Getting Started in Fixed/Random

Effects Models using R/RStudio

(v. 1.0)

Oscar Torres-Reyna

otorres@princeton.edu

Fall 2010 http://www.princeton.edu/~otorres/

Intro

Panel data (also known as

longitudinal or cross-sectional

time-series data) is a dataset in

which the behavior of entities

are observed across time.

These entities could be states,

companies, individuals,

countries, etc.

Panel data looks like this

country year Y X1 X2 X3

1 2000 6.0 7.8 5.8 1.3

1 2001 4.6 0.6 7.9 7.8

1 2002 9.4 2.1 5.4 1.1

2 2000 9.1 1.3 6.7 4.1

2 2001 8.3 0.9 6.6 5.0

2 2002 0.6 9.8 0.4 7.2

3 2000 9.1 0.2 2.6 6.4

3 2001 4.8 5.9 3.2 6.4

3 2002 9.1 5.2 6.9 2.1

2

For a brief introduction on the theory behind panel data analysis please see the following document:

http://dss.princeton.edu/training/Panel101.pdf

The contents of this document rely heavily on the document:

“Panel Data Econometrics in R: the plm package” http://cran.r-project.org/web/packages/plm/vignettes/plm.pdf

and notes

from the ICPSR’s Summer Program in Quantitative Methods of Social Research (summer 2010)

Exploring panel data

3

library(foreign)

Panel <- read.dta("http://dss.princeton.edu/training/Panel101.dta")

