Userid: CPM Schema:

instrx

Leadpct: 100% Pt. size: 10

Draft Ok to Print

AH XSL/XML

Fileid: … ns/i5471/202401/a/xml/cycle08/source (Init. & Date) _______

Page 1 of 52 7:44 - 25-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Instructions for Form 5471

(Rev. January 2024)

(Use with the December 2023 revision of Form 5471 and separate Schedules G-1

and Q; the December 2021 revision of separate Schedules E, H, I-1, and M; the

December 2020 revision of separate Schedules J, P, and R; and the December 2012

revision of separate Schedule O.)

Information Return of U.S. Persons

With Respect to Certain Foreign Corporations

Department of the Treasury

Internal Revenue Service

Section references are to the Internal

Revenue Code unless otherwise noted.

Contents Page

Future Developments ............1

What’s New ..................1

General Instructions .............1

Purpose of Form ...............1

Who Must File ................1

When and Where To File ..........2

Categories of Filers .............2

Additional Filing Requirements ......7

Penalties ....................8

Other Reporting Requirements ......8

Specific Instructions .............9

Schedule B ................. 12

Schedule C ................. 13

Schedule F ................. 13

Schedule G ................. 13

Schedule I .................. 19

Instructions for Separate

Schedules ............... 29

Schedule E ................. 29

Schedule E-1 ................ 32

Schedule G-1 ................ 34

Schedule H ................. 35

Schedule I-1 ................ 37

Schedule J ................. 39

Schedule M ................. 42

Schedule O ................. 43

Schedule P ................. 43

Schedule Q ................. 44

Schedule R ................. 48

Principal Business Activity Codes ... 50

Future Developments

For the latest information about

developments related to Form 5471,

its schedules, and its instructions,

such as legislation enacted after they

were published, go to

IRS.gov/

Form5471.

What’s New

Changes to Form 5471. On page 1

of the form, new line 1b(3) requests

the previous reference ID number(s)

of the foreign corporation, if any.

On page 5 of the form, the question

on Schedule G, line 18, has been

deleted and replaced with new

questions 18a and 18b to better

reflect Regulations section 1.482-2(a)

(2)(iii)(B).

On page 5, the question on

Schedule G, line 19a, has been

reworded to better reflect Regulations

section 1.385-3. As a result, the

information requested on line 19b(1)

has also been reworded.

Changes to separate Sched-

ule G-1. Line 6b was reworded to

better reflect Regulations section

1.482-7A.

Changes to separate Schedule Q.

On page 1 of the schedule, line 1f now

requests “Other Foreign Personal

Holding Company Income.” Filers are

directed to see the instructions for an

attachment requirement for line 1f.

On page 4 of the schedule, the

following lines have been shaded

under column (xv), Loss Allocation.

•

Lines 3, 3(1), and 3(2), pertaining to

the Tested Income Group.

•

Lines 4, 4(1), and 4(2), pertaining to

the Residual Income Group.

Changes to these instructions.

These instructions have been updated

for the aforementioned changes to

Form 5471 and separate Schedule Q.

No changes were needed to the

instructions for separate

Schedule G-1.

In addition, the following changes

have been made.

The table of questions for Form

5471, Schedule G, line 14, has been

amended as follows. If the answer to

question 22 of that table is “Yes,” for

tax year 2023, affected Form 5471

filers will enter code “PRS” on Form

5471, Schedule G, line 14. For tax

year 2022, affected Form 5471 filers

entered “XX” on Form 5471,

Schedule G, line 14, if the answer to

question 22 of the table in the

instructions was “Yes.”

Worksheet A, lines 23 and 25, were

revised to add a reference to section

961(c).

Worksheet A, lines 28 and 31, were

amended.

Worksheet A, line 58, was revised

to more accurately reflect Regulations

section 1.951-1(b)(1)(ii)(A).

The instructions for Worksheet A,

line 1a, were clarified by adding a

reference to the limitation on section

954(c)(6) in Regulations section

1.245A-5.

A new instruction for Worksheet A,

lines 13b, 13d, 13e, 14b, 15b, 16b,

18b, and 19b, was added regarding

allocation and apportionment of

expenses to better reflect Regulations

section 1.954-1(c)(1)(i), (ii), and (iv).

A new Worksheet H-1 has been

added to these instructions. Also, new

Worksheet H-1 Instructions have been

provided.

In the instructions for separate

Schedule Q, line 1, the attachment

requirement for line 1f has been

clarified.

General Instructions

Purpose of Form

Form 5471 is used by certain U.S.

persons who are officers, directors, or

shareholders in certain foreign

corporations. The form and schedules

are used to satisfy the reporting

requirements of sections 6038 and

6046, and the related regulations.

Who Must File

Generally, all U.S. persons described

in Categories of Filers below must

Jan 25, 2024

Cat. No. 49959G

Page 2 of 52 Fileid: … ns/i5471/202401/a/xml/cycle08/source 7:44 - 25-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

complete the schedules, statements,

and/or other information requested in

the chart, Filing Requirements for

Categories of Filers, later. Read the

information for each category carefully

to determine which schedules,

statements, and/or information apply.

Note. When a schedule is required

but all amounts are zero, the schedule

should still be filed with one or more

zero amounts. For schedules that are

completed by category (that is,

Schedules E, I-1, J, P, and Q),

inclusion of a single instance of that

schedule for any separate category

will meet the requirement.

If the filer is described in more than

one filing category, do not duplicate

information. However, complete all

items that apply. For example, if you

are the sole owner of a CFC (that is,

you are described in Categories 4 and

5a), complete all six pages of Form

5471 and separate Schedules E, G-1,

H, I-1, J, M, P, Q, and R.

Note. Complete a separate Form

5471 and all applicable schedules for

each applicable foreign corporation.

When and Where To File

Attach Form 5471 to your income tax

return (or, if applicable, partnership or

exempt organization return) and file

both by the due date (including

extensions) for that return.

Categories of Filers

Category 1 Filers

In general, a Category 1 filer is a

person who was a U.S. shareholder of

a foreign corporation that was a

section 965 specified foreign

corporation (SFC) at any time during

the foreign corporation’s tax year

ending with or within the U.S.

shareholder’s tax year, and who

owned that stock on the last day in

that year in which the foreign

corporation was a section 965 SFC,

taking into account the regulations

under section 965. There are three

different types of Category 1 filers,

each described below: Category 1a

filers, Category 1b filers, and

Category 1c filers.

Except as otherwise provided in the

instructions for each type of Category

1 filer below, the following definitions

apply for purposes of Category 1.

U.S. shareholder.

For purposes of

Category 1, a U.S. shareholder is a

U.S. person who owns (directly,

indirectly, or constructively, within the

meaning of section 958(a) and (b))

10% or more of the total combined

voting power or value of shares of all

classes of stock of a section 965 SFC.

See section 951(b).

U.S. person. For purposes of

Category 1, a U.S. person is:

1. A citizen or resident of the

United States;

2. A domestic partnership;

3. A domestic corporation; or

4. An estate or trust that is not a

foreign estate or trust, as defined in

section 7701(a)(31).

See section 957(c) for exceptions.

Section 965 SFC. For purposes of

Category 1, a section 965 SFC is:

1. A controlled foreign corporation

(CFC) (see Category 5 Filers, later, for

definition); or

2. Any foreign corporation with

respect to which one or more

domestic corporations are U.S.

shareholders.

However, if a passive foreign

investment company (PFIC) (as

defined in section 1297) with respect

to the shareholder is not a CFC, then

such corporation is not a section 965

SFC.

See section 965 and the

regulations thereunder for exceptions.

Category 1a Filer

A Category 1a filer is a Category 1

filer that is not a Category 1b or 1c

filer.

Category 1b Filer

A Category 1b filer is a person who is

an unrelated section 958(a) U.S.

shareholder (defined below) of a

foreign-controlled section 965 SFC

(defined below). This type of Category

1 filer extends the relief for certain

Category 5 filers announced in

section 8.02 of

Rev. Proc. 2019-40,

2019-43 I.R.B. 982, to similarly

situated Category 1 filers.

Unrelated section 958(a) U.S.

shareholder. For purposes of

Category 1b, an unrelated section

958(a) U.S. shareholder is a U.S.

shareholder with respect to a

foreign-controlled section 965 SFC

who:

1. Owns, within the meaning of

section 958(a), stock of a

foreign-controlled section 965 SFC;

and

2. Is not related (using principles

of section 954(d)(3)) to the

foreign-controlled section 965 SFC.

Foreign-controlled section 965

SFC. For purposes of Category 1b, a

foreign-controlled section 965 SFC is

a foreign corporation that is a section

965 SFC that would not be a section

965 SFC if the determination were

made without applying subparagraphs

(A), (B), and (C) of section 318(a)(3)

so as to consider a U.S. person as

owning stock that is owned by a

foreign person.

