tourists because

these are services that tourists need to consume locally—thus, it matters how many of these services

are near the tourist’s place of stay. Alternatively, the larger number of restaurants and hotels may

reflect an underlying local amenity that tourists value.

For the instrument to have power, potential hosts must be more likely to rent their property

in the short-term market in response to learning about Airbnb. We can verify this assumption

by examining the relationship between Google trends and the difference in Airbnb listings for

more touristy and less touristy zipcodes. Figure 4 shows that such difference increases as Airbnb

awareness increases, confirming our hypothesis.

In order for the instrument to be valid, z

ict

= g

t

× h

i,2010

must be uncorrelated with the

zipcode-specific, time-varying shocks to the housing market, ξ

ict

. This would be true if either

ex-ante touristiness in 2010 (h

i,2010

) is independent of time-varying zipcode level shocks (ξ

ict

) or

growth in worldwide Airbnb searches (g

t

) is independent of the specific timing of those shocks. To

see how our instrument addresses potential confounding factors, consider changes in zipcode level

crime rate as an omitted variable. It is unlikely that changes to crime rates across all zipcodes are

systematically correlated in time with worldwide Airbnb searches. Even if they were, they would

have to correlate in such a way that the correlation is systematically stronger or weaker in more

touristy zipcodes. Moreover, these biases would have to be systematically present within all cities

in our sample. Of course, we cannot rule this possibility out completely. We therefore now turn

to a detailed discussion of the instrument and its validity and present some exercises that suggest

that the exogeneity assumption is likely satisfied.

20

We provide further evidence to this effect in Section 6.2.

20

Electronic copy available at: https://ssrn.com/abstract=3006832

5.1 Discussion: Validity of the instrumental variable

The construction of an instrumental variable using the interaction of a plausibly exogenous time-

series (Google trends) with a potentially endogenous cross-sectional exposure variable (the touristi-

ness measure) is an approach that was popularized by Bartik (1991) and that researchers have

used in many prominent recent papers (Peri, 2012; Dube and Vargas, 2013; Nunn and Qian, 2014;

Hanna and Oliva, 2015; Diamond, 2016).

The approach is popular because one can often argue that some aggregate time trend, which

is exogenous to local conditions, will affect different spatial units systematically along some cross-

sectional exposure variable. In the classic Bartik (1991) example, national trends in industry-

specific productivity are interacted with the historical local industry composition to create an

instrument for local labor demand. Such an instrument will be valid if the interaction of the

aggregate time trend with the exposure variable is independent of the error term. This could

happen if either the time trend is independent of the error term (E[g

t

, ξ

ict

] = 0) or if the exposure

variable is independent of the error term (E[h

i,2010

, ξ

ict

] = 0). While this may seem plausible at

first glance, Christian and Barrett (2017) point out that if there are long-run time trends in the

error term, and if these long-run trends are systematically different along the exposure variable,

then the exogeneity assumption may fail. In our context, a story that may be told is the following.

Suppose there is a long-run trend toward gentrification that leads to higher house prices over time.

Suppose also that the trend of gentrification is higher in more touristy zipcodes. Since there is

also a systematic long-run trend in the time-series variable, g

t

, the instrument g

t

h

i,2010

is no longer

independent of the error term, and 2SLS estimates may reflect the effects of gentrification rather

than home-sharing.

We now proceed to make four arguments for why the exogeneity condition is likely to hold in

our setting.

Parallel pre-trends

As Christian and Barrett (2017) note, the first stage of this instrumental variable approach is anal-

ogous to a difference-in-differences (DD) coefficient estimates. In our case, since the specification

includes year-month and zipcode fixed effects, the variation in the instrument comes from compar-

21

Electronic copy available at: https://ssrn.com/abstract=3006832

ing Airbnb listings between high- and low-Airbnb awareness year-months, and between high- and

low-touristiness zipcodes. Because of this, Christian and Barrett (2017) suggest testing whether

spatial units with different levels of the exposure variable have parallel trends in periods before g

t

takes effect. This is similar to testing whether control and treatment groups have parallel pre-trends

in DD analysis. To do this, we plot the Zillow house price index for zipcodes in different quartiles

of 2010 touristiness (h

i,2010

) from 2009 to the end of 2016.

21

The results are shown in Figure 5.

The figure shows that there are no differential pre-trends in the Zillow Home-Value Index (ZHVI)

for zipcodes in different quartiles of touristiness until after 2012, which also happens to be when

interest in Airbnb began to grow according to Figure 1. This is true both when computing the raw

averages of ZHVI within quartile (top panel) and when computing the average of the residuals after

controlling for zipcode and CBSA-year-month fixed effects (bottom panel). The lack of differential

pre-trends suggests that zipcodes with different levels of touristiness do not generally have different

long-run house price trends, but they only began to diverge after 2012 when Airbnb started to

become well known.