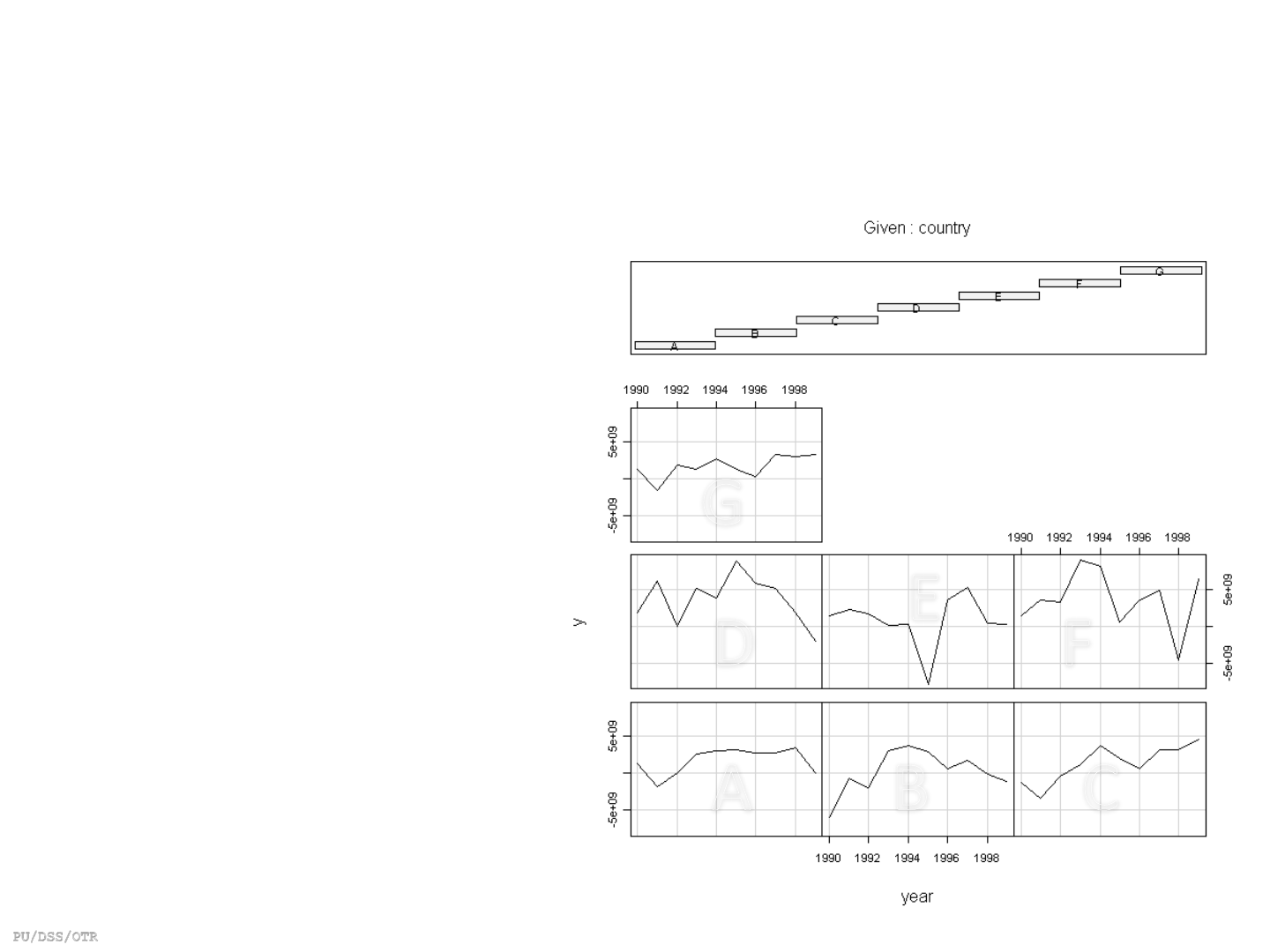

coplot(y ~ year|country, type="l", data=Panel) # Lines

coplot(y ~ year|country, type="b", data=Panel) # Points and lines

# Bars at top indicates corresponding graph (i.e. countries)

from left to right starting on the bottom row

(Muenchen/Hilbe:355)

Exploring panel data

4

library(foreign)

Panel <- read.dta("http://dss.princeton.edu/training/Panel101.dta")

library(car)

scatterplot(y~year|country, boxplots=FALSE, smooth=TRUE, reg.line=FALSE, data=Panel)

FIXED-EFFECTS MODEL

(Covariance Model, Within Estimator,

Individual Dummy Variable Model, Least

Squares Dummy Variable Model)