Category 1c Filer

A Category 1c filer is a person who is

a related constructive U.S.

shareholder (defined below) of a

foreign-controlled section 965 SFC

(defined below). This type of Category

1 filer extends the relief for certain

Category 5 filers announced in

section 8.03 of

Rev. Proc. 2019-40,

2019-43 I.R.B. 982, to similarly

situated Category 1 filers.

Related constructive U.S. share-

holder. For purposes of Category 1c,

a related constructive U.S.

shareholder is a U.S. shareholder with

respect to a foreign-controlled section

965 SFC who:

1. Does not own, within the

meaning of section 958(a), stock of

the foreign-controlled section 965

SFC; and

2. Is related (using principles of

section 954(d)(3)) to the

foreign-controlled section 965 SFC.

Foreign-controlled section 965

SFC. For purposes of Category 1c,

the term “foreign-controlled section

965 SFC” has the same meaning as

provided under Category 1b Filer,

earlier.

Additional Information for

Category 1 Filers

When Category 1 reporting is no

longer required. A Category 1 filer

must continue to file all information

required as long as:

2

Instructions for Form 5471 (Rev. 01-2024)

Page 3 of 52 Fileid: … ns/i5471/202401/a/xml/cycle08/source 7:44 - 25-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

•

The section 965 SFC (or

foreign-controlled section 965 SFC)

has accumulated earnings and profits

(E&P) related to section 965 that is

reportable on Schedule J (Form

5471), or

•

The Category 1 filer has previously

taxed E&P related to section 965 that

is reportable on Schedule P (Form

5471).

Category 1 Filers—Exceptions

From Filing

Certain constructive owners.

•

A Category 1 filer does not have to

file Form 5471 if all of the following

conditions are met.

1. The Category 1 filer does not

own a direct interest in the foreign

corporation.

2. The Category 1 filer is required

to furnish the information requested

solely because of constructive

ownership (as determined under

Regulations section 1.958-2,

1.6038-2(c), or 1.6046-1(i)) from

another U.S. person.

3. The U.S. person through which

the Category 1 filer constructively

owns an interest in the foreign

corporation files Form 5471 to report

all of the information required of the

Category 1 filer.

•

A Category 1 filer does not have to

file Form 5471 if it:

1. Does not own a direct or

indirect interest in the foreign

corporation, and

2. Is required to file Form 5471

solely because of constructive

ownership from a nonresident alien.

No statement is required to be

attached to the tax return of a

Category 1 filer claiming either

constructive ownership exception.

See Regulations section 1.6038-2(j)

(2) and (3), and Regulations section

1.6038-2(l) for additional information.

No section 958(a) U.S. sharehold-

er. A Category 1 filer does not have to

file Form 5471 if no U.S. shareholder

(including the Category 1 filer) owns,

within the meaning of section 958(a),

stock in the section 965 SFC on the

last day in the year of the foreign

corporation in which it was a section

965 SFC and the SFC is a

foreign-controlled section 965 SFC.

This exception extends the relief for

Category 5 filers announced in

section 5.02 of

Notice 2018-13,

2018-6 I.R.B. 341, to similarly situated

Category 1 filers.

Unrelated constructive U.S. share-

holder. A Category 1 filer does not

have to file Form 5471 if all of the

following conditions are met.

1. The foreign corporation is a

foreign-controlled section 965 SFC.

2. The Category 1 filer is a U.S.

shareholder that does not own stock,

within the meaning of section 958(a),

in the foreign-controlled section 965

SFC.

3. The Category 1 filer is not

related, using principles of section

954(d)(3), to the foreign-controlled

section 965 SFC.

This exception implements the

relief for certain Category 5 filers

announced in section 8.04 of

Rev.

Proc. 2019-40, 2019-43 I.R.B. 982,

and extends it to Category 1 filers.

Other filing exceptions. Certain

other filing exceptions apply to all

categories of filers. See

Additional

Filing Exceptions, later.

Category 2 Filer

This category includes a U.S. citizen

or resident who is an officer or director

of a foreign corporation in which a

U.S. person (defined below) has

acquired (in one or more

transactions):

1. Stock that meets the 10% stock

ownership requirement (defined

below) with respect to the foreign

corporation, or

2. An additional 10% or more (in

value or voting power) of the

outstanding stock of the foreign

corporation.

A U.S. person has acquired stock

in a foreign corporation when that

person has an unqualified right to

receive the stock, even though the

stock is not actually issued. See

Regulations section 1.6046-1(c) and

(f)(1) for more details.

10% stock ownership requirement.

For purposes of Category 2, the stock

ownership threshold is met if a U.S.

person owns:

1. 10% or more of the total value

of the foreign corporation's stock, or

2. 10% or more of the total

combined voting power of all classes

of stock with voting rights.

See Regulations section

1.6046-1(i) for additional information.

U.S. person. For purposes of

Category 2, a U.S. person is:

1. A citizen or resident of the

United States;

2. A domestic partnership;

3. A domestic corporation; or

4. An estate or trust that is not a

foreign estate or trust, as defined in

section 7701(a)(31).

See Regulations section

1.6046-1(f)(3) for exceptions.

Additional Information for

Category 2 Filers

Foreign sales corporations (FSCs).

Category 2 filers who are

shareholders, officers, and directors

of an FSC (as defined in section 922,

as in effect before its repeal) must file

Form 5471 and a separate

Schedule O to report changes in the

ownership of the FSC.

Category 2 Filers—Exceptions

From Filing

A Category 2 filer does not have to file

Form 5471 if:

1. Immediately after a reportable

stock acquisition, three or fewer U.S.

persons own 95% or more in value of

the outstanding stock of the foreign

corporation and the U.S. person

making the acquisition files a return

for the acquisition as a Category 3

filer; or

2. The U.S. person(s) for which

the Category 2 filer is required to file

Form 5471 does not directly own an

interest in the foreign corporation but

is required to furnish the information

solely because of constructive stock

ownership from a U.S. person and the

person from whom the stock

ownership is attributed furnishes all of

the information required of the

Category 2 filer.

Other filing exceptions. Certain

other filing exceptions apply to all

categories of filers. See Additional

Filing Exceptions, later.

Category 3 Filer

This category includes:

1. A U.S. person (defined below)

who acquires stock in a foreign

corporation which, when added to any

stock owned on the date of

Instructions for Form 5471 (Rev. 01-2024)

3

Page 4 of 52 Fileid: … ns/i5471/202401/a/xml/cycle08/source 7:44 - 25-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

acquisition, meets the 10% stock

ownership requirement (defined

below) with respect to the foreign

corporation;

2. A U.S. person who acquires

stock which, without regard to stock

already owned on the date of

acquisition, meets the 10% stock

ownership requirement with respect to

the foreign corporation;

3. A person who is treated as a

U.S. shareholder under section 953(c)

with respect to the foreign corporation;

4. A person who becomes a U.S.

person while meeting the 10% stock

ownership requirement with respect to

the foreign corporation; or

5. A U.S. person who disposes of

sufficient stock in the foreign

corporation to reduce his or her

interest to less than the 10% stock

ownership requirement.

For more information, see section

6046 and Regulations section

1.6046-1.

10% stock ownership requirement.

For purposes of Category 3, the stock

ownership threshold is met if a U.S.

person owns:

1. 10% or more of the total value

of the foreign corporation's stock, or

2. 10% or more of the total

combined voting power of all classes

of stock with voting rights.

See Regulations section

1.6046-1(i) for additional information.

U.S. person. For purposes of

Category 3, a U.S. person is:

1. A citizen or resident of the

United States;

2. A domestic partnership;

3. A domestic corporation; or

4. An estate or trust that is not a

foreign estate or trust, as defined in

section 7701(a)(31).

See Regulations section

1.6046-1(f)(3) for exceptions.

Additional Information for

Category 3 Filers

Statement required. Category 3

filers must attach a statement that

includes:

1. The amount and type of any

indebtedness the foreign corporation

has with the related persons

described in Regulations section

1.6046-1(b)(11), and

2.

The name, address, identifying

number, and number of shares

subscribed to by each suscriber to the

foreign corporation's stock.

Foreign sales corporations (FSCs).

Category 3 filers who are

shareholders, officers, and directors

of an FSC (as defined in section 922,

as in effect before its repeal) must file

Form 5471 and a separate

Schedule O to report changes in the

ownership of the FSC.

Category 3 Filers—Exception

From Filing

A Category 3 filer does not have to

file Form 5471 if all of the following

conditions are met.

1. The Category 3 filer does not

own a direct interest in the foreign

corporation.

2. The Category 3 filer is required

to furnish the information requested

solely because of constructive

ownership (as determined under

Regulations section 1.958-2,

1.6038-2(c), or 1.6046-1(i)) from

another U.S. person.

3. The U.S. person through which

the Category 3 filer constructively

owns an interest in the foreign

corporation files Form 5471 to report

all of the information required of the

Category 3 filer.

No statement is required to be

attached to tax returns for persons

claiming this constructive ownership

exception.