IV has no effect in non-Airbnb zipcodes

To further provide support for the validity of our instrument, we perform another test that consists

of checking whether the instrumental variable predicts house prices and rental rates in zipcodes

that were never observed to have any Airbnb listings. If the instrument is valid, then it should only

be correlated to house prices and rental rates through its effect on Airbnb listings. So, in areas

with no Airbnb, we should not see a positive relationship between the instrument and house prices

and rental rates.

22

To test this, we regress the Zillow rent index and house price index on the instrumental variable

directly, using only data from zipcodes in which we never observed any Airbnb listings. The first

two columns of Table 3 report the results of these regressions and show that, conditional on the

fixed effects and zipcode demographics, we do not find any statistically significant relationship

21

We cannot repeat this exercise with rental rates because Zillow rental price data did not begin until 2011 or

2012 for most zipcodes.

22

This exercise is similar in spirit to an exercise performed by Martin and Yurukoglu (2017) to support the validity

of their instrument. Martin and Yurukoglu (2017) use the channel position of Fox News in the cable line-up as an

instrument for the effect of Fox viewership on Republican voting. They show that the future channel position of Fox

News is not correlated with Republican voting in the time periods before Fox News. This is analogous to us showing

that our instrument is not correlated with house prices and rents in zipcodes without Airbnb.

22

Electronic copy available at: https://ssrn.com/abstract=3006832

between the instrument and house prices/rental rates in zipcodes without Airbnb. If anything, we

find that there is a negative relationship between the instrument and house prices/rental rates in

zipcodes without Airbnb, though the estimates are imprecise and the sample size is considerably

reduced when considering only such zipcodes. By contrast, columns 3-4 of Table 3 show that if we

regress house prices and rental rates directly on the instrument for zipcodes with Airbnb, we find

a positive and statistically significant relationship.

Of course, the sample of zipcodes that never had any Airbnb listings could be fundamentally

different from the sample of zipcodes that did. In columns 1 and 2 of Table 4, we show that the

sample of zipcodes with Airbnb are indeed quite different from the sample of zipcodes without

Airbnb, which are richer and more educated in general. We therefore construct a third sample

of zipcodes with Airbnb, but that are more similar to the sample of zipcodes without Airbnb.

To do so, we use propensity-score matching. Starting with the full sample of zipcodes, we first

estimate a logistic regression at the zipcode level that predicts whether or not a zipcode will

be a non-Airbnb zipcode based on 2010 zipcode demographic characteristics (median household

income, population, college share, and employment rate) and touristiness. For each zipcode that

is observed to have no Airbnb, we find the nearest zipcode in terms of propensity score that

is observed to have some Airbnb entry over the whole 2011-2016 time period. In column 3 of

Table 4, we show that the propensity-score matched sample of zipcodes with Airbnb listings is (as

expected) demographically similar to the non-Airbnb sample (column 1). Columns 5-6 of Table

3 report the results when we regress house prices and rental rates directly on the instrument in

the propensity-score matched sample with Airbnb listings. The direct effect of the instrument is

positive and statistically significant, alleviating concerns that the null effect of the instrument in

the non-Airbnb sample is only because they are poorer and smaller than other zipcodes. Thus,

there does not appear to be any evidence that the instrument would be positively correlated with

house prices/rental rates, except through the effect on Airbnb.

Placebo test

As a final exercise, we follow Christian and Barrett (2017) to implement a form of randomization

inference to test whether the instrument is really exogenous or primarily driven by spurious time

trends. To do so, we keep constant touristiness, Google trends, the identity of zipcodes experiencing

23

Electronic copy available at: https://ssrn.com/abstract=3006832

Airbnb entry, observable time-varying zipcode characteristics, housing market variables, and the

aggregate number of Airbnb listings in any year-month period. However, among the zipcodes with

positive Airbnb listings, we randomly swap the specific number of Airbnb listings across these

zipcodes. For example, we randomly assign to zipcode i the variable Airbnb

jct

(i.e., the Airbnb

counts of zipcode j for CBSA c in time t). The randomized regressor preserves the overall time

trends in the number of Airbnb listings but randomizes the identity of which zipcodes had how

much Airbnb growth and thus eliminates the impact of touristiness on the intensive margin of

Airbnb listings. If the results are primarily driven by a spurious time trends that interacts with

the extensive margin of whether there are any Airbnb listings, then this exercise will produce 2SLS

estimates that continue to be positively and statistically significant. Indeed, in their critique of

the Nunn and Qian (2014) instrument, Christian and Barrett (2017) perform this test and find

positive and statistically significant coefficients even using the randomized regressor. However, if

the effect of touristiness on the intensive margin of Airbnb listings is really what matters, as is our

argument, then the first-stage will become very weak when regressing the randomized regressor

on the instrument, leading to statistically insignificant estimates. Moreover, these estimates will

exhibit extremely large variance due to the weak first stage.