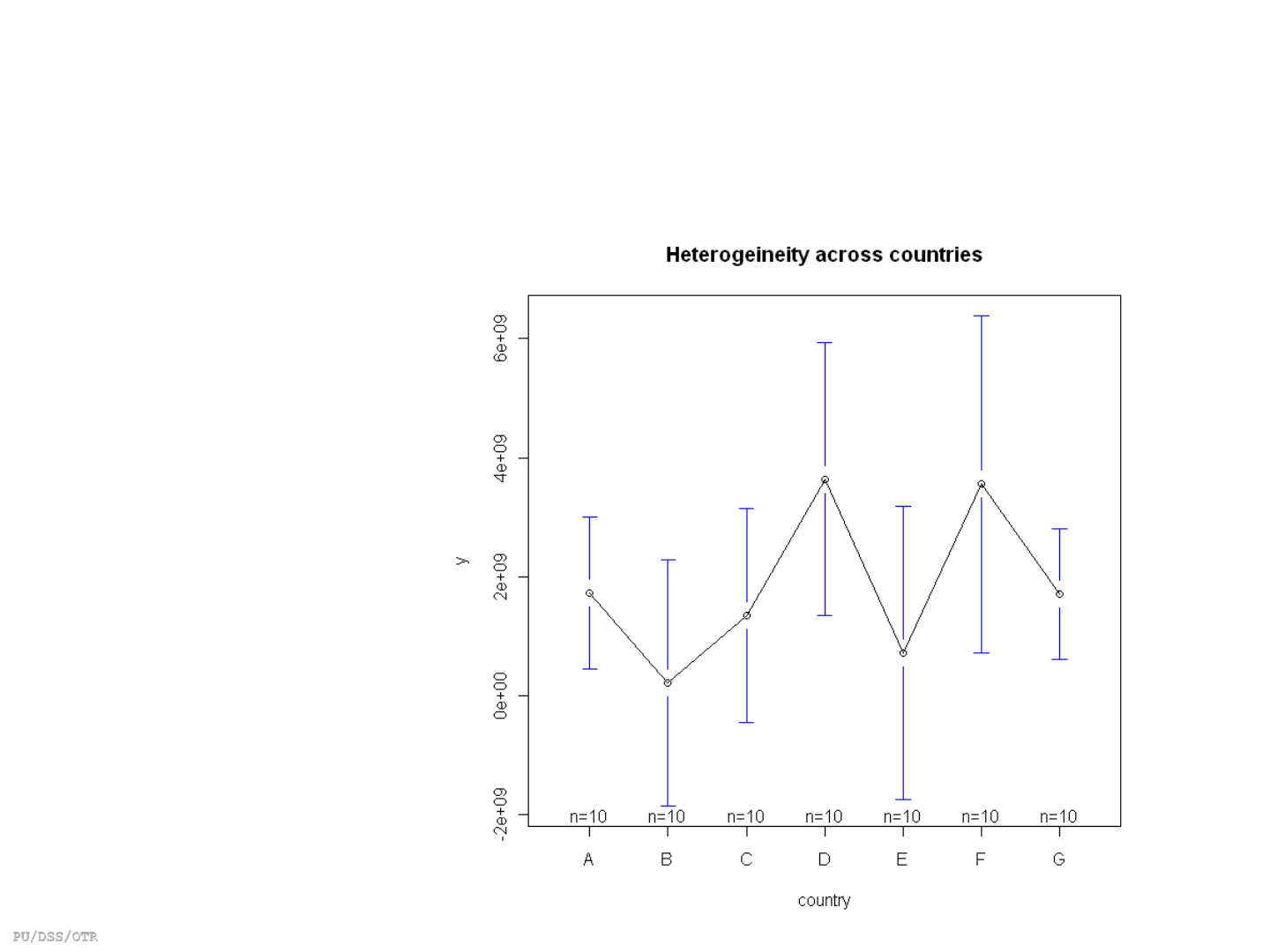

Fixed effects: Heterogeneity across countries (or entities)

library(foreign)

Panel <- read.dta("http://dss.princeton.edu/training/Panel101.dta")

library(gplots)

plotmeans(y ~ country, main="Heterogeineity across countries", data=Panel)

# plotmeans draw a 95%

confidence interval

around the means

detach("package:gplots")

# Remove package ‘gplots’

from the workspace

6

Heterogeneity: unobserved variables that do not change over time

Fixed effects: Heterogeneity across years

library(foreign)

Panel <- read.dta("http://dss.princeton.edu/training/Panel101.dta")

library(gplots)

plotmeans(y ~ year, main="Heterogeineity across years", data=Panel)

# plotmeans draw a 95%

confidence interval

around the means

detach("package:gplots")

# Remove package ‘gplots’

from the workspace

7

Heterogeneity: unobserved variables that do not change over time

OLS regression

8

> library(foreign)

> Panel <- read.dta("http://dss.princeton.edu/training/Panel101.dta")

> ols <-lm(y ~ x1, data=Panel)

> summary(ols)

Call:

lm(formula = y ~ x1, data = Panel)

Residuals:

Min 1Q Median 3Q Max

-9.546e+09 -1.578e+09 1.554e+08 1.422e+09 7.183e+09

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.524e+09 6.211e+08 2.454 0.0167 *

x1 4.950e+08 7.789e+08 0.636 0.5272

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 3.028e+09 on 68 degrees of freedom

Multiple R-squared: 0.005905, Adjusted R-squared: -0.008714

F-statistic: 0.4039 on 1 and 68 DF, p-value: 0.5272

> yhat <- ols$fitted

> plot(Panel$x1, Panel$y, pch=19, xlab="x1", ylab="y")

> abline(lm(Panel$y~Panel$x1),lwd=3, col="red")

Regular OLS regression does

not consider heterogeneity

across groups or time

Fixed effects using Least squares dummy variable model

9

> library(foreign)

>Panel <- read.dta("http://dss.princeton.edu/training/Panel101.dta")

> fixed.dum <-lm(y ~ x1 + factor(country) - 1, data=Panel)

> summary(fixed.dum)

Call:

lm(formula = y ~ x1 + factor(country) - 1, data = Panel)

Residuals:

Min 1Q Median 3Q Max

-8.634e+09 -9.697e+08 5.405e+08 1.386e+09 5.612e+09

Coefficients:

Estimate Std. Error t value Pr(>|t|)

x1 2.476e+09 1.107e+09 2.237 0.02889 *

factor(country)A 8.805e+08 9.618e+08 0.916 0.36347

factor(country)B -1.058e+09 1.051e+09 -1.006 0.31811

factor(country)C -1.723e+09 1.632e+09 -1.056 0.29508

factor(country)D 3.163e+09 9.095e+08 3.478 0.00093 ***

factor(country)E -6.026e+08 1.064e+09 -0.566 0.57329

factor(country)F 2.011e+09 1.123e+09 1.791 0.07821 .