Other filing exceptions. Certain

other filing exceptions apply to all

categories of filers. See Additional

Filing Exceptions, later.

Category 4 Filer

This category includes a U.S. person

(defined below) who had control

(defined below) of a foreign

corporation during the annual

accounting period of the foreign

corporation.

U.S. person. For purposes of

Category 4, a U.S. person is:

1. A citizen or resident of the

United States;

2. A nonresident alien for whom an

election is in effect under section

6013(g) to be treated as a resident of

the United States;

3. An individual for whom an

election is in effect under section

6013(h), relating to nonresident aliens

who become residents of the United

States during the tax year and are

married at the close of the tax year to

a citizen or resident of the United

States;

4. A domestic partnership;

5. A domestic corporation; and

6. An estate or trust that is not a

foreign estate or trust, as defined in

section 7701(a)(31).

See Regulations section

1.6038-2(d) for exceptions.

Control. For purposes of Category 4,

a U.S. person has control of a foreign

corporation if, at any time during that

person's tax year, it owns stock

possessing:

1. More than 50% of the total

combined voting power of all classes

of stock of the foreign corporation

entitled to vote, or

2. More than 50% of the total

value of shares of all classes of stock

of the foreign corporation.

For purposes of Category 4, a

person in control of a corporation that,

in turn, owns more than 50% of the

combined voting power, or the value,

of all classes of stock of another

corporation is also treated as being in

control of such other corporation.

Example. Corporation A owns

51% of the voting stock in Corporation

B. Corporation B owns 51% of the

voting stock in Corporation C.

Corporation C owns 51% of the voting

stock in Corporation D. Therefore,

Corporation D is controlled by

Corporation A.

For more details on “control” for

purposes of Category 4, see section

6038(e)(2) and Regulations section

1.6038-2(b) and (c).

Additional Information for

Category 4 Filers

Foreign sales corporations (FSCs).

•

Category 4 filers who are

shareholders of an FSC are not

subject to the subpart F rules with

respect to the FSC for:

1. Exempt foreign trade income;

2. Deductions that are

apportioned or allocated to exempt

foreign trade income;

3. Nonexempt foreign trade

income (other than section 923(a)(2)

nonexempt income, within the

4

Instructions for Form 5471 (Rev. 01-2024)

Page 5 of 52 Fileid: … ns/i5471/202401/a/xml/cycle08/source 7:44 - 25-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

meaning of section 927(d)(6), as in

effect before repeal); and

4. Any deductions that are

apportioned or allocated to the

nonexempt foreign trade income

described above.

•

Category 4 filers who are

shareholders of an FSC are subject to

the subpart F rules for:

1. All other types of FSC income

(including section 923(a)(2)

nonexempt income within the

meaning of section 927(d)(6), as in

effect before its repeal);

2. Investment income and carrying

charges (as defined in section 927(c)

and (d)(1), as in effect before its

repeal); and

3. All other FSC income that is not

foreign trade income or investment

income or carrying charges.

Category 4 Filers—Exceptions

From Filing

Certain constructive owners.

•

A Category 4 filer does not have to

file Form 5471 if all of the following

conditions are met.

1. The Category 4 filer does not

own a direct interest in the foreign

corporation.

2. The Category 4 filer is required

to furnish the information requested

solely because of constructive

ownership (as determined under

Regulations section 1.958-2,

1.6038-2(c), or 1.6046-1(i)) from

another U.S. person.

3. The U.S. person through which

the Category 4 filer constructively

owns an interest in the foreign

corporation files Form 5471 to report

all of the information required of the

Category 4 filer.

•

A Category 4 filer does not have to

file Form 5471 if it:

1. Does not own a direct or

indirect interest in the foreign

corporation, and

2. Is required to file Form 5471

solely because of constructive

ownership from a nonresident alien.

No statement is required to be

attached to the tax return of a

Category 4 filer claiming either

constructive ownership exception.

See Regulations section 1.6038-2(j)

(2) and (3), and Regulations section

1.6038-2(l) for additional information.

FSCs.

Category 4 filers are not

required to file a Form 5471 (in order

to satisfy the requirements of section

6038) if the FSC has filed a Form

1120-FSC. See Temporary

Regulations section 1.921-1T(b)(3).

However, these filers are required to

file Form 5471 for an FSC, regardless

of whether it has filed Form

1120-FSC, if the filer has inclusions

with respect to the FSC under section

951(a) (as described above).

Other filing exceptions. Certain

other filing exceptions apply to all

categories of filers. See

Additional

Filing Exceptions, later.

Category 5 Filers

In general, a Category 5 filer is a

person who was a U.S. shareholder

(defined below) that owned stock in a

foreign corporation that was a CFC

(defined below) at any time during the

foreign corporation’s tax year ending

with or within the U.S. shareholder’s

tax year, and who owned that stock on

the last day in that year in which the

foreign corporation was a CFC. There

are three different types of Category 5

filers, each described below:

Category 5a filers, Category 5b filers,

and Category 5c filers.

Except as otherwise provided in the

instructions for each type of Category

5 filer below, the following definitions

apply for purposes of Category 5.

U.S. shareholder. For purposes of

Category 5, a U.S. shareholder is a

U.S. person (defined below) who:

1. Owns (directly, indirectly, or

constructively, within the meaning of

section 958(a) and (b)) 10% or more

of the total combined voting power or

value of shares of all classes of stock

of a CFC; or

2. Owns (either directly or

indirectly, within the meaning of

section 958(a)) any stock of a CFC

(as defined in sections 953(c)(1)(B)

and 957(b)), unless the foreign

corporation has an effective section

953(c)(3)(C) election in place for the

tax year.

U.S. person. For purposes of

Category 5, a U.S. person is:

1. A citizen or resident of the

United States;

2. A domestic partnership;

3. A domestic corporation; or

4.

An estate or trust that is not a

foreign estate or trust, as defined in

section 7701(a)(31).

See section 957(c) for exceptions.

In general, a CFC is a foreign

corporation that has U.S.

shareholders that own (directly,

indirectly, or constructively, within the

meaning of section 958(a) and (b)) on

any day of the tax year of the foreign

corporation, more than 50% of:

1. The total combined voting

power of all classes of its voting stock,

or

2. The total value of the stock of

the corporation.

For purposes only of taking into

account income described in section

953(a) (relating to insurance income),

a CFC also includes a foreign

corporation that is described in

section 957(b); and for purposes only

of taking into account related person

insurance income, a CFC includes a

foreign corporation described in

section 953(c)(1)(B).

Category 5a Filer

A Category 5a filer is a Category 5

filer that is not a Category 5b or 5c

filer.

Category 5b Filer

A person is a Category 5b filer if they

are an unrelated section 958(a) U.S.

shareholder (defined below) of a

foreign-controlled CFC (defined

below). This type of Category 5 filer

implements the relief for certain

Category 5 filers announced in

section 8.02 of

Rev. Proc. 2019-40,

2019-43 I.R.B. 982.

Unrelated section 958(a) U.S.

shareholder. For purposes of

Category 5b, an unrelated section

958(a) U.S. shareholder is a U.S.

shareholder with respect to a

foreign-controlled CFC who:

1. Owns, within the meaning of

section 958(a), stock of a

foreign-controlled CFC; and

2. Is not related (using principles

of section 954(d)(3)) to the

foreign-controlled CFC.

Foreign-controlled CFC. For

purposes of Category 5b, a

foreign-controlled CFC is a foreign

corporation that is a CFC that would

Instructions for Form 5471 (Rev. 01-2024)

5

Page 6 of 52 Fileid: … ns/i5471/202401/a/xml/cycle08/source 7:44 - 25-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

not be a CFC if the determination

were made without applying

subparagraphs (A), (B), and (C) of

section 318(a)(3) so as to consider a

U.S. person as owning stock that is

owned by a foreign person.

Category 5c Filer

A person is a Category 5c filer if they

are a related constructive U.S.

shareholder (defined below) of a

foreign-controlled CFC (defined

below). This type of Category 5 filer

implements the relief for certain

Category 5 filers announced in

section 8.03 of Rev. Proc. 2019-40,

2019-43 I.R.B. 982.

Related constructive U.S. share-

holder. For purposes of Category 5c,

a related constructive U.S.

shareholder is a U.S. shareholder with

respect to a foreign-controlled CFC

who:

1. Does not own, within the

meaning of section 958(a), stock of

the foreign-controlled CFC; and

2. Is related (using principles of

section 954(d)(3)) to the

foreign-controlled CFC.

Foreign-controlled CFC. For

purposes of Category 5c, the term

“foreign-controlled CFC” has the same

meaning as defined in

Category 5b

Filer, earlier.

Additional Information for

Category 5 Filers

Foreign sales corporations (FSCs).