We estimate the 2SLS specification on this dataset for 1,000 draws of randomized allocations

of Airbnb listings among zipcodes that had positive Airbnb listings. We find that the measured

effect of Airbnb is statistically insignificant for over 99% of the randomized draws across our three

dependent variables, i.e., rent index, price index, and price-to-rent ratio, both in the main effect and

the interaction term with owner-occupancy rate. Figure 6 shows the distribution of the estimated

coefficients and the associated t-statistics that we estimate for both the main effect β , for each of the

three dependent variables.

23

As expected, the procedure produces a large variance of estimates that

are statistically insignificant. If spurious time trends were driving our results, we would expect the

Christian and Barrett (2017) procedure to give statistically significant estimates even when using

the randomized regressor.

24

The results of this test are therefore consistent with an instrument

that is exogenous.

23

Results for the interaction terms γ look similar but with a different sign.

24

See Figure 6 in Christian and Barrett (2017). In Appendix A, we discuss the test in greater detail using a Monte

Carlo simulation with both a valid and an invalid instrument and show that the results of this test we obtained with

our instrument are consistent with a valid instrument.

24

Electronic copy available at: https://ssrn.com/abstract=3006832

Taken together, the preceding results paint a strong picture in support of the validity of our

instrument. We will therefore maintain this assumption for now, presenting results as though the

instrument were valid and discuss further threats to identification in Section 6.2.

6 Results

6.1 The effect of Airbnb on house prices and rents

We begin by reporting results in which Airbnb

ict

is measured as the natural log of one plus the

number of listings as measured by method 1 in Table 1.

25

Doing so, we estimate a specification

similar to that used in Zervas et al. (2017) and Farronato and Fradkin (2018) where the authors es-

timate the impact of Airbnb on the hotel industry. Therefore, our estimates represent the elasticity

of our dependent variables with respect to Airbnb supply.

In our main specifications, we consider three dependent variables: the natural log of the Zillow

Rent Index (ZRI), the natural log of the Zillow Home-Value Index (ZHVI), and the natural log of

the price-to-rent ratio (ZHVI/ZRI). In order to maintain our measure of touristiness, h

i,2010

, as a

pre-period variable, we only use data from 2011 to 2016. This time frame covers all of the period of

significant growth in Airbnb (see Figure 3). We also include only data from the 100 largest CBSAs,

as measured by 2010 population.

26

The data is monthly, so we deseasonalize all variables. Since the

regression in Equation 2 has two endogenous regressors (Airbnb

ict

and Airbnb

ict

× oorate

ic,2010

),

we use two instruments for the two-stage least squares estimation (g

t

× h

i,2010

and g

t

× h

i,2010

×

oorate

ic,2010

).

Table 5 reports the regression results when the dependent variable is ln ZRI. Column 1 reports

the results from a simple OLS regression of ln ZRI on ln listings and no controls. Without controls,

a 1% increase in Airbnb listings is associated with a 0.1% increase in rental rates. Column 2 includes

zipcode and CBSA-year-month fixed effects. With the fixed effects, the estimated coefficient on

Airbnb declines by an order of magnitude. Column 3 includes the interaction of Airbnb listings

with the zipcode’s owner-occupancy rate. Column 3 shows the importance of controlling for owner-

25

We add one to the number of listings to avoid taking logs of zero. In Appendix B, we show that our results are

robust to dropping observations with 0 listings and using ln(listings) instead.

26

The 100 largest CBSAs constitute the majority of Airbnb listings (over 80%). In Appendix B, we show that our

results are robust to the inclusion of more CBSAs.

25

Electronic copy available at: https://ssrn.com/abstract=3006832

occupancy rate, as it significantly mediates the effect of Airbnb listings. Column 4 includes time-

varying zipcode level characteristics, including the ln total population, the ln median household

income, the share of 25-60 years old with Bachelors’ degrees or higher, and the employment rate.

Because these measures are not available at a monthly frequency, we linearly interpolate them to the

monthly level using ACS 5-year estimates from 2011 to 2016.

27

Column 4 shows that the results

are robust to the inclusion of these zipcode demographics. Finally, columns 5 and 6 report the

2SLS results using the instrumental variable with and without time-varying zipcode characteristics

as controls. Using the results from column 6 (our preferred specification), we estimate that a 1%

increase in Airbnb listings in zipcodes with the median owner-occupancy rate (72%) leads to a

0.018% increase in rents.The effect of Airbnb is significantly declining in the owner-occupancy rate.