factor(country)G -9.847e+08 1.493e+09 -0.660 0.51190

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 2.796e+09 on 62 degrees of freedom

Multiple R-squared: 0.4402, Adjusted R-squared: 0.368

F-statistic: 6.095 on 8 and 62 DF, p-value: 8.892e-06

For the theory behind fixed effects, please see http://dss.princeton.edu/training/Panel101.pdf

Least squares dummy variable model

10

> yhat <- fixed.dum$fitted

> library(car)

> scatterplot(yhat~Panel$x1|Panel$country, boxplots=FALSE, xlab="x1", ylab="yhat",smooth=FALSE)

> abline(lm(Panel$y~Panel$x1),lwd=3, col="red")

OLS regression

Comparing OLS vs LSDV model

Each component of the factor variable (country) is absorbing the effects particular to each

country. Predictor x1 was not significant in the OLS model, once controlling for differences across

countries, x1 became significant in the OLS_DUM (i.e. LSDV model).

11

> library(apsrtable)

> apsrtable(ols,fixed.dum, model.names = c("OLS", "OLS_DUM")) # Displays a table in Latex form

> cat(apsrtable(ols, fixed.dum, model.names = c("OLS", "OLS_DUM"), Sweave=F), file="ols_fixed1.txt")

# Exports the table to a text file (in Latex code).

\begin{table}[!ht]

\caption{}

\label{}

\begin{tabular}{ l D{.}{.}{2}D{.}{.}{2} }

\hline

& \multicolumn{ 1 }{ c }{ OLS } & \multicolumn{ 1 }{ c }{ OLS_DUM } \\

\hline

% & OLS & OLS_DUM \\

(Intercept) & 1524319070.05 ^* & \\

& (621072623.86) & \\

x1 & 494988913.90 & 2475617827.10 ^*\\

& (778861260.95) & (1106675593.60) \\

factor(country)A & & 880542403.99 \\

& & (961807052.24) \\

factor(country)B & & -1057858363.16 \\

& & (1051067684.19) \\

factor(country)C & & -1722810754.55 \\

& & (1631513751.40) \\

factor(country)D & & 3162826897.32 ^*\\

& & (909459149.66) \\

factor(country)E & & -602622000.33 \\

& & (1064291684.41) \\

factor(country)F & & 2010731793.24 \\

& & (1122809097.35) \\

factor(country)G & & -984717493.45 \\

& & (1492723118.24) \\

$N$ & 70 & 70 \\

$R^2$ & 0.01 & 0.44 \\

adj. $R^2$ & -0.01 & 0.37 \\

Resid. sd & 3028276248.26 & 2795552570.60 \\ \hline

\multicolumn{3}{l}{\footnotesize{Standard errors in parentheses}}\\

\multicolumn{3}{l}{\footnotesize{$^*$ indicates significance at $p< 0.05

$}}

\end{tabular}

\end{table}

The coefficient of x1 indicates how

much Y changes overtime, controlling

by differences in countries, when X

increases by one unit. Notice x1 is

significant in the LSDV model

The coefficient of x1 indicates how

much Y changes when X increases by

one unit. Notice x1 is not significant in

the OLS model

Fixed effects: n entity-specific intercepts (using plm)

> library(plm)

> fixed <- plm(y ~ x1, data=Panel, index=c("country", "year"), model="within")

> summary(fixed)

Oneway (individual) effect Within Model

Call:

plm(formula = y ~ x1, data = Panel, model = "within", index = c("country",

"year"))

Balanced Panel: n=7, T=10, N=70

Residuals :

Min. 1st Qu. Median Mean 3rd Qu. Max.