•

Category 5 filers who are

shareholders of an FSC are not

subject to the subpart F rules with

respect to the FSC for:

1. Exempt foreign trade income;

2. Deductions that are

apportioned or allocated to exempt

foreign trade income;

3. Nonexempt foreign trade

income (other than section 923(a)(2)

nonexempt income, within the

meaning of section 927(d)(6), as in

effect before repeal); and

4. Any deductions that are

apportioned or allocated to the

nonexempt foreign trade income

described above.

•

Category 5 filers who are

shareholders of an FSC are subject to

the subpart F rules for:

1.

All other types of FSC income

(including section 923(a)(2)

nonexempt income, within the

meaning of section 927(d)(6), as in

effect before its repeal);

2. Investment income and carrying

charges (as defined in section 927(c)

and (d)(1), as in effect before its

repeal); and

3. All other FSC income that is not

foreign trade income or investment

income or carrying charges.

Category 5 Filers—Exceptions

From Filing

Certain constructive owners.

•

A Category 5 filer does not have to

file Form 5471 if all of the following

conditions are met.

1. The Category 5 filer does not

own a direct interest in the foreign

corporation.

2. The Category 5 filer is required

to furnish the information requested

solely because of constructive

ownership (as determined under

Regulations section 1.958-2,

1.6038-2(c), or 1.6046-1(i)) from

another U.S. person.

3. The U.S. person through which

the Category 5 filer constructively

owns an interest in the foreign

corporation files Form 5471 to report

all of the information required of the

Category 5 filer.

•

A Category 5 filer does not have to

file Form 5471 if it:

1. Does not own a direct or

indirect interest in the foreign

corporation, and

2. Is required to file Form 5471

solely because of constructive

ownership from a nonresident alien.

No statement is required to be

attached to the tax return of a

Category 5 filer claiming either

constructive ownership exception.

See Regulations section 1.6038-2(j)

(2) and (3), and Regulations section

1.6038-2(l) for additional information.

No section 958(a) U.S. sharehold-

er. A Category 5 filer does not have to

file Form 5471 if no U.S. shareholder

(including the Category 5 filer) owns,

within the meaning of section 958(a),

stock in the CFC on the last day in the

year of the foreign corporation in

which it was a CFC and the CFC is a

foreign-controlled CFC. See section

5.02 of

Notice 2018-13, 2018-6 I.R.B.

341, for additional information.

Unrelated constructive U.S. share-

holder. A Category 5 filer does not

have to file Form 5471 if

all of the

following conditions are met.

1. The foreign corporation is a

foreign-controlled CFC.

2. The filer is a U.S. shareholder

that does not own stock, within the

meaning of section 958(a), in the

foreign-controlled CFC.

3. The filer is not related, using

principles of section 954(d)(3), to the

foreign-controlled CFC.

See section 8.04 of Rev. Proc.

2019-40, 2019-43 I.R.B. 982, for

additional information.

FSCs. Category 5 filers are not

required to file a Form 5471 (in order

to satisfy the requirements of section

6038) if the FSC has filed a Form

1120-FSC. See Temporary

Regulations section 1.921-1T(b)(3).

However, these filers are required to

file Form 5471 for an FSC, regardless

of whether it has filed Form

1120-FSC, if the filer has inclusions

with respect to the FSC under section

951(a) (as described above).

Other filing exceptions. Certain

other filing exceptions apply to all

categories of filers. See Additional

Filing Exceptions next.

Additional Filing

Exceptions

Multiple filers of same information.

With respect to any category of filer,

one person may file Form 5471 and

the applicable schedules for other

persons who have the same filing

requirements. If you and one or more

other persons are required to furnish

information for the same foreign

corporation for the same period, a

joint information return that contains

the required information may be filed

with your tax return or with the tax

return of any one of the other persons.

For example, a U.S. person described

in Category 5 may file a joint Form

5471 with a Category 4 filer or another

Category 5 filer; similarly, a U.S.

person described in Category 5b may

file a joint Form 5471 with a Category

4 or 5a filer or another Category 5b

filer (but not a Category 5c filer).

However, for Category 3 filers, the

required information may only be filed

6

Instructions for Form 5471 (Rev. 01-2024)

Page 7 of 52 Fileid: … ns/i5471/202401/a/xml/cycle08/source 7:44 - 25-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

by another person having an equal or

greater interest (measured in terms of

value or voting power of the stock of

the foreign corporation).

The person that files Form 5471

must complete Form 5471 in the

manner described in the instructions

for item H. All persons identified in

item H must attach a statement to

their income tax return that includes

the information described in the

instructions for item H. See

Regulations section 1.6038-2(j)(1)

and (3) for additional information.

Domestic corporations.

Shareholders are not required to file

Form 5471 for a foreign insurance

company that has elected (under

section 953(d)) to be treated as a

domestic corporation and has filed a

U.S. income tax return for its tax year

under that provision. See Rev. Proc.

2003-47, 2003-28 I.R.B. 55, available

at

IRS.gov/irb/

2003-28_IRB#RP-2003-47, for

procedural rules regarding the

election under section 953(d).

Additional Filing

Requirements

Section 338 election. If a section

338 election is made with respect to a

qualified stock purchase of a foreign

target corporation for which a Form

5471 must be filed:

•

A purchaser (or its U.S.

shareholder) must attach a copy of

Form 8883, Asset Allocation

Statement Under Section 338, to the

first Form 5471 for the new foreign

target corporation (see the

Instructions for Form 8883 for details);

•

A seller (or its U.S. shareholder)

must attach a copy of Form 8883 to

the last Form 5471 for the old foreign

target corporation;

•

A U.S. shareholder that files a

section 338 election on behalf of a

foreign purchasing corporation that is

a CFC pursuant to Regulations

section 1.338-2(e)(3) must attach a

copy of Form 8023, Elections Under

Section 338 for Corporations Making

Qualified Stock Purchases, to the

Form 5471 filed with respect to the

purchasing corporation for the tax

year that includes the acquisition date

(see the Instructions for Form 8023 for

details).

Reportable transaction disclosure

statement. If a U.S. shareholder of a

CFC is considered to have

participated in a reportable

transaction under the rules of

Regulations section 1.6011-4(c)(3)(i)

(G), the shareholder is required to

disclose information for each

reportable transaction. Form 8886,

Reportable Transaction Disclosure

Statement, must be filed for each tax

year indicated in Regulations section

1.6011-4(c)(3)(i)(G). The following are

reportable transactions.

1. Any listed transaction, which is

a transaction that is the same as or

substantially similar to one of the

types of transactions that the IRS has

determined to be a tax avoidance

transaction and identified by notice,

regulation, or other published

guidance as a listed transaction.

2. Any transaction offered under

conditions of confidentiality for which

the corporation (or a related party)

paid an advisor a fee of at least

$250,000.

3. Certain transactions for which

the corporation (or a related party)

has contractual protection against

disallowance of the tax benefits.