At 56% owner-occupancy rate (the 25th percentile), the effect of a 1% increase in Airbnb listings

is to increase rents by 0.024%, and at 82% owner-occupancy rate (the 75th percentile), the effect

of a 1% increase in Airbnb listings is to increase rents by 0.014%.

Table 6 repeats the regressions with ln ZHVI as the dependent variable. As with the rental

rates, we find that controlling for owner-occupancy rate is very important as the estimated direct

effect of Airbnb listings increases by an order of magnitude when controlling for the interaction vs.

not. Further, including demographic controls still does not affect the results. Using the coefficients

reported in column 6 of Table 6, we estimate that a 1% increase in Airbnb listings leads to a 0.026%

increase in house prices for a zipcode with a median owner-occupancy rate. The effect increases

to 0.037% in zipcodes with an owner-occupancy rate equal to the 25th percentile and decreases to

0.019% in zipcodes with an owner-occupancy rate equal to the 75th percentile.

It is worth noting that in both the rental rate and house price regressions, the 2SLS estimates

(columns 5 and 6 of Tables 5 and 6) are about twice as large as the OLS estimates (columns 3 and 4

of Tables 5and 6). This goes against our initial intuition that omitted factors (such as gentrification)

are most likely to be positively correlated with both Airbnb listings and house prices/rents, thus

creating a positive bias. However, we note that the OLS estimate may also be negatively biased

or biased toward zero for two reasons. First, there may be measurement error in the true amount

of home-sharing, leading to attenuation bias. Measurement error may arise from the fact that we

only estimate the number of Airbnb listings, and we do not know their exact entry and exit, nor do

27

Results are not sensitive to different types of interpolations.

26

Electronic copy available at: https://ssrn.com/abstract=3006832

we know their availability for bookings. Measurement error may also arise from the fact that there

are other home-sharing platforms besides Airbnb that we do not measure.

28

Our estimate for the

number of listings is therefore a noisy measure of the true number of short-term rentals. Second,

simultaneity bias may be negative if higher rental rates in the long-term rental market would cause

a decrease in the number of Airbnb listings, ceteris paribus. This could happen if an increase in the

long-term rental rate causes fewer landlords to choose to supply the short-term market and more

to supply the long-term market.

Finally, Table 7 reports the regression results when ln ZHVI/ZRI is used as the dependent

variable. Column 6 shows that the effect of Airbnb listings on the price-to-rent ratio is positive,

and that, similarly to rents and prices, the effect is declining in owner-occupancy rate. At the

median owner-occupancy rate, a 1% increase in Airbnb listings leads to a statistically significant

0.01% increase in the price-to-rent ratio.

To summarize the results reported in Tables 5-7, we show that: 1) An increase in Airbnb listings

leads to both higher house prices and rental rates, 2) the effect is slightly higher for house prices

than it is for rental rates, and 3) the effect is decreasing in the zipcode’s owner-occupancy rate.

These results are consistent with the hypothesized effects of reallocation discussed in Section 3,

namely that Airbnb causes some landlords to reallocate housing from the long-term rental stock to

the short-term rental stock, pushing up prices and rents in the long-term market, and the effects

are attenuated in areas with more owner-occupiers because owner-occupier usage of Airbnb is less

likely to represent true reallocation. We provide further, more direct evidence of reallocation in

Section 6.4. The finding that the effect of Airbnb on price-to-rent ratio is positive suggests that

home-sharing may have increased homeowners’ option value for utilizing spare capacity. Finally, if

there are negative externalities generated by the use of Airbnb that spill over to house prices and

rental rates, they do not appear to be large enough to override the effects of reallocation.

28

Our results are robust, however, to the inclusion of controls reflecting the popularity of other home-sharing

websites like HomeAway and VRBO. We do so by using Google Trends index, a widely used proxy for demand in

several settings (Choi and Varian, 2012; Ghose, 2009; Li et al., 2016), as a proxy for demand for such platforms. We

report these results in Table 18 of Appendix B.

27

Electronic copy available at: https://ssrn.com/abstract=3006832

6.2 Threats to identification

As in any study using observational data without experimental variation, endogeneity is always a

concern. Even though we conducted a number of exercises in Section 5.1 that support the validity of

the instrument, one might still be concerned that the instrument is picking up spurious correlation.

In this section, we discuss three potential threats to our identification strategy, and provide evidence

that they do not affect our results.

Gentrification One may be concerned that post-2012, touristy and non-touristy zipcodes ex-

perienced differential trends in gentrification or neighborhood change. However, columns 5-6 of

Tables 5-7 show that the main results are unchanged by the inclusion of time-varying zipcode de-

mographic controls. Because the included demographic controls (population, household income,

share of college-educated, and employment rate) are fairly basic measurements of zipcode level eco-