-8.63e+09 -9.70e+08 5.40e+08 1.81e-10 1.39e+09 5.61e+09

Coefficients :

Estimate Std. Error t-value Pr(>|t|)

x1 2475617827 1106675594 2.237 0.02889 *

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Total Sum of Squares: 5.2364e+20

Residual Sum of Squares: 4.8454e+20

R-Squared : 0.074684

Adj. R-Squared : 0.066148

F-statistic: 5.00411 on 1 and 62 DF, p-value: 0.028892

> fixef(fixed) # Display the fixed effects (constants for each country)

A B C D E F

880542404 -1057858363 -1722810755 3162826897 -602622000 2010731793

G

-984717493

> pFtest(fixed, ols) # Testing for fixed effects, null: OLS better than fixed

F test for individual effects

data: y ~ x1

F = 2.9655, df1 = 6, df2 = 62, p-value = 0.01307

alternative hypothesis: significant effects

Fixed effects option

Outcome

variable

Predictor

variable(s)

Panel setting

n = # of groups/panels, T = # years, N = total # of observations

Pr(>|t|)= Two-tail p-values test the hypothesis that each coefficient

is different from 0. To reject this, the p-value has to be lower than

0.05 (95%, you could choose also an alpha of 0.10), if this is the case

then you can say that the variable has a significant influence on

your dependent variable (y)

If this number is < 0.05 then your model is ok. This is a test

(F) to see whether all the coefficients in the model are

different than zero.

If the p-value is < 0.05 then the fixed effects model is a

better choice

The coeff of

x1 indicates

how much Y

changes

overtime, on

average per

country,

when X

increases by

one unit.

12

RANDOM-EFFECTS MODEL

(Random Intercept, Partial Pooling Model)

Random effects (using plm)

> random <- plm(y ~ x1, data=Panel, index=c("country", "year"), model="random")

> summary(random)

Oneway (individual) effect Random Effect Model

(Swamy-Arora's transformation)

Call:

plm(formula = y ~ x1, data = Panel, model = "random", index = c("country",

"year"))

Balanced Panel: n=7, T=10, N=70

Effects:

var std.dev share

idiosyncratic 7.815e+18 2.796e+09 0.873

individual 1.133e+18 1.065e+09 0.127

theta: 0.3611

Residuals :

Min. 1st Qu. Median Mean 3rd Qu. Max.

-8.94e+09 -1.51e+09 2.82e+08 5.29e-08 1.56e+09 6.63e+09

Coefficients :

Estimate Std. Error t-value Pr(>|t|)

(Intercept) 1037014284 790626206 1.3116 0.1941

x1 1247001782 902145601 1.3823 0.1714

Total Sum of Squares: 5.6595e+20

Residual Sum of Squares: 5.5048e+20

R-Squared : 0.02733

Adj. R-Squared : 0.026549

F-statistic: 1.91065 on 1 and 68 DF, p-value: 0.17141

# Setting as panel data (an alternative way to run the above model

Panel.set <- plm.data(Panel, index = c("country", "year"))

# Random effects using panel setting (same output as above)

random.set <- plm(y ~ x1, data = Panel.set, model="random")

summary(random.set)

Random effects option

Outcome

variable

Predictor

variable(s)

Panel setting

n = # of groups/panels, T = # years, N = total # of observations

Pr(>|t|)= Two-tail p-values test the hypothesis that each coefficient

is different from 0. To reject this, the p-value has to be lower than

0.05 (95%, you could choose also an alpha of 0.10), if this is the case

then you can say that the variable has a significant influence on

your dependent variable (y)

If this number is < 0.05 then your model is ok. This is a test

(F) to see whether all the coefficients in the model are

different than zero.

Interpretation of the

coefficients is tricky

since they include both

the within-entity and

between-entity effects.

In the case of TSCS data

represents the average

effect of X over Y when

X changes across time

and between countries

by one unit.

For the theory behind random effects please see: http://dss.princeton.edu/training/Panel101.pdf

14

FIXED OR RANDOM?

Fixed or Random: Hausman test

To decide between fixed or random effects you can run a Hausman test where the null

hypothesis is that the preferred model is random effects vs. the alternative the fixed

effects (see Green, 2008, chapter 9). It basically tests whether the unique errors (u

i

) are

correlated with the regressors, the null hypothesis is they are not.

Run a fixed effects model and save the estimates, then run a random model and save the

estimates, then perform the test. If the p-value is significant (for example <0.05) then use

fixed effects, if not use random effects.