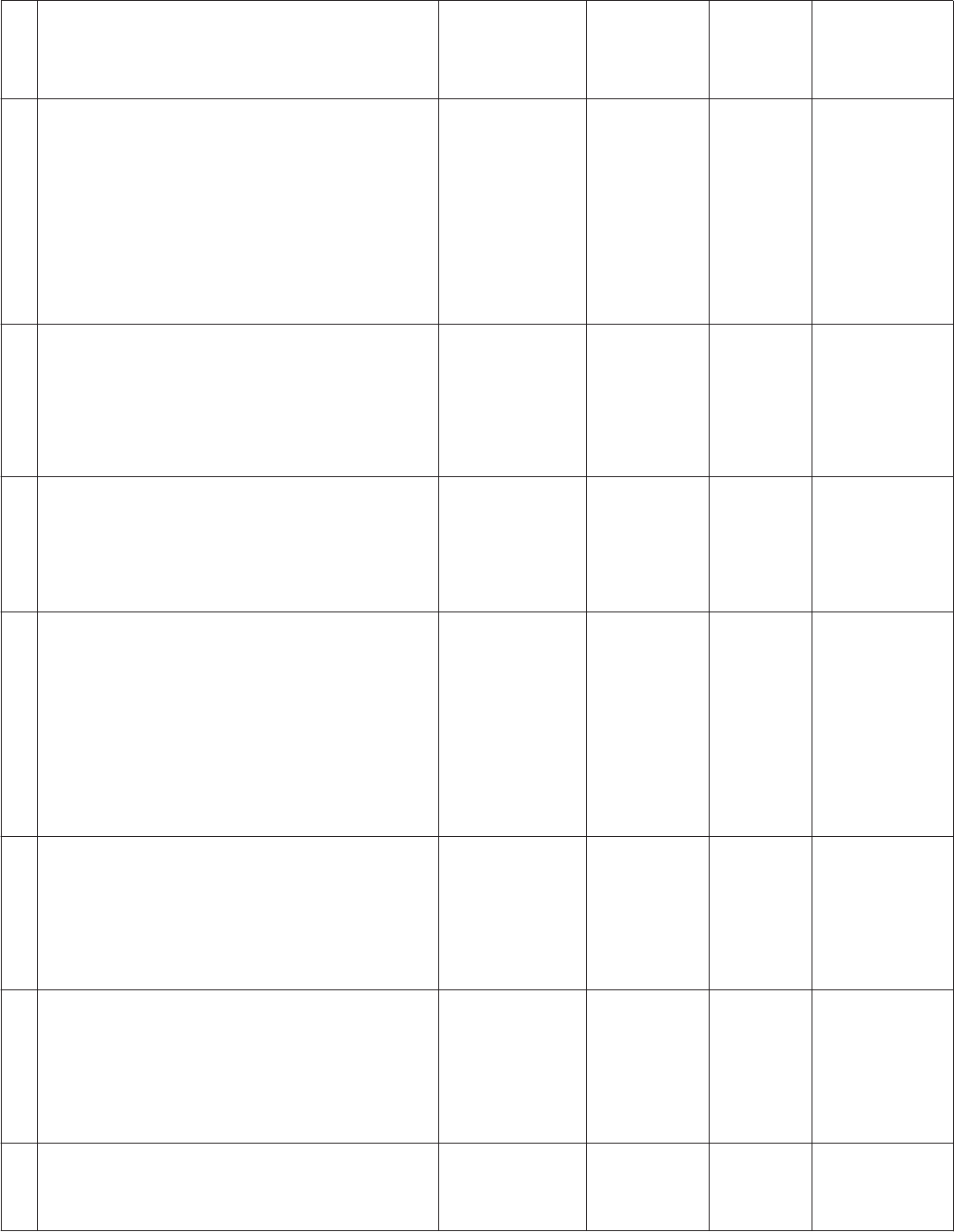

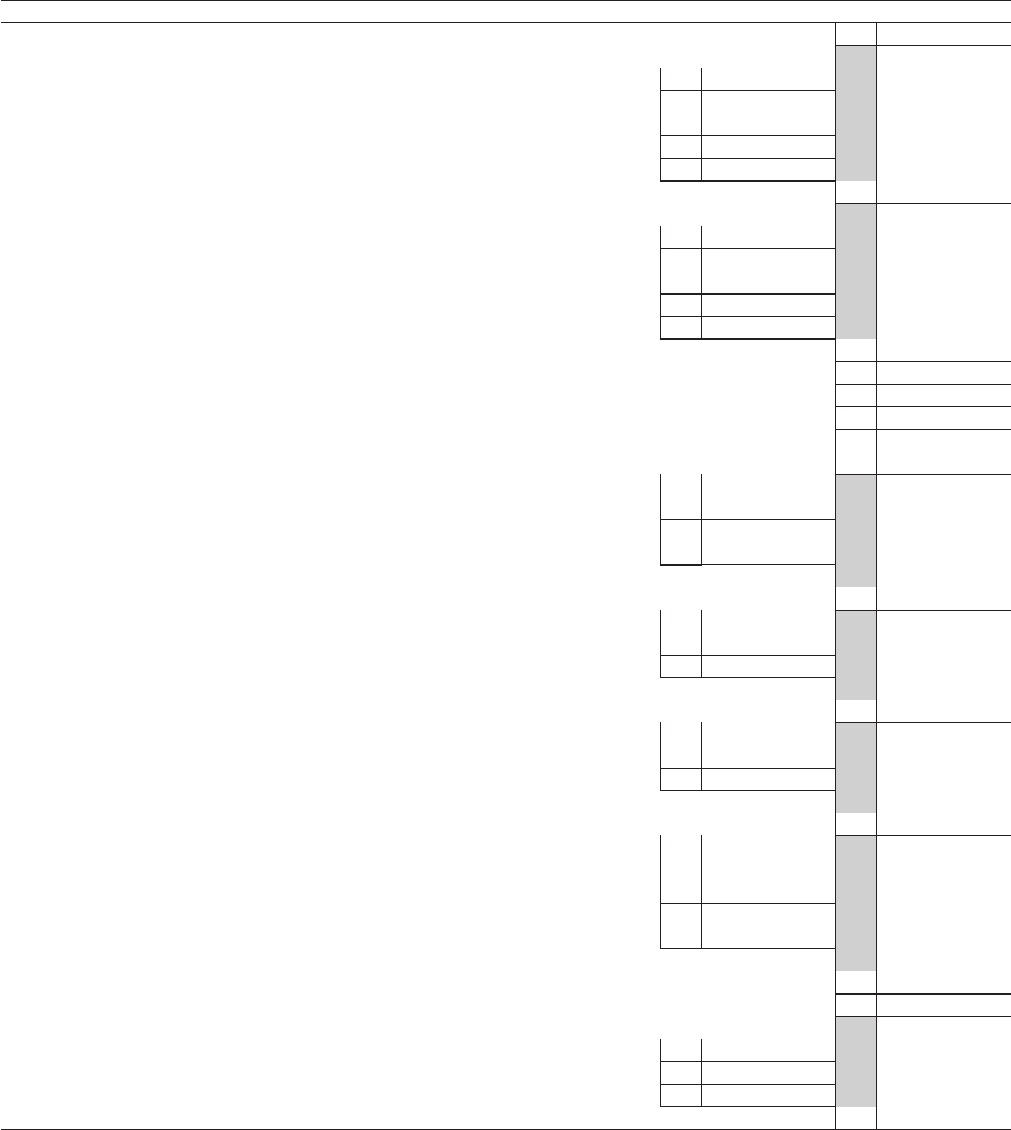

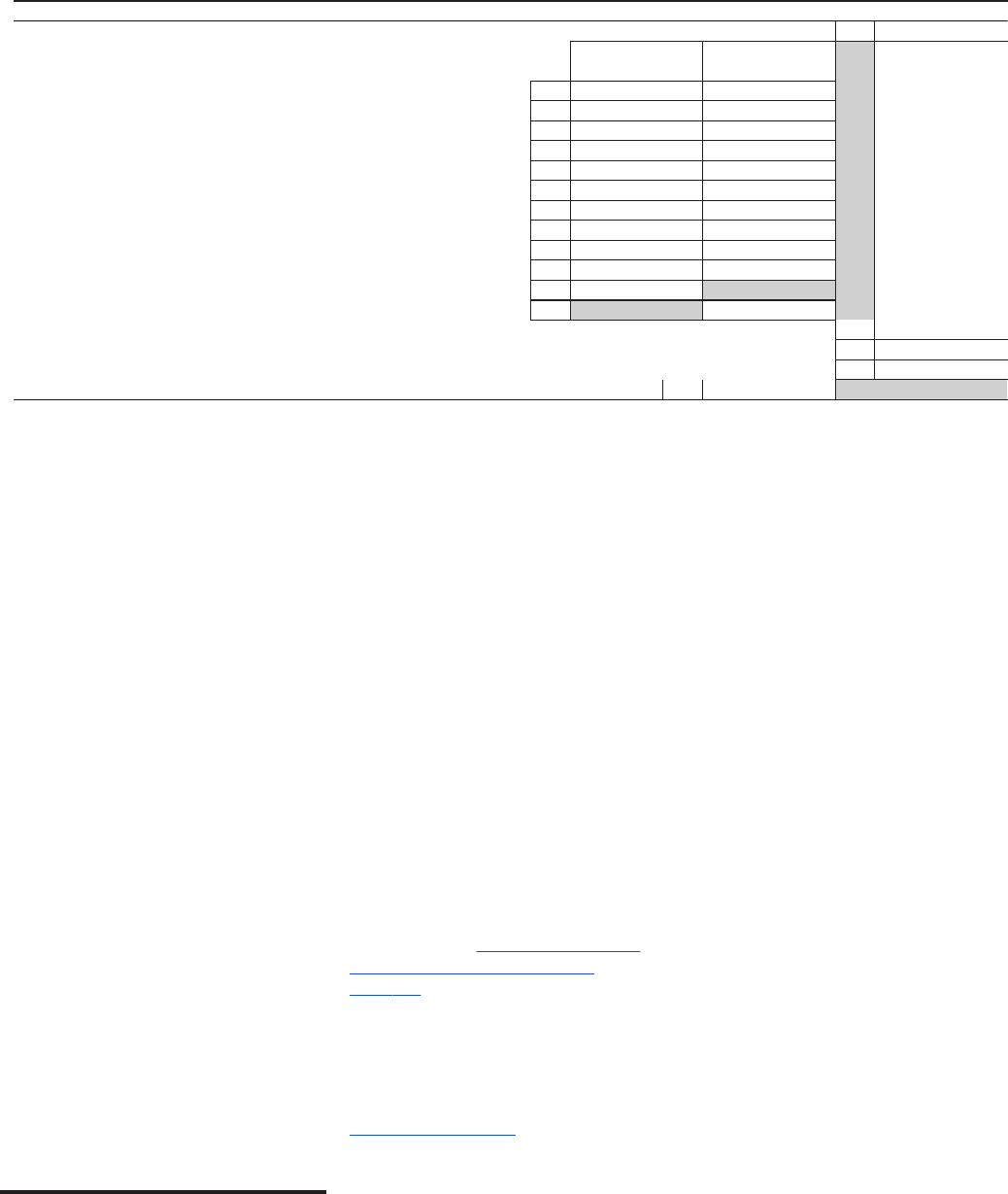

Filing Requirements for Categories of Filers

Table of Required Information

Required Information*

Category of Filer

1a 1b 1c 2 3 4 5a 5b 5c

The identifying information on page

1 of Form 5471 above Schedule A;

see Specific Instructions

Schedule A

Schedule B, Part I

Schedule B, Part II

Schedules C and F

Separate Schedule E

1 2 1 2

Schedule E-1 (included with

separate Schedule E)

1 1

Schedule G

Separate Schedule G-1

Separate Schedule H

Schedule I

Separate Schedule I-1

Separate Schedule J

Separate Schedule M

Separate Schedule O, Part I

Separate Schedule O, Part II

Separate Schedule P

Separate Schedule Q

Separate Schedule R

* See also Additional Filing Requirements.

1

Schedules E and E-1 are required for an Unrelated section 958(a) U.S. shareholder. only if the filer claims

deemed paid foreign income taxes of the foreign-controlled section 965 SFC or foreign-controlled CFC

under section 960 for the filer’s tax year. See Rev. Proc. 2019-40 for more details.

2

Related constructive U.S. shareholder. only need to complete Schedule E (they can leave Schedule E-1

blank). See Rev. Proc. 2019-40 for more details.

Instructions for Form 5471 (Rev. 01-2024)

7

Page 8 of 52 Fileid: … ns/i5471/202401/a/xml/cycle08/source 7:44 - 25-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

4. Certain transactions resulting in

a loss of at least $10 million in any

single year or $20 million in any

combination of years.

5. Any transaction identified by the

IRS by notice, regulation, or other

published guidance as a “transaction

of interest.” See Notice 2009-55,

2009-31 I.R.B. 170, available at

IRS.gov/irb/

2009-31_IRB#NOT-2009-55.

For more information, see

Regulations section 1.6011-4. Also,

see the Instructions for Form 8886.

Penalties. The U.S. shareholder

may have to pay a penalty if it is

required to disclose a reportable

transaction under section 6011 and

fails to properly complete and file

Form 8886. Penalties may also apply

under section 6707A if the U.S.

shareholder fails to file Form 8886

with its income tax return, fails to

provide a copy of Form 8886 to the

Office of Tax Shelter Analysis (OTSA),

or files a form that fails to include all

the information required (or includes

incorrect information). Other

penalties, such as an

accuracy-related penalty under

section 6662A, may also apply. See

the Instructions for Form 8886 for

details on these and other penalties.

Reportable transactions by materi-

al advisors. Material advisors to any

reportable transaction must disclose

certain information about the

reportable transaction by filing Form

8918, Material Advisor Disclosure

Statement, with the IRS. For details,

see the Instructions for Form 8918.

Reporting other foreign financial

assets. If you have other foreign

financial assets, you may be required

to file Form 8938, Statement of

Specified Foreign Financial Assets.

However, you are not required to

report any items otherwise reported

on Form 5471 on that form. See the

Instructions for Form 8938 for more

information.

Penalties

Failure to file information required

by section 6038(a) (Form 5471 and

Schedule M).

•

A $10,000 penalty is imposed for

each annual accounting period of

each foreign corporation for failure to

furnish the information required by

section 6038(a) within the time

prescribed. If the information is not

filed within 90 days after the IRS has

mailed a notice of the failure to the

U.S. person, an additional $10,000

penalty (per foreign corporation) is

charged for each 30-day period, or

fraction thereof, during which the

failure continues after the 90-day

period has expired. The additional

penalty is limited to a maximum of

$50,000 for each failure.

•

Any person who fails to file or report

all of the information required within

the time prescribed will be subject to a

reduction of 10% of the foreign taxes

available for credit under sections 901

and 960. If the failure continues 90

days or more after the date the IRS

mails notice of the failure to the U.S.

person, an additional 5% reduction is

made for each 3-month period, or

fraction thereof, during which the

failure continues after the 90-day

period has expired. See section

6038(c)(2) for limits on the amount of

this penalty.

See Regulations sections 1.6038-1(j)

(4) and 1.6038-2(k)(3) for alleviation

of this penalty in certain cases.

Failure to file information required

by section 6046 and the related

regulations (Form 5471 and

Schedule O). Any person who fails

to file or report all of the information

requested by section 6046 is subject

to a $10,000 penalty for each such

failure for each reportable transaction.

If the failure continues for more than

90 days after the date the IRS mails

notice of the failure, an additional

$10,000 penalty will apply for each

30-day period, or fraction thereof,

during which the failure continues

after the 90-day period has expired.

The additional penalty is limited to a

maximum of $50,000. See section

6679.

Criminal penalties. Criminal

penalties under sections 7203, 7206,

and 7207 may apply for failure to file

the information required by sections

6038 and 6046.

Note. Any person required to file

Form 5471 and Schedule J, M, or O

who agrees to have another person

file the form and schedules for them

may be subject to the above penalties

if the other person does not file a

correct and proper form and schedule.

Section 6662(j).

Penalties may be

imposed for undisclosed foreign

financial asset understatements. No

penalty will be imposed with respect

to any portion of an underpayment if

the taxpayer can demonstrate that the

failure to comply was due to

reasonable cause with respect to

such portion of the underpayment and

the taxpayer acted in good faith with

respect to such portion of the

underpayment. See sections 6662(j)

and 6664(c) for additional information.

Inapplicability of certain penalties.

Certain penalties under sections 6038

and 6662 may be waived for certain

persons under Rev. Proc. 2019-40.

See section 7 of Rev. Proc. 2019-40

for more details.

Other Reporting

Requirements

Reporting exchange rates on Form

5471. When translating amounts from

functional currency to U.S. dollars,

you must use the method specified in

these instructions. For example, when

translating amounts to be reported on

Schedule E, you must generally use

the average exchange rate as defined

in section 986(a). But, regardless of

the specific method required, all

exchange rates must be reported

using a “divide-by convention”

rounded to at least four places. That

is, the exchange rate must be

reported in terms of the amount by

which the functional currency amount

must be divided in order to reflect an

equivalent amount of U.S. dollars. As

such, the exchange rate must be

reported as the units of foreign

currency that equal one U.S. dollar,

rounded to at least four places.

Do

not report the exchange rate as the

number of U.S. dollars that equal one

unit of foreign currency.

Note. You must round the result to

more than four places if failure to do

so would materially distort the

exchange rate or the equivalent

amount of U.S. dollars.

Example. During its annual

accounting period, the foreign

corporation paid income taxes of

30,255,400 Yen to Japan. The

Schedule E instructions specify that

the foreign corporation must translate

these amounts into U.S. dollars at the

average exchange rate for the tax year

8

Instructions for Form 5471 (Rev. 01-2024)

Page 9 of 52 Fileid: … ns/i5471/202401/a/xml/cycle08/source 7:44 - 25-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

to which the tax relates in accordance

with the rules of section 986(a). The

average exchange rate is 108.8593

Japanese Yen to one U.S. dollar or

(0.009184) U.S. dollar to one

Japanese Yen. The foreign

corporation divides 30,255,400 Yen by

108.8593 to determine the U.S. dollar

amount to enter in column (l) of

Schedule E, Part I, Section 1, line 1.

Line 1 of Schedule E, Part I, Section

1, is completed in relevant part as

follows.

•

Enter the name of the payor entity in

column (a).

•

Enter the payor entity’s employer

identification number (EIN) or

reference ID number in column (b).

•

Enter “JA” in column (d).

•

Enter “JPY” in column (i).

•

Enter “30,255,400 Yen” in column

(j).

•

Enter “108.8593” in column (k).

•

Enter “277,931” in column (l).

Computer-Generated Form

5471 and Schedules

Generally, all computer-generated

forms must receive prior approval from

the IRS and are subject to an annual

review. However, see the Exception

below. Requests for approval may be

submitted electronically to

substitutef[email protected]v, or requests

may be mailed to:

Internal Revenue Service

Attention: Substitute Forms

Program

SE:W:CAR:MP:P:TP

1111 Constitution Ave. NW

Room 6554

Washington, DC 20224

Exception. If a computer-generated

Form 5471 and its schedules conform

to and do not deviate from the official

form and schedules, they may be filed

without prior approval from the IRS.

Important. Be sure to attach the

approval letter to Form 5471.

However, if the computer-generated

form is identical to the IRS-prescribed

form, it does not need to go through

the approval process, and an

attachment is not necessary.

Every year, the IRS issues a

revenue procedure to provide

guidance for filers of

computer-generated forms. In

addition, every year, the IRS issues

Pub. 1167, General Rules and

Specifications for Substitute Forms

and Schedules, which reprints the

most recent applicable revenue

procedure. Pub. 1167 is available at

IRS.gov/Pub. 1167.