16

> phtest(fixed, random)

Hausman Test

data: y ~ x1

chisq = 3.674, df = 1, p-value = 0.05527

alternative hypothesis: one model is inconsistent

If this number is < 0.05 then use fixed effects

For the theory behind fixed/random effects please see: http://dss.princeton.edu/training/Panel101.pdf

OTHER TESTS/ DIAGNOSTICS

Testing for time-fixed effects

18

> library(plm)

> fixed <- plm(y ~ x1, data=Panel, index=c("country", "year"),

model="within")

> fixed.time <- plm(y ~ x1 + factor(year), data=Panel, index=c("country",

"year"), model="within")

> summary(fixed.time)

Oneway (individual) effect Within Model

Call:

plm(formula = y ~ x1 + factor(year), data = Panel, model = "within",

index = c("country", "year"))

Balanced Panel: n=7, T=10, N=70

Residuals :

Min. 1st Qu. Median Mean 3rd Qu. Max.

-7.92e+09 -1.05e+09 -1.40e+08 1.48e-07 1.63e+09 5.49e+09

Coefficients :

Estimate Std. Error t-value Pr(>|t|)

x1 1389050354 1319849567 1.0524 0.29738

factor(year)1991 296381559 1503368528 0.1971 0.84447

factor(year)1992 145369666 1547226548 0.0940 0.92550

factor(year)1993 2874386795 1503862554 1.9113 0.06138 .

factor(year)1994 2848156288 1661498927 1.7142 0.09233 .

factor(year)1995 973941306 1567245748 0.6214 0.53698

factor(year)1996 1672812557 1631539254 1.0253 0.30988

factor(year)1997 2991770063 1627062032 1.8388 0.07156 .

factor(year)1998 367463593 1587924445 0.2314 0.81789

factor(year)1999 1258751933 1512397632 0.8323 0.40898

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Total Sum of Squares: 5.2364e+20

Residual Sum of Squares: 4.0201e+20

R-Squared : 0.23229

Adj. R-Squared : 0.17588

F-statistic: 1.60365 on 10 and 53 DF, p-value: 0.13113

> # Testing time-fixed effects. The null is that no time-fixed

effects needed

> pFtest(fixed.time, fixed)

F test for individual effects

data: y ~ x1 + factor(year)

F = 1.209, df1 = 9, df2 = 53, p-value = 0.3094

alternative hypothesis: significant effects

> plmtest(fixed, c("time"), type=("bp"))

Lagrange Multiplier Test - time effects (Breusch-Pagan)

data: y ~ x1

chisq = 0.1653, df = 1, p-value = 0.6843

alternative hypothesis: significant effects

If this number is < 0.05 then

use time-fixed effects. In this

example, no need to use

time-fixed effects.

Testing for random effects: Breusch-Pagan Lagrange multiplier (LM)

The LM test helps you decide between a

random effects regression and a simple OLS

regression.

The null hypothesis in the LM test is that

variances across entities is zero. This is, no

significant difference across units (i.e. no panel

effect).

(http://dss.princeton.edu/training/Panel101.pdf)

19

Here we failed to reject the null and conclude that random effects is not appropriate. This is, no

evidence of significant differences across countries, therefore you can run a simple OLS regression.

> # Regular OLS (pooling model) using plm

>

> pool <- plm(y ~ x1, data=Panel, index=c("country", "year"), model="pooling")

> summary(pool)

Oneway (individual) effect Pooling Model

Call:

plm(formula = y ~ x1, data = Panel, model = "pooling", index = c("country",

"year"))

Balanced Panel: n=7, T=10, N=70

Residuals :

Min. 1st Qu. Median Mean 3rd Qu. Max.

-9.55e+09 -1.58e+09 1.55e+08 1.77e-08 1.42e+09 7.18e+09

Coefficients :

Estimate Std. Error t-value Pr(>|t|)

(Intercept) 1524319070 621072624 2.4543 0.01668 *

x1 494988914 778861261 0.6355 0.52722

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Total Sum of Squares: 6.2729e+20

Residual Sum of Squares: 6.2359e+20

R-Squared : 0.0059046

Adj. R-Squared : 0.0057359

F-statistic: 0.403897 on 1 and 68 DF, p-value: 0.52722

> # Breusch-Pagan Lagrange Multiplier for random effects. Null is no panel effect (i.e. OLS better).

> plmtest(pool, type=c("bp"))

Lagrange Multiplier Test - (Breusch-Pagan)

data: y ~ x1

chisq = 2.6692, df = 1, p-value = 0.1023

alternative hypothesis: significant effects

Testing for cross-sectional dependence/contemporaneous correlation:

using Breusch-Pagan LM test of independence and Pasaran CD test

According to Baltagi, cross-sectional dependence is a problem in macro panels with long time series.

This is not much of a problem in micro panels (few years and large number of cases).

The null hypothesis in the B-P/LM and Pasaran CD tests of independence is that residuals across

entities are not correlated. B-P/LM and Pasaran CD (cross-sectional dependence) tests are used to test

whether the residuals are correlated across entities*. Cross-sectional dependence can lead to bias in

tests results (also called contemporaneous correlation).

20

No cross-sectional dependence

*Source: Hoechle, Daniel, “Robust Standard Errors for Panel Regressions with Cross-Sectional Dependence”,

http://fmwww.bc.edu/repec/bocode/x/xtscc_paper.pdf

> fixed <- plm(y ~ x1, data=Panel, index=c("country", "year"), model="within")

> pcdtest(fixed, test = c("lm"))

Breusch-Pagan LM test for cross-sectional dependence in panels

data: formula

chisq = 28.9143, df = 21, p-value = 0.1161

alternative hypothesis: cross-sectional dependence

> pcdtest(fixed, test = c("cd"))

Pesaran CD test for cross-sectional dependence in panels

data: formula

z = 1.1554, p-value = 0.2479

alternative hypothesis: cross-sectional dependence

Testing for serial correlation

Serial correlation tests apply to macro panels with long time series. Not a problem in micro

panels (with very few years). The null is that there is not serial correlation.

21

No serial correlation

> pbgtest(fixed)

Loading required package: lmtest

Breusch-Godfrey/Wooldridge test for serial correlation in panel models

data: y ~ x1

chisq = 14.1367, df = 10, p-value = 0.1668

alternative hypothesis: serial correlation in idiosyncratic errors

Testing for unit roots/stationarity

22

> Panel.set <- plm.data(Panel, index = c("country", "year"))

> library(tseries)

> adf.test(Panel.set$y, k=2)

Augmented Dickey-Fuller Test

data: Panel.set$y

Dickey-Fuller = -3.9051, Lag order = 2, p-value = 0.01910

alternative hypothesis: stationary

The Dickey-Fuller test to check for stochastic trends. The null hypothesis is that the

series has a unit root (i.e. non-stationary). If unit root is present you can take the first

difference of the variable.

If p-value < 0.05 then no unit roots present.

Testing for heteroskedasticity

The null hypothesis for the Breusch-Pagan test is homoskedasticity.

23

Presence of heteroskedasticity

If hetersokedaticity is detected you can use robust covariance matrix to account for it. See

the following pages.

> library(lmtest)

> bptest(y ~ x1 + factor(country), data = Panel, studentize=F)

Breusch-Pagan test

data: y ~ x1 + factor(country)

BP = 14.6064, df = 7, p-value = 0.04139

Controlling for heteroskedasticity: Robust covariance matrix estimation (Sandwich estimator)

24

The --vcovHC– function estimates three heteroskedasticity-consistent covariance

estimators:

• "white1" - for general heteroskedasticity but no serial correlation. Recommended for

random effects.

• "white2" - is "white1" restricted to a common variance within groups. Recommended

for random effects.

• "arellano" - both heteroskedasticity and serial correlation. Recommended for fixed

effects.

The following options apply*:

• HC0 - heteroskedasticity consistent. The default.

• HC1,HC2, HC3 – Recommended for small samples. HC3 gives less weight to influential

observations.

• HC4 - small samples with influential observations

•

HAC - heteroskedasticity and autocorrelation consistent (type ?vcovHAC for more

details)

See the following pages for examples

For more details see:

• http://cran.r-project.org/web/packages/plm/vignettes/plm.pdf

• http://cran.r-project.org/web/packages/sandwich/vignettes/sandwich.pdf (see page 4)

• Stock and Watson 2006.

• *Kleiber and Zeileis, 2008.