Dormant Foreign Corporations

Rev. Proc. 92-70, 1992-2 C.B. 435,

provides a summary filing procedure

for filing Form 5471 for a dormant

foreign corporation (defined in section

3 of Rev. Proc. 92-70). This summary

filing procedure will satisfy the

reporting requirements of sections

6038 and 6046.

If you elect the summary

procedure, complete only page 1 of

Form 5471 for each dormant foreign

corporation as follows.

•

The top margin of the summary

return must be labeled “Filed Pursuant

to Rev. Proc. 92-70 for Dormant

Foreign Corporation.”

•

Include filer information such as

name and address, items A through

C, and tax year.

•

Include corporate information such

as the dormant corporation's annual

accounting period (below the title of

the form) and items 1a, 1b, 1c, and

1d.

For more information, see Rev. Proc.

92-70.

File this summary return in the

manner described under When and

Where To File, earlier.

Treaty-Based Return Positions

You are generally required to file Form

8833, Treaty-Based Return Position

Disclosure Under Section 6114 or

7701(b), to disclose a return position

that any treaty of the United States

(such as an income tax treaty; an

estate and gift tax treaty; or a

friendship, commerce, and navigation

treaty):

•

Overrides or modifies any provision

of the Internal Revenue Code; and

•

Causes, or potentially causes, a

reduction of any tax incurred at any

time.

See Form 8833 for exceptions.

Failure to make a required

disclosure may result in a $1,000

penalty ($10,000 for a C corporation).

See section 6712.

Section 362(e)(2)(C) Elections

The transferor and transferee in

certain section 351 transactions may

make a joint election under section

362(e)(2)(C) to limit the transferor's

basis in the stock received instead of

the transferee's basis in the

transferred property. The election is

made by a statement as provided in

Regulations section 1.362-4(d)(3).

Do not attach the statement

described above to Form

5471.

Corrections to Form 5471

If you file a Form 5471 that you later

determine is incomplete or incorrect,

file a corrected Form 5471 with an

amended tax return, using the

amended return instructions for the

return with which you originally filed

Form 5471. Enter “Corrected” at the

top of the form and attach a statement

identifying the changes.

Foreign Disregarded Entities

and Branches

If the foreign corporation for which you

are furnishing information is the tax

owner of a foreign disregarded entity

(FDE) or foreign branch (FB), or a

partner in a partnership, the amounts

reported on Form 8858, Schedules

K-1 and K-3 of Form 1065, or

Schedules K-1 and K-3 of Form 8865

must be included in determining the

amounts reported on Form 5471. The

“tax owner” of an FDE is the person

that is treated as owning the assets

and liabilities of the FDE for purposes

of U.S. income tax law.

Specific Instructions

Important. If the information required

in a given section exceeds the space

provided within that section,

do not

enter “See attached” in the section

and then attach all of the information

on additional sheets. Instead,

complete all entry spaces in the

section and attach the remaining

information on additional sheets. The

additional sheets must conform with

the IRS version of that section.

Identifying Information

Annual Accounting Period

Enter, in the space provided below the

title of Form 5471, the annual

accounting period of the foreign

corporation for which you are

furnishing information. Except for

information contained on Schedule O,

report information for the tax year of

the foreign corporation that ends with

CAUTION

!

Instructions for Form 5471 (Rev. 01-2024)

9

Page 10 of 52 Fileid: … ns/i5471/202401/a/xml/cycle08/source 7:44 - 25-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

or within your tax year. When filing

Schedule O, report acquisitions,

dispositions, and organizations or

reorganizations that occurred during

your tax year.

Section 898 specified foreign cor-

poration (SFC). The annual

accounting period of an SFC (as

defined in section 898) is generally

required to be the tax year of the

corporation's majority U.S.

shareholder. If there is more than one

majority shareholder, the required tax

year will be the tax year that results in

the least aggregate deferral of income

to all U.S. shareholders of the foreign

corporation.

For these purposes, section 898(b)

defines an SFC as any foreign

corporation:

1. That is treated as a CFC for any

purpose under subpart F, and

2. In which more than 50% of the

total voting power or value of all

classes of stock of the corporation is

treated as owned by a U.S.

shareholder.

For more information, see section

898 and Rev. Proc. 2006-45, 2006-45

I.R.B. 851, available at

IRS.gov/irb/

2006-45_IRB#RP-2006-45, as

modified by Rev. Proc. 2007-64,

2007-42 I.R.B. 818, available at

IRS.gov/irb/

2007-42_IRB#RP-2007-64.

Name of Person Filing This

Return

The name of the person filing Form

5471 is generally the name of the U.S.

person described in the applicable

category or categories of filers (see

Categories of Filers, earlier). However,

in the case of a consolidated return,

enter the name of the U.S. parent in

the field for “Name of person filing this

return.” Be sure to list each U.S.

shareholder of the foreign corporation

in Schedule B, Part I.

Name change. If the name of either

the person filing the return or the

corporation whose activities are being

reported changed within the past 3

years, show the prior name(s) in

parentheses after the current name.

Address

Include the suite, room, or other unit

number after the street address. If the

post office does not deliver mail to the

street address and the U.S. person

has a P.O. box, show the box number

instead.

Foreign address. Enter the

information in the following order: city,

province or state, and country. Follow

the country's practice for entering the

postal code, if any. Do not abbreviate

the country name.

Item A—Identifying Number

The identifying number of an

individual is his or her social security

number (SSN). The identifying

number of all others is their EIN. If a

U.S. corporation that owns stock in a

foreign corporation is a member of a

consolidated group, list the common

parent as the person filing the return

and enter its EIN in item A.

Item B—Category of Filer

Complete item B to indicate the

category or categories that describe

the person filing this return. If more

than one category applies, check all

boxes that apply. See Categories of

Filers, earlier.

Note. If you satisfy the requirements

of both Category 4 and Category 5a

filers, only check the box for Category

4 and leave the box for Category 5a

blank.

Item C—Percentage of Voting

Stock Owned

Enter the total percentage of the

foreign corporation's voting power you

owned directly, indirectly, or

constructively at the end of the

corporation's annual accounting

period.

Item D—Final Year

Check the item D checkbox only if this

is the final year of the foreign

corporation's existence as a

corporation for federal tax purposes,

for example, if a reorganization has

occurred, a complete liquidation has

occurred, or an election to treat the

foreign corporation as a disregarded

entity has been made. If this item D is

checked, complete Schedule O.

Item E—Excepted Specified

Foreign Financial Assets

Check the item E checkbox if any

excepted specified foreign financial

assets are reported on Form 5471. If

this is the case, you do not have to

also report these assets on Form

8938. It is only necessary to complete

Form 8938, Part IV, line 17. For more

information, see the Instructions for

Form 8938, generally, and in

particular, Duplicative Reporting and

the specific instructions for Part IV,

Excepted Specified Foreign Financial

Assets.

Item F—Alternative Information

Under Rev. Proc. 2019-40

Check the item F checkbox if Form

5471 has been completed using

alternative information (as defined in

section 3.01 of Rev. Proc. 2019-40).

Section 5 of Rev. Proc. 2019-40

provides a safe harbor for determining

certain items, including taxable

income and E&P, of certain CFCs

based on alternative information.

Specifically, in the case of a

foreign-controlled CFC with respect to

which there is no related section

958(a) U.S. shareholder, if information

satisfying the requirements of

Regulations section 1.952-2(a), (b),

and (c)(2) and section 964 and the

regulations thereunder is not readily

available to an unrelated section

958(a) U.S. shareholder or an

unrelated constructive U.S.

shareholder with respect to the

foreign-controlled CFC, an amount

reported on a Form 5471 may be

determined by the unrelated section

958(a) U.S. shareholder or the

unrelated constructive U.S.

shareholder, as applicable, on the

basis of alternative information

(without adjustments other than those

described in section 3.01(b) and 3.10

of the revenue procedure) with

respect to the foreign-controlled CFC.

See section 3 of Rev. Proc. 2019-40

for definitions of terms.

Section 6 of Rev. Proc. 2019-40

provides a safe harbor for determining

certain items of certain SFCs based

on alternative information. Specifically,

in the case of an SFC, other than

either a foreign-controlled CFC with

respect to which there is no related

section 958(a) U.S. shareholder or a

U.S. controlled CFC, if information

satisfying the requirements of section

964 and the regulations thereunder is

not readily available to an unrelated

section 958(a) U.S. shareholder or an

unrelated constructive U.S.

shareholder with respect to the SFC,

an amount reported on a Form 5471

may be determined by the unrelated

section 958(a) U.S. shareholder or the

unrelated constructive U.S.

shareholder, as applicable, on the

10

Instructions for Form 5471 (Rev. 01-2024)

Page 11 of 52 Fileid: … ns/i5471/202401/a/xml/cycle08/source 7:44 - 25-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

basis of alternative information

(without adjustments other than those

described in sections 3.01(b) and

3.10 of the revenue procedure) with

respect to the SFC. See section 3 of

Rev. Proc. 2019-40 for definitions of

terms.

Item G—Alternative Information

Code

If the item F checkbox is checked,

enter the applicable code from the list

provided below.

01

Audited separate-entity financial

statements of the foreign corporation that

are prepared in accordance with U.S.

generally accepted accounting principles

(U.S. GAAP).

02

Audited separate-entity financial

statements of the foreign corporation that

are prepared on the basis of international

financial reporting standards (IFRS).

03

Audited separate-entity financial

statements of the foreign corporation that

are prepared on the basis of the generally

accepted accounting principles of the

jurisdiction in which the foreign

corporation is organized (“local-country

GAAP”).

04

Unaudited separate-entity financial

statements of the foreign corporation that

are prepared in accordance with U.S.

GAAP.

05

Unaudited separate-entity financial

statements of the foreign corporation that

are prepared on the basis of IFRS.

06

Unaudited separate-entity financial

statements of the foreign corporation that

are prepared on the basis of local-country

GAAP.

07

Separate-entity records used by the

foreign corporation for tax reporting.

08

Separate-entity records used by the

foreign corporation for internal

management controls or regulatory or

other similar purposes.

Information described in a code

listed above qualifies as alternative

information only if information

described in any preceding code is

not “readily available” (as defined in

section 3.04 of Rev. Proc. 2019-40).

For example, information described in

code 03 above qualifies as alternative

information only if information

described in codes 01 and 02 is not

readily available.

For more information, see Rev.

Proc. 2019-40.

Item H—Person(s) on Whose

Behalf This Information Return

Is Filed

One person may file Form 5471 and

the applicable schedules for other

persons who have the same filing

requirements. See

Multiple filers of

same information, earlier. The person

that files the required information on

behalf of other persons must

complete a joint Form 5471 according

to the applicable column(s) of the

Filing Requirements for Categories of

Filers, earlier. This includes

completing item H on page 1 of the

form. When completing item H with

respect to members of a consolidated

group, identify only the direct owners

in item H (constructive owners are not

required to be listed).

A separate Schedule I must be filed

for each person described in Category

4, 5a, or 5b. For each Category 4, 5a,

or 5b filer that is required to file a

Schedule I, send a copy of their

separate Schedule I to them to assist

them in completing their tax return.

A separate Worksheet H-1 must be

attached for each person described in

Category 4, 5a, 5b, or 5c. For each

Category 4, 5a, 5b, or 5c filer that is

required to file Worksheet H-1, send a

copy of their separate Worksheet H-1

to them to assist them in completing

their tax return.

Note. New Worksheet H-1 may be

found later in these instructions. See

Worksheet H-1 and Worksheet H-1

Instructions, later.

Filing requirements for persons

identified in item H. Except for

members of the filer's consolidated

return group, all persons identified in

item H must attach a statement to

their tax returns that includes the

following information.

•

The name, address, and EIN (or

reference ID number) of the foreign

corporation(s).

•

A statement that their filing

requirements with respect to the

foreign corporation(s) have been or

will be satisfied.

•

The name, address, and identifying

number of the taxpayer on the return

with which the information was or will

be filed.

•

The IRS Service Center where the

return was or will be filed. If the return

was or will be filed electronically, enter

“e-file.”

Exception.

If the person who is filing

Form 5471 on behalf of others is

married to a person identified in item

H and they are filing Form 1040 jointly,

the statement described above does

not have to be attached to the jointly

filed Form 1040.

All persons identified in item H

must complete a separate

Schedule P (Form 5471) if the

person is a U.S. shareholder

described in Category 1a, 1b, 4, 5a, or

5b. In such a case, the Schedule P

must be attached to the statement

described above.

Item 1b(2)—Reference ID

Number

A reference ID number (defined

below) is required in item 1b(2) only in

cases where no EIN was entered in

item 1b(1) for the foreign corporation.

However, filers are permitted to enter

both an EIN in item 1b(1) and a

reference ID number in item 1b(2). If

applicable, enter the reference ID

number you have assigned to the

foreign corporation identified in item

1a.

A “reference ID number” is a

number established by or on behalf of

the U.S. person identified at the top of

page 1 of the form that is assigned to

a foreign corporation with respect to

which Form 5471 reporting is

required. These numbers are used to

uniquely identify the foreign

corporation in order to keep track of

the corporation from tax year to tax

year.

The reference ID number must

meet the requirements set forth below.

Note. Because reference ID numbers

are established by or on behalf of the

U.S. person filing Form 5471, there is

no need to apply to the IRS to request

a reference ID number or for

permission to use these numbers.

Note. The reference ID number

assigned to a foreign corporation on

Form 5471 generally has relevance

only on Form 5471, its schedules, and

any other form that is attached to or

associated with Form 5471, and

generally should not be used with

respect to that foreign corporation on

any other IRS forms. However, the

foreign corporation’s reference ID

number should also be entered on

Form 8858 if the foreign corporation is

CAUTION

!

Instructions for Form 5471 (Rev. 01-2024)

11

Page 12 of 52 Fileid: … ns/i5471/202401/a/xml/cycle08/source 7:44 - 25-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

listed as a tax owner of an FDE or FB

on Form 8858. See the instructions for

Form 8858, line 3c(2), for more

information. Also, if a U.S. shareholder

is required to file Schedule A (Form

8992) or Schedule B (Form 8992) with

respect to the CFC, the reference ID

number on Form 5471 and the

reference ID number used on

Schedule A (Form 8992) or

Schedule B (Form 8992) for that CFC

must be the same.

Requirements. The reference ID

number that is entered in item 1b(2)

must be alphanumeric (defined below)

and no special characters or spaces

are permitted. The length of a given

reference ID number is limited to 50

characters.

The same reference ID number

must be used consistently from tax

year to tax year with respect to a given

foreign corporation. If for any reason a

reference ID number falls out of use

(for example, the foreign corporation

no longer exists due to disposition or

liquidation), the reference ID number

used for that foreign corporation

cannot be used again for another

foreign corporation for purposes of

Form 5471 reporting.

For these purposes, the term

“alphanumeric” means the entry can

be alphabetical, numeric, or any

combination of the two.

Taxpayers no longer have the

option of entering “FOREIGNUS” or

“APPLIED FOR” in a column that

requests an EIN or reference ID

number with respect to a foreign

entity. Instead, if the foreign entity

does not have an EIN, the taxpayer

must enter a reference ID number that

uniquely identifies the foreign entity.

Correlation issues. There are some

situations that warrant correlation of a

new reference ID number with a

previous reference ID number when

assigning a new reference ID number

to a foreign corporation. For example:

•

In the case of a merger or

acquisition, a Form 5471 filer must

use a reference ID number that

correlates the previous reference ID

number with the new reference ID

number assigned to the foreign

corporation; or

•

In the case of an entity

classification election that is made on

behalf of a foreign corporation on

Form 8832, Regulations section

301.6109-1(b)(2)(v) requires the

foreign corporation to have an EIN for

this election. For the first year that

Form 5471 is filed after an entity

classification election is made on

behalf of the foreign corporation on

Form 8832, the new EIN must be

entered in item 1b(1) of Form 5471

and the old reference ID number must

be entered in item 1b(2). In

subsequent years, the Form 5471 filer

may continue to enter both the EIN in

item 1b(1) and the reference ID

number in item 1b(2), but must enter

at least the EIN in item 1b(1).

You must correlate the reference ID

numbers as follows: Enter the new

reference ID number in item 1b(2) and

enter the previous reference ID

number(s) in item 1b(3). If there is

more than one old reference ID

number, you must enter a space

between each such number. As

indicated above, the length of a given

reference ID number is limited to 50

characters and each number must be

alphanumeric and no special

characters are permitted.

Note. This correlation requirement

applies only to the first year the new

reference ID number is used and it

applies only on Form 5471, page 1,

items 1b(2) and 1b(3). On all separate

schedules for Form 5471, please

enter only the current reference ID

number in the applicable entry space.

Item 1b(3)—Previous Reference

ID Number(s), if Any

See Correlation issues, earlier.

Items 1f and 1g—Principal

Business Activity

Enter the principal business activity

code number and the description of

the activity from the list at the end of

these instructions.

Effective beginning with tax

year 2022, several changes

were made to the principal

business activities and codes listed at

the end of these instructions. See the

revised list before entering a six-digit

code and the description of the

activity on page 1, items 1f and 1g.

Item 1h—Functional Currency

The foreign corporation's functional

currency is determined under section

985. Enter the applicable

three-character alphabet code for the

foreign corporation's functional

currency using the ISO 4217

CAUTION

!

standard. These codes are available

at six-group.com/en/products-

services/financial-information/data-

standards.html#scrollTo=currency-