Controlling for heteroskedasticity: Random effects

25

> random <- plm(y ~ x1, data=Panel, index=c("country", "year"), model="random")

> coeftest(random) # Original coefficients

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1037014284 790626206 1.3116 0.1941

x1 1247001782 902145601 1.3823 0.1714

> coeftest(random, vcovHC) # Heteroskedasticity consistent coefficients

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1037014284 907983029 1.1421 0.2574

x1 1247001782 828970247 1.5043 0.1371

> coeftest(random, vcovHC(random, type = "HC3")) # Heteroskedasticity consistent coefficients, type 3

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1037014284 943438284 1.0992 0.2756

x1 1247001782 867137585 1.4381 0.1550

> # The following shows the HC standard errors of the coefficients

> t(sapply(c("HC0", "HC1", "HC2", "HC3", "HC4"), function(x) sqrt(diag(vcovHC(random, type = x)))))

(Intercept) x1

HC0 907983029 828970247

HC1 921238957 841072643

HC2 925403820 847733474

HC3 943438284 867137584

HC4 941376033 866024033

Standard errors given different types of HC.

> fixed <- plm(y ~ x1, data=Panel, index=c("country", "year"), model="within")

> coeftest(fixed) # Original coefficients

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

x1 2475617827 1106675594 2.237 0.02889 *

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

> coeftest(fixed, vcovHC) # Heteroskedasticity consistent coefficients

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

x1 2475617827 1358388942 1.8225 0.07321 .

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

> coeftest(fixed, vcovHC(fixed, method = "arellano")) # Heteroskedasticity consistent coefficients (Arellano)

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

x1 2475617827 1358388942 1.8225 0.07321 .

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

> coeftest(fixed, vcovHC(fixed, type = "HC3")) # Heteroskedasticity consistent coefficients, type 3

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

x1 2475617827 1439083523 1.7203 0.09037 .

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

> # The following shows the HC standard errors of the coefficients

> t(sapply(c("HC0", "HC1", "HC2", "HC3", "HC4"), function(x) sqrt(diag(vcovHC(fixed, type = x)))))

HC0.x1 HC1.x1 HC2.x1 HC3.x1 HC4.x1

[1,] 1358388942 1368196931 1397037369 1439083523 1522166034

Controlling for heteroskedasticity:

Fixed effects

26

Standard errors given different types of HC.

References/Useful links

• DSS Online Training Section http://dss.princeton.edu/training/

• Princeton DSS Libguides http://libguides.princeton.edu/dss

• John Fox’s site http://socserv.mcmaster.ca/jfox/

• Quick-R http://www.statmethods.net/

• UCLA Resources to learn and use R http://www.ats.ucla.edu/stat/R/

• UCLA Resources to learn and use Stata http://www.ats.ucla.edu/stat/stata/

• DSS - Stata http://dss/online_help/stats_packages/stata/

• DSS - R http://dss.princeton.edu/online_help/stats_packages/r

• Panel Data Econometrics in R: the plm package http://cran.r-project.org/web/packages/plm/vignettes/plm.pdf

• Econometric Computing with HC and HAC Covariance Matrix Estimators

http://cran.r-project.org/web/packages/sandwich/vignettes/sandwich.pdf

27

References/Recommended books

• An R Companion to Applied Regression, Second Edition / John Fox , Sanford Weisberg, Sage Publications, 2011

• Data Manipulation with R / Phil Spector, Springer, 2008

• Applied Econometrics with R / Christian Kleiber, Achim Zeileis, Springer, 2008

• Introductory Statistics with R / Peter Dalgaard, Springer, 2008

• Complex Surveys. A guide to Analysis Using R / Thomas Lumley, Wiley, 2010

• Applied Regression Analysis and Generalized Linear Models / John Fox, Sage, 2008

• R for Stata Users / Robert A. Muenchen, Joseph Hilbe, Springer, 2010

• Introduction to econometrics / James H. Stock, Mark W. Watson. 2nd ed., Boston: Pearson Addison Wesley,

2007.

• Data analysis using regression and multilevel/hierarchical models / Andrew Gelman, Jennifer Hill. Cambridge ;

New York : Cambridge University Press, 2007.

• Econometric analysis / William H. Greene. 6th ed., Upper Saddle River, N.J. : Prentice Hall, 2008.

• Designing Social Inquiry: Scientific Inference in Qualitative Research / Gary King, Robert O. Keohane, Sidney

Verba, Princeton University Press, 1994.

• Unifying Political Methodology: The Likelihood Theory of Statistical Inference / Gary King, Cambridge University

Press, 1989

• Statistical Analysis: an interdisciplinary introduction to univariate & multivariate methods / Sam

Kachigan, New York : Radius Press, c1986

• Statistics with Stata (updated for version 9) / Lawrence Hamilton, Thomson Books/Cole, 2006